do you think you’re in charge?

GM and BRRR.

Sometimes, bitcoin ignores the rest of the news cycle and does its own thing. Monday was one of those days.

On a day with low volatility across markets, bitcoin defied the odds with a 5% surge, shattering key resistance levels and eventually settling over $29,600.

Searching for a catalyst is a fool’s errand - there was no significant news. As is often the case with bitcoin over its 14 year existence, demand was higher than the supply.

We continue to HODL the most immutable, decentralized, limited-supply store of value secured by the most powerful computing network in the history of the world - for the long-term.

Markets look to Wednesday’s inflation data (CPI) and FOMC Meeting Minutes for the next volatility event. Buckle up.

Last chance to vote in CPI on what you think Wednesday’s CPI Number will be below 👇

What will Wednesday's CPI report indicate y/y price inflation as?

Here’s what we brrr’d today:

Inflation vs. Unemployment: Which Pain Will We Choose?

Biden’s EV policy sparks debate, but will it actually work?

Fed’s Inflation Fight Results: all pain, no gain

Inflation dilemma: Fed must choose between increasing interest rates to further combat inflation while risking the job market and the banking sector, or waiting to see if their recent hikes and the elevated rates are already working as intended. Consensus estimates have the Fed increasing the benchmark lending rate by 0.25% at next meeting.

Urgency for wait-and-see approach: Failures of Silicon Valley Bank and Signature Bank, as well as the rescue of Credit Suisse by UBS, increase plausibility for a wait-and-see approach to avoid recession.

Previous statistics: Reported YoY inflation rate was 9.1% for June 2022, decreased to 6% for February 2023, and is expected to drop further to 5.1% for March’s report, announced Wednesday. The Fed targets 2% inflation and aims to raise rates to achieve that. US employers added 236,000 jobs in March, indicating a strong labor market that can absorb another rate hike.

Mixed outlook: Futures prices suggest a possible recession, while Fed projections indicate that the economy will avoid a recession. However markets are often forward-looking, and form price bottoms well before a recession is technically over.

Biden’s Regulators: Majority EVs by 2032 or Else

Strict pollution limits for electric cars: The US aims to have all-electric cars make up 67% of new passenger vehicle sales by 2032, with some of the toughest pollution limits globally. This policy would make the US a leader in cutting greenhouse gases created by cars, but poses significant obstacle for automakers who have yet to agree to goals of the Biden administration.

Massive undertaking to adopt electric vehicles: The regulation would require millions of new electric vehicle charging stations, revamping electric grids, and securing supplies of minerals and other materials for batteries. The proposed changes represent a complete transformation of the automotive market and industrial base, according to industry experts.

Impact on climate policy: Rapidly transitioning to zero-emissions vehicles is necessary to reach Biden's campaign promise to halve the country's emissions by 2030. The regulations would aid in efforts to speed up the transition to renewable energy and reduce demand for oil.

“Buy” the numbers: Average car price $46k, Toyota says $50, KBB reports average new electric vehicle costs $66k; only 5.8% of cars sold in the US last year were all-electric.

NYTimes and The VergeImpact on stocks: Ignoring of the feasibility of the plan, this narrative is good for $TSLA

AI ART OF THE DAY

The BRRR’s Portfolio

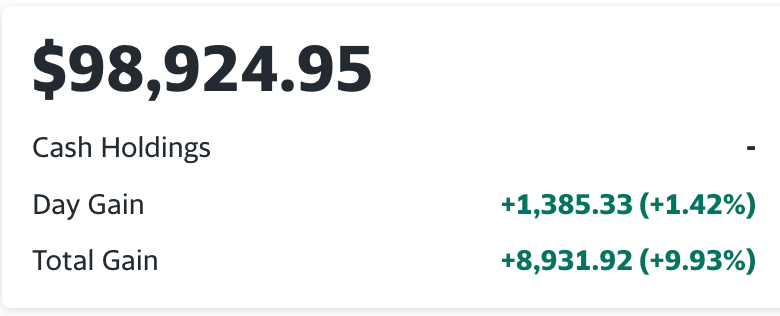

The crypto bounce carried us with BTC, ETH and Coinbase all strong. Portfolio is up 9.93% since we launched the newsletter on March 15th. 💪

Here’s your referral link to qualify for the Prediction Contest $100 Prize 👇

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.