TheBRRR’s Thoughts

GM.

Stocks are getting comfortable at all-time highs.

Crypto is stabilizing and bouncing as Grayscale’s BTC sales are slowing down.

China is signaling that they’re ready to support asset prices with massive stimulus.

The Fed is about to start cutting interest rates in an election year.

Inflation is calm.

How’re you feeling about risk assets?

We think we’re going much higher this year.

Fed Accidentally Created Risk-Free Profit For Banks

WHAT HAPPENED:

The Fed's BTFP Becomes a Money Maker for Banks: The Federal Reserve's Bank Term Funding Program (BTFP), initially a crisis response tool, morphed into a profit machine for banks. The program, designed to aid banks during the 2023 banking crisis, allowed banks to borrow against inflated value of their plunging Treasury bonds.

Low-Risk Profit Opportunity Emerges: Banks are borrowing from the Fed at 4.8% through the program and earning 5.4% on their cash balances, pocketing a 0.6% spread risk-free.

Rising Use of BTFP: Since November, the BTFP usage has surged from $109bn to $147bn, indicating exploitation for profit rather than necessity.

WHY IT MATTERS:

Taxpayers Foot the Bill: The scheme essentially makes taxpayers fund these risk-free bank profits.

Deviating from Bagehot's Rule: The Fed's strategy strays from the central banking principle of lending at penalty rates against good collateral to solvent institutions. This deviation could have long-term implications for financial stability and central banking policy.

Calls for Fed Action: Due to the backlash, The Fed raised the interest rate on the BTFP loans immediately and have proclaimed the program will end, as intended, in March.

The BRRR’s Take: Sad state of affairs to see our economic central planners give banks a free handout. The BTFP was pure, unadulterated corporate welfare.

Tech Layoffs Surge Amid Wall Street Rally

WHAT HAPPENED:

Record Layoffs in Tech: January witnessed 23,670 layoffs in the tech sector, the highest since March, affecting 85 companies. Notable cuts include SAP (8,000 jobs) and Microsoft (1,900 in gaming division). Other significant layoffs were at Brex, eBay, Google, Amazon, Unity, and Discord.

Contrast with Market Performance: Despite these layoffs, tech stocks are thriving. The Nasdaq reached its highest since early 2022, with Alphabet, Meta, and Microsoft hitting all-time highs. The S&P 500 is also at a record level.

Cost-Cutting Amid Economic Challenges: These layoffs follow a tough 2022, marked by inflation, interest rate hikes, and recession concerns. Companies are continuing cost-cutting measures from last year despite an improving economic outlook.

AI and Efficiency: AI advancements are driving efficiency, reducing the need for human labor in some areas. Companies are reallocating resources to focus on AI, with Meta and others emphasizing "efficiency" in their operations.

Beyond Tech Sector: Layoffs aren't limited to tech. Other industries, including banking and media, are also reducing workforces, with Citigroup and Levi Strauss announcing significant cuts.

Market Optimism: Despite layoffs, there's economic optimism. The U.S. GDP grew faster than expected in Q4, and inflation is cooling, hinting at potential Federal Reserve rate cuts in 2024.

WHY IT MATTERS:

This trend reflects the tech industry's shift towards AI and efficiency, impacting jobs but potentially bolstering long-term growth and investor confidence.

The contrast between soaring stock values and workforce reductions highlights the complex dynamics between market performance and employment stability in the tech sector.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $12.99/year.

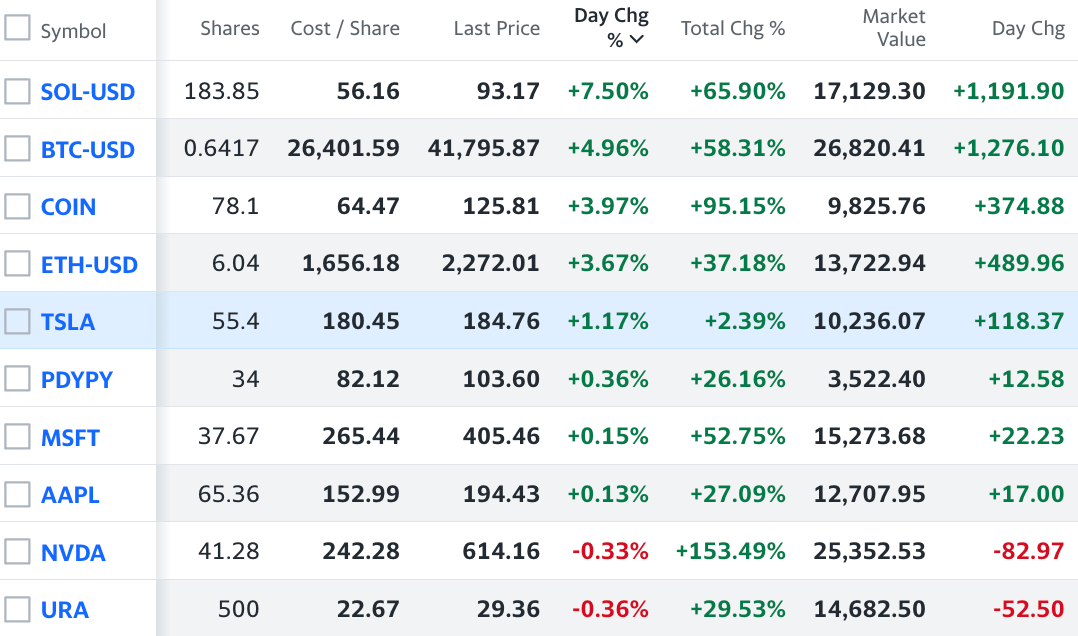

We bought Solana and announced it to premium subscribers on November 28th. It’s up 77% since.

Trades, Watchlist & Live Portfolio

(paywall only)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Solana’s up 30+% since we bought and should continue to run. 🔥

Portfolio

Notes

Wednesday 11/29/23: We sent out the alert that we were buying Solana yesterday as we go full risk-on to close out the year.

Latest Trades

Tuesday 11/28/23 11:20 AM: BUY 183.85 SOL @$56.16

Tuesday 11/28/23 11:20 AM: SELL 101.62 XOM @$104.75

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.