TheBRRR’s Thoughts

GM.

We got the jumbo 0.50% rate cut from the Fed today - the Fed’s first rate cut since 2020 and the first change to interest rates in a year and a half.

Stocks and risk assets initially pumped on the news but sold off to close the day. The main indexes are all ±0.25% over the last 24 hours.

This grants other central banks around the world permission to inject liquidity into their own economies without fearing the destruction of their native currencies.

This marks the beginning of a new liquidity cycle which should broaden the market rally as economic growth starts to reaccelerate.

Got any spare change between the couch cushions? it’s time to deploy it.

The Fed Slashes Rates by 50bps, Sends Market Into Chaos

Fed Slashes Rates by 50bps, Sends Markets into Chaos

WHAT HAPPENED:

The Federal Reserve cut its benchmark interest rate by 50 basis points today, bringing it down to a range of 4.75%-5.0%—the first rate cut in four years.

This move surprised economists, as only 9 out of 113 expected such an aggressive cut, with most anticipating a smaller 25bps reduction

Despite record highs in stocks and home prices, the Fed's rationale was focused on softening labor market conditions and continued moderation of inflation.

Fed Chair Jerome Powell emphasized that this rate cut is aimed at sustaining the economy but downplayed it as a new policy direction, which led to sharp market reversals during his press conference

MARKET REACTION:

The market’s knee-jerk response saw small caps soar by nearly 2.5%, only to reverse later in the day.

Treasury yields and the U.S. Dollar initially fell but quickly rebounded as Powell hinted the Fed was not in a rush for further cuts

Bitcoin spiked past $61,000 before falling back to its earlier levels

Gold hit a new record high of $2,600 before retreating as Powell’s hawkish tone tempered enthusiasm

FED'S DOT PLOT & PROJECTIONS:

The dot plot for 2024 shows a sharp shift in the Fed’s outlook, with the median forecast for the federal funds rate dropping from 5.125% to 4.375%. This marks a dramatic dovish turn as the Fed signals additional cuts

Despite cutting rates, the Fed left its forecasts for GDP growth and unemployment mostly unchanged, raising concerns that the Fed might be reacting to political pressure ahead of the upcoming elections

The core inflation forecast remains on track to decline toward the Fed’s 2% target, with a goal of hitting that level by 2026

POLITICAL FALLOUT:

The timing, just two months before the presidential election, has stoked political tensions. While Kamala Harris and Maxine Waters applauded the move, Republicans like Senator Kevin Cramer criticized the Fed for what they saw as politically motivated intervention.

Powell reiterated that the Fed remains "independent" and that political factors do not play into their decisions. Yet, critics argue that slashing rates this close to the election, without a clear economic emergency, raises serious credibility questions

WHY IT MATTERS:

This cut looks like a desperate measure to protect the labor market from further weakening. Nonfarm payrolls have been slowing, and the unemployment rate, though still low, is trending upward(

The labor market’s fragility paired with falling inflation does justify some easing, but many are left wondering if the 50bps cut reflects panic more than prudence. By slashing rates so aggressively without significant changes in growth or unemployment forecasts, the Fed risks undermining its credibility

Markets are highly volatile, caught between the Fed’s dovish actions and Powell’s hawkish rhetoric. Investors now have to navigate a Fed that says it's in no rush to cut further but has just unleashed a crisis-level intervention

THE TAKEAWAY:

The Fed’s decision raises questions about its long-term strategy and independence. While Powell insists this is not a new pace for rate cuts, the Fed has pivoted sharply toward easing just months after holding rates at a two-decade high.

Expect continued volatility in stocks, bonds, and currency markets as investors grapple with mixed signals from the central bank. For traders, this environment presents opportunities but also significant risks as the Fed’s credibility hangs in the balance.

This aggressive policy shift might temporarily boost employment and consumer spending, but it risks inflating asset bubbles and reigniting inflationary pressures. Keep a close eye on market movements and the Fed’s next steps, especially as 2024 elections draw nearer.

BlackRock Touts BTC as “Unique Diversifier” Against Global Risks

WHAT HAPPENED:

BlackRock, the largest asset manager globally, released a whitepaper detailing why Bitcoin (BTC) is a "unique diversifier" among asset classes.

The paper comes on the heels of BlackRock’s spot bitcoin ETF, launched earlier this year, which quickly became one of the most successful ETFs in history with $21 billion in AUM.

KEY INSIGHTS:

Bitcoin's independence from macro factors: BlackRock argues that BTC has little exposure to the fiscal and monetary forces that drive most traditional assets. This makes it harder for investors to predict but also gives it a potential advantage as a hedge against geopolitical risks and macroeconomic instability

Performance: In seven of the last ten years, Bitcoin has outperformed all major asset classes. However, in the years it underperformed, it ranked at the bottom, highlighting its volatility.

Geopolitical hedge: The paper posits Bitcoin as a "flight to safety" during global tensions. As the U.S. federal deficit grows, BlackRock points to BTC as a safeguard against potential U.S. dollar weakening.

