SBF Plotting a Return?

GM and BRRR.

Today’s inflation data was encouraging, but not as rosy as the headline figures would indicate.

CPI came in at 5.0% y/y vs the 5.1% expectation. Only 30% of our readers correctly predicted this on our poll earlier this week.

Markets initially moved up. Then as the details were digested, traders recognized that the data was more nuanced, as surprising softness in Energy was responsible for much of the overall improvement. Markets sold off and finished lower.

The energy softness is on the back of last week’s announcement from OPEC, where it announced it would cut back on oil production through the end of the year. Many expect this to drive energy prices higher - negating some of the inflation improvement we saw this month.

Gold continued its steady walk above $2,000/oz before settling at $2,015. Reports are circulating that central banks and governments, specifically China, are buying record amounts of the shiny metal this year.

Do you like gold? Will it go up the rest of the week? Vote 👇

What will an ounce of gold be priced at on Friday April 14 at 4:00 ET?

In other news, a report circulated that bankrupt crypto exchange FTX has been able to recover/locate over $7B in funds, and is exploring a relaunch.

Astounding. Encouraging. Fascinating. Just return the money and let everyone go their owns ways.

Here’s what we brrr’d today:

Markets Cooled After CPI & FOMC Minutes

Ex-FTX CTO Assists Finding Missing Money

Markets Chilled Post CPI & FOMC Minutes

Stocks fall on recession concerns: Despite cooler-than-expected inflation data being released, stocks fell on Wednesday due to concerns about an upcoming recession.

Dow Jones and S&P 500 decline: The Dow Jones Industrial Average fell by 0.11%, ending a four-day winning streak, while the S&P 500 declined by 0.41% and the Nasdaq Composite fell by 0.85%.

Fed predicts mild recession: The Federal Reserve's Open Market Committee (FOMC) expects a mild recession to start later this year and last for two years due to fallout from the US banking crisis, with recovery thereafter.

Emergency lending facilities created: Following the collapse of Silicon Valley Bank and two others, the Fed officials created “emergency lending facilities”, ala BTFP, to ensure that banks could continue their operations.

Inflation data in line with Fed goals: “Inflation” has been mostly cooperative with the Fed's goals, with the personal consumption expenditures price index increasing only by 0.3% in February. However, core inflation increased by 0.4% for the month and 5.6% from a year ago, slightly above where it was in February, and the Fed expects housing inflation to slow through the year.

Former FTX CTO Helps Unearth Hidden Assets

FTX crypto exchange back from the dead: After filing a reorganization plan in July, FTX is considering reopening the exchange, although the details of the plan are yet to be determined.

FTX assets worth $7.3 billion: FTX's lawyers have confirmed that the company has collected $7.3 billion in assets, and reopening the exchange would require "significant capital" or the use of estate funds.

CEO proposed reopening: Current CEO John Ray III suggested the idea of reopening FTX in January, and lawyers representing the company's creditors have held several "reboot of exchange" meetings.

Former CTO knows where to look: Former FTX CTO Gary Wang, who pleaded guilty to criminal charges last year, is helping FTX debtors locate additional assets.

AI ART OF THE DAY

Janet Yellen weighed in on Ukraine today. The woman can do anything.

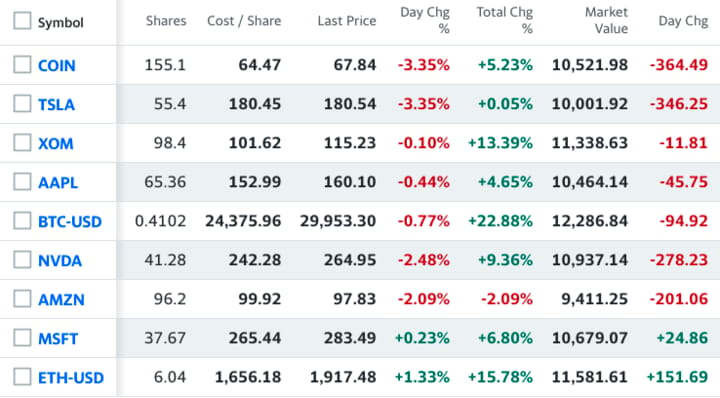

The BRRR’s Portfolio

Pain for the portfolio as tech was indiscriminately sold into the close.

Here’s your referral link to qualify for the Prediction Contest $100 Prize 👇

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Fed decisions can be a real pain in the assets. Join our Facebook group for industry insights and tricks to stay ahead of the curve. Memes for days, too.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.