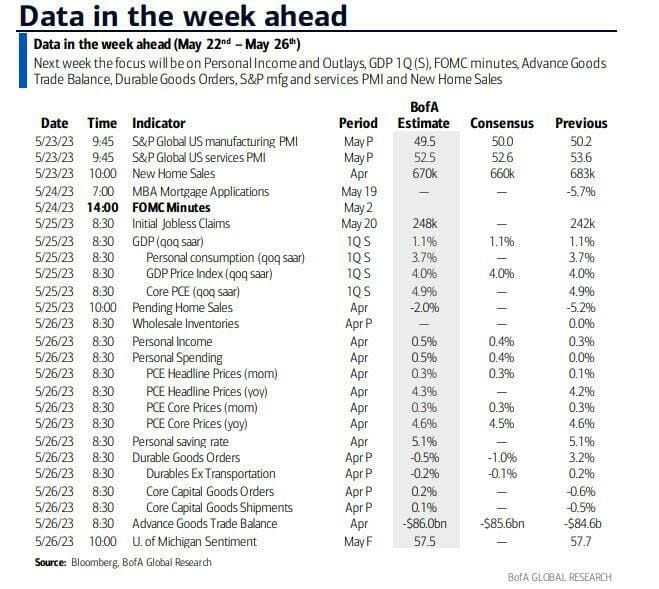

Table of this week’s data releases

GM and BRRR.

Editor’s Note: We started a daily podcast version of the newsletter. If you’d like to subscribe, it’s called Money Printer Go BRRR Podcast across all the podcast players. Here are the links to it on Spotify and Apple.

We have an interesting week ahead.

Elected and unelected bureaucrats from both the left and the right are hoping for an accommodative resolution to the debt ceiling negotiations. While Republicans insist on broad spending cuts and rollbacks of specific provisions of the ironically named Inflation Reduction Act as a prerequisite to any deal, Democrats have signaled a willingness to oblige.

While these spending cuts buy the country some time, they’re not nearly steep enough to change our long-term outcome, as the overall budget would still exceed 2019 levels without significant incremental revenue.

Elsewhere this morning, Fed President Neel Kashkari fielded questions on the path forward on the Fed’s inflation fight. Kashkari expressed that the Fed is currently split on June’s interest rate decision on whether to raise rates or leave them unchanged, but did stress that a pause would not preclude them from raising rates at the subsequent meeting.

A pause, in Kashkari’s view, would allow the Fed to collect more data on the impact of their actions to date. In our view, inflation has been tamed and this month’s data will confirm it.

Here’s what we brrr’d today:

The Fed’s Kashkari: We Might Leave Rates Unchanged in June

Weekend Setbacks: Biden and McCarthy to Meet Today

Apple Softens on Web3: STEPN Approved for Apple Pay

The Fed’s Kashkari: We Might Leave Rates Unchanged in June

Consideration of June Interest Rate Pause: Minneapolis Fed President Neel Kashkari hinted at the possibility of a pause in the Federal Reserve's rate-hiking cycle in June during his appearance on CNBC's "Squawk Box". While emphasizing that a June pause doesn't signal an end to the tightening cycle, he explained it would allow for more information gathering. Current markets predict an 83% chance that the Federal Open Market Committee will hold off on an 11th consecutive rate increase during their June meeting.

Long-Term Commitment to Inflation Control: Kashkari stressed the central bank's dedication to controlling inflation through consistent monetary policy tightening. He expressed concern over potential underestimation of persistent price pressures, indicating a possible need for the federal funds rate to exceed 6%. Despite market optimism about potential rate reductions later in the year, Kashkari clarified that if inflation fails to decrease, he would support further rate increases.

Impact of Banking Stresses and Macro-economic Uncertainty: There are potential indications that recent banking system stresses could influence the speed of economic progression, potentially affecting how aggressive the Fed needs to be with its rate changes. Kashkari expressed uncertainty about the broader macroeconomic impact of these banking issues, stating this as one of the most uncertain periods for understanding underlying inflation dynamics. These factors will be taken into account during the June meeting, which will also include updates on the Fed's forecasts for inflation, GDP, and unemployment.

Weekend Setbacks: Biden & McCarthy to Meet Today

Scheduled Debt Ceiling Negotiations: President Biden and House Speaker Kevin McCarthy are set to meet to revive stalled debt ceiling discussions. These negotiations aim to reach a resolution that would pass the Republican-dominated House and Democratic-led Senate. The two leaders have roughly 10 days to finalize a deal to raise or suspend the debt ceiling before the US Treasury exhausts its funds.

Differing Party Stances: The Republican party insists on significant cuts in government spending to accompany any increase in borrowing and has passed a House bill to implement this, while Democrats advocate for a 'clean' increase with no preconditions. Disputes over the proposed measures have contributed to the ongoing negotiation deadlock. Democrats accuse Republicans of pursuing harsh spending cuts that could negatively impact education and healthcare research programs, while Republicans reject tax increases proposed by Democrats.

Implications of Impasse: The failure to reach a deal has induced anxiety in Wall Street, with Treasury Secretary Janet Yellen and ratings agencies warning of the impending "X-date" - the day when treasury reserves dip below required levels for expenses. This date could be as soon as June 1. The situation could lead to a credit review and potential downgrade of the country's rating, similar to the events of 2011, which triggered a significant market downturn. Financial firms predict the "X-date" to be around June 8 or 9, granting Congress an additional week to find a solution.

Apple Softens on Web3: STEPN Approved for Apple Pay

Integration of Apple Pay into STEPN: The Web3 move-to-earn game, STEPN, is integrating Apple Pay as a fiat onramp to facilitate in-app purchases, with the goal of enhancing the app's accessibility. This move allows users to link their credit cards to Apple Pay, enabling them to buy non-fungible token (NFT) sneakers essential for gameplay without having to connect a crypto wallet.

Onboarding the Next Web3 Users: STEPN's Chief Operating Officer, Shiti Manghani, expressed that incorporating a familiar fiat onramp like Apple Pay can expedite the onboarding of the next 100 million Web3 users. Being the first blockchain gaming app to secure Apple Pay integration, STEPN aims to diversify and expose the app as well as Web3 to a broader audience outside of the existing Web3 community.

Leveraging Hybrid Technologies for User Onboarding: Despite seeing a decrease in active users over the past year, STEPN's co-founder, Jerry Huang, believes that utilizing a hybrid of Web2 and Web3 technologies, as evident in the Apple Pay integration, can simplify user experience, remove entry barriers, and aid in maturing the Web3 space to foster mainstream acceptance.

Mass Adoption: STEPN peaked at close to 1M daily active users in 2022.

AI ART OF THE DAY

The BRRR’s Portfolio

Portfolio has cracked $100k for the first time, up 11.24% in 6 weeks.

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Join our Facebook group to connect with the community.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.