WHY IT MATTERS:

As the traditional financial system faces challenges—rising federal deficits, inflationary pressures, and geopolitical instability—BlackRock’s endorsement of Bitcoin highlights a growing mainstream acceptance of the asset as a hedge rather than just a speculative tool.

BlackRock’s assessment underscores BTC’s potential role in diversifying portfolios, especially as investors look for alternatives to hedge against traditional risks

🦾 Master AI & ChatGPT for FREE in just 3 hours 🤯

1 Million+ people have attended, and are RAVING about this AI Workshop.

Don’t believe us? Attend it for free and see it for yourself.

Highly Recommended: 🚀

Join this 3-hour Power-Packed Masterclass worth $399 for absolutely free and learn 20+ AI tools to become 10x better & faster at what you do

🗓️ Tomorrow | ⏱️ 10 AM EST

In this Masterclass, you’ll learn how to:

🚀 Do quick excel analysis & make AI-powered PPTs

🚀 Build your own personal AI assistant to save 10+ hours

🚀 Become an expert at prompting & learn 20+ AI tools

🚀 Research faster & make your life a lot simpler & more…

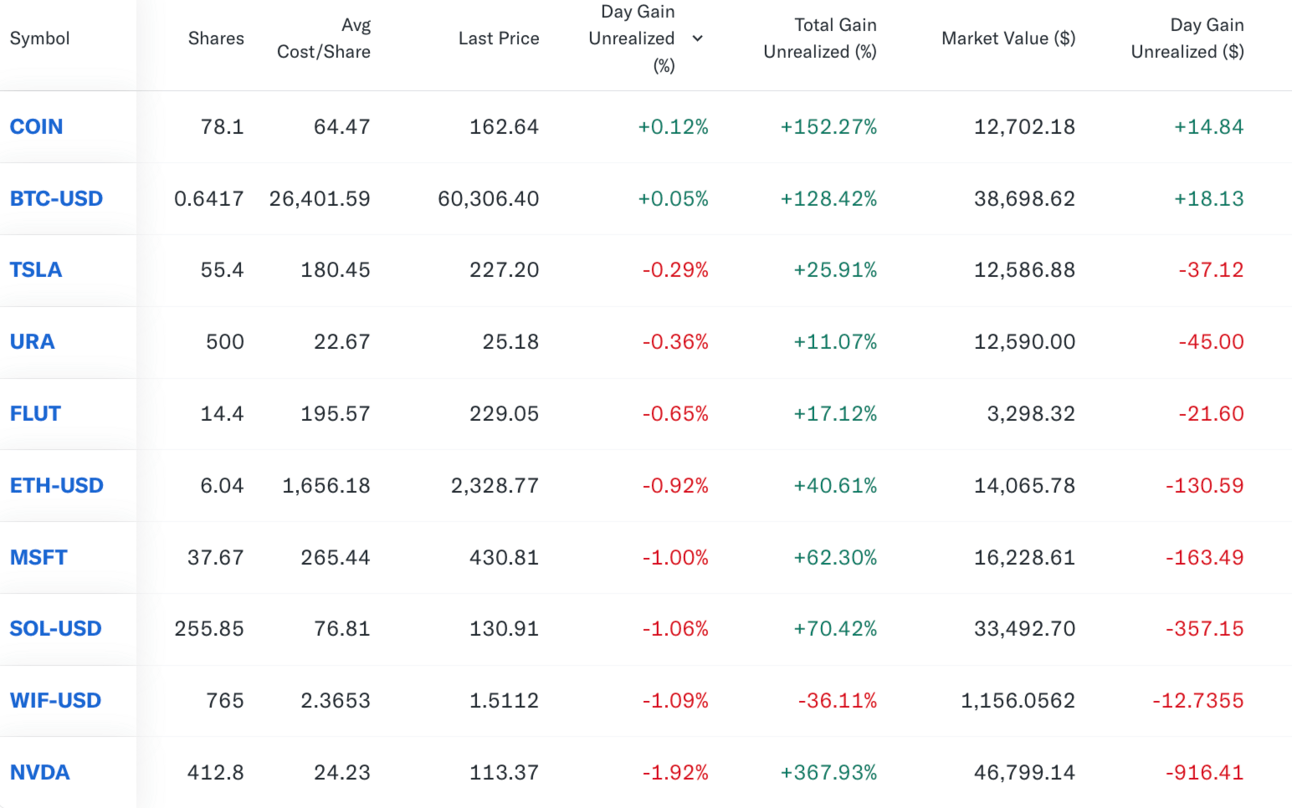

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Most Recently Revealed Trade:

Wednesday April 17 2024: We bought more Solana at $131 and added Solana’s top memecoin WIF at $2.36 on the heels of a leverage wipeout dip after the WW3 scare.

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio Notes

June 12: These assets all look great for continuation higher.

We are considering moving on from Tesla as it has lagged the rest of our portfolio badly and doesn’t have an obvious catalyst. We’ll monitor and let you know if we decide to move on.

Older Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll