Moment of truth this afternoon - we have The US Federal Reserve’s board of shadowy bankers announcing their Federal Funds Rate dictate at 2:00 pm ET.

Consensus estimate has the Fed hiking by 0.25%, with outlier outcomes skewed to the dovish side - leaving rates unchanged.

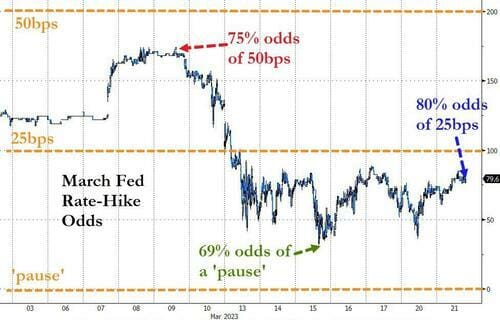

This morning Canada reported a February y/y inflation figure at 5.2% vs 5.4% estimated - potentially another indicator that inflation is cooling faster globally than was expected - giving the the Fed additional ammo to pause rates altogether. I expect 0.25% but think a total pause is more likely than is being priced in.

That’s in-line with my broad opinion that money printer is about to go brrr.

Here’s what you should know headed into Tuesday:

0.50% Hike Would Be Dramatic Policy Error

US Housing Saw Surprising Activity in Feb

Bitcoin & Ether on the move

WHAT WE OWN

$BTC, $ETH, $NVDA, $AAPL, $COIN, $XOM, $TSLA, $MSFT, $AMZN

Want our concise thesis on each asset? Refer a friend to The BRRR and we’ll send you the doc! Here’s how ⬇️

0.50% Hike Would Be Dramatic Error

Small banks expected to tighten lending rules given recent stress, slowing down economy

Commodity prices have slumped, with oil leading the charge (-42% since June 2022 high, indicating costs and demand have cooled, and the interest rate hikes may have actually helped

Small banks are in trouble because of high interest rates and further aggressive increases at a fragile moment could lead to more contagion

Looking like 0.25% is likely

US Housing Strong

Sales of previously owned homes increased 14.5% in February vs January, putting sales at an annualized rate of 4.58 million units.

This was the first monthly gain in 12 months and the largest increase since July 2020.

Sales were still 22.6% lower than February of last year.

Median home prices fell 0.2% from February 2022 to $363,000, the first decline in 131 consecutive months.

Higher mortgage rates since last summer have cooled home prices, but homes on the more affordable end of the market are selling.

Inventory levels are still at historic lows, with just 980,000 homes for sale at the end of February.

Bitcoin & Ether on the move

Cryptocurrency prices remain strong, as Bitcoin climbs back above $28k after a recent dip.

Ether is also on the rise, up 2.4% to $1,800.

With a roughly 17% chance of no rate hike, there’s a realistic chance of a complete reversal in the coming months as we’ve seen peak rates.

While some attribute the recent crypto rally to a lack of confidence in traditional institutions, others see inflation and Fed policy as the real driving force behind Bitcoin's price.

BTIG's Jonathan Krinsky warns that Bitcoin may be showing signs of "upside exhaustion" and faces resistance in the $28k-30k range.

Regardless, Bitcoin is up 21% for the month and a whopping 70% for the year so far.

TWEET OF THE DAY

Messari founder paraphrasing what the White House announced today.

AI ART OF THE DAY

Jerome’s a busy man printing money

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.