Editor’s Note: We started a daily podcast version of the newsletter. If you’d like to subscribe, it’s called Money Printer Go BRRR Podcast across all the podcast players. Here are the links to it on Spotify and Apple.

GM and BRRR.

In a developing story, Janet Yellen apparently believes there “is motivation to see some consolidation and it wouldn’t surprise me to see some of that going forward”, according to a recent interview on CNBC. Ahem, too big to fail, anyone? Combine this with a recent take from another former Fed official warning of “sticky” inflation, seeing no short-term end to rate hikes, and it’s no wonder why so many smaller institutions may soon falter.

Delving a bit deeper, rising interest rates only worsen the outlook of homebuyers as mortgage rates hover between 6-7%, further worsened by low market supply. Homeownership used to be paramount to the American dream, but many are finding the nightmare of financing any new purchases too terrifying to consider.

Lastly, we switch gears (or clubs, in this case) for covering the merger between the USPGA and LIV golf, ending all current litigation between the two entities. Terms of the deal have not been disclosed yet, but under the control of the Saudi crown prince significant forthcoming investment is expected. Although many of us may not be scratch golfers, it will be interesting if other professional sports leagues look elsewhere under the guise of “driving the game’s future.”

Here’s what we’ve BRRR’d:

Former Fed President's Forecast: Higher Prices, Lower Spirits

Mortgage Rates - The Only Thing Going Higher Than Inflation

Fore-play No More: PGA Tour and LIV Golf Embrace a Passionate Merger

Former Fed President's Forecast: Higher Prices, Lower Spirits

Former KC Fed Pres says “no end to inflation and high rates”: Esther George, the former president of the Kansas City Federal Reserve Bank, predicts that the US will experience extended periods of elevated inflation and interest rates. The Fed is widely expected to pause or “skip” a rate increase at its June meeting for the first time after almost a year and a half of rate hikes.

Fed's rate currently at 16-year high: The Federal Reserve has raised its key short-term rate to over 5%, reaching a 16-year high. This increase comes after the rate was near zero in early 2022.

Difficulty in reducing inflation: Inflation has shown resilience over the past six months, making it a challenging task for the central bank. George supports a pause in interest rate hikes to allow the Fed time to evaluate its next moves, as it faces the challenge of bringing inflation down to target of 2%.

Mortgage Rates - The Only Thing Going Higher Than Inflation

Mortgage rates continue to rise: St. Louis Fed data shows an increase in 30-year mortgage rates, with an average of 6.79% through June 1. Bankrate data indicates that the average 30-year fixed-rate mortgage remains above 7%.

Blast from the Past: In October 1981, the average 30-year mortgage rate was 18.61%, more than double the current rate. Rates steadily declined to a low of 2.6% in December 2020 during the COVID-19 pandemic.

Upward trend in rates expected: With the Federal Reserve potentially raising interest rates further past a possible June pause, experts predict the continuation of the upward trend. Inflation and the prospect of more rate hikes contribute to the recalibration of benchmark Treasury yields.

Limited supply stress for homebuyers: Housing record lows, with only 1.6 months of supply available in January 2022. The scarcity of homes for sale compounds the challenges faced by prospective homebuyers.

Rates by the numbers:

30-year fixed-rate mortgages: Average rate of 7.18%, down 8 basis points over past week.

15-year fixed-rate mortgages: Average rate of 6.61%, up 5 basis points.

Jumbo mortgages: Average rate of 7.18%, decreasing by 13 basis points.

5/1 adjustable-rate mortgages: Average rate of 6.03%, an increase of 9 basis points and a 52-week high.

FHA-insured mortgages: Average rate of 6.41% for 30-year loans, down 4 basis points. VA loans reached 6.57%, up 4 basis points.

Fore-play No More: PGA Tour and LIV Golf Embrace a Passionate Merger

PGA Tour merges with LIV Golf: The merger will combine their commercial businesses and rights, creating a new for-profit company. LIV Golf is supported by the Saudi Arabia Public Investment Fund, which has reportedly invested $2 billion already. The integration of the PGA European Tour, known as DP World Tour, is included in the agreement. The specific terms of the deal, including the investment amount from the Public Investment Fund, have not been disclosed.

Pending litigation to be resolved: The proposed merger will bring an end to all ongoing antitrust lawsuits between the PGA Tour and LIV Golf. The agreement will establish a fair and objective process for players to re-apply for membership with the PGA Tour or DP World Tour after the 2023 season.

PGA Commissioner accepts criticism: PGA Tour Commissioner Jay Monahan acknowledges the criticism he may face and accepts being labeled a hypocrite due to the merger with LIV Golf. Monahan addressed the intense and heated reaction from PGA Tour players during a meeting regarding the merger announcement.

Significant investment expected from SA: The Saudi Arabia Public Investment Fund, controlled by the Saudi crown prince, is prepared to invest billions of new capital into the merged entity. The exact amount of investment has not been disclosed, but it signifies a substantial financial commitment to the future of the merged golf enterprise.

Trump supports the merger: Former President Donald Trump, who has hosted LIV Golf events at his golf courses, expressed his approval of the merger on his Truth Social platform.

AI ART OF THE DAY

Today’s AI Art of the Day features Treasury Secretary Janet Yellen as an astronaut, ready to leave us all behind…

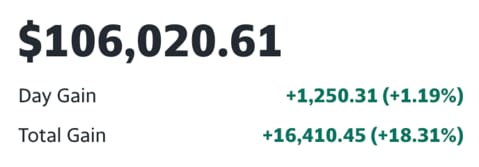

The BRRR’s Portfolio

Crypto rollercoaster continues, Tesla humming along…

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Join our Facebook group to connect with the community.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.