TheBRRR’s Thoughts

GM. Tides have changed and volatility is picking up.

Keith Gill, known on the internet as Roaring Kitty or DeepFuckingValue, the Youtuber most responsible for orchestrating 2021’s epic short squeeze in GameStop stock, tweeted on Sunday - his first social media post since the saga ended three years ago.

With Gamestock tripling from multi-year lows over the last three weeks, Gil posted a simple image of a man “locking in”, which has since been viewed over 10 million times:

Are the retail investor animal spirits about to return to close out a wild election year?

With the Fed itching to cut interest rates, Biden fielding inconvenient economic questions from a now-skeptical media, and Trump rising in the polls, are we about to see a flood of stimulus hit the economy to boost souring sentiment?

We think it’s very likely, and will remain “risk on”. The newsletter’s portfolio continues to reflect this.

Roaring Kitty’s Return Sends GameStop Soaring

WHAT HAPPENED:

GameStop Shares Surge: GameStop's stock soared over 70% in early trading following a new post by Keith Gill, also known as "Roaring Kitty," on social media platform X. This marks his first public activity since a three-year hiatus. His previous online presence was instrumental in the meme stock phenomenon that significantly impacted GameStop’s stock prices in 2021.

Meme Stock Frenzy Relived: The market reacted strongly to Roaring Kitty's new post, reminiscent of the 2021 meme stock frenzy. This time, the movement also boosted related meme coins on various blockchains, with some seeing astronomical rises in value.

WHY IT MATTERS:

Impact on Market Dynamics: The sudden spike in GameStop shares demonstrates the ongoing influence of social media and prominent figures within retail investment communities. This can lead to rapid volatility in the market, as seen with other meme stocks and digital assets linked to popular trends.

Impact on Market Sentiment: The excitement and speculative trading by retail investors can significantly influence overall market sentiment, potentially shifting it to a 'risk-on' stance where investors are more willing to invest in higher-risk assets.

Increased Retail Activity: A resurgence in retail investor enthusiasm, signaled by viral social media posts like those from Keith Gil (Roaring Kitty), could lead to greater market participation by individual traders. This can drive increased liquidity and potentially more dramatic price movements in certain stocks or sectors.

Week Ahead: Previewing The Incoming Economic Data

WHAT HAPPENED:

This week, financial markets are centered on a series of crucial economic reports and Federal Reserve communications. Key events include:

US Economic Data Releases: Major reports this week are the Producer Price Index (PPI) on Tuesday and the Consumer Price Index (CPI) on Wednesday, with additional data on retail sales and jobless claims later in the week.

Fed Speakers: A busy schedule includes remarks from Fed Chair Jerome Powell and other Fed officials, which could provide insights into future monetary policy.

Global Economic Indicators: Besides US data, notable releases include Japanese GDP, European economic sentiment, and Chinese industrial production.

WHY IT MATTERS:

Inflation Data as Market Catalyst: April's CPI and PPI data will be pivotal in gauging whether the inflation surge in Q1 is persisting into Q2, influencing Fed policy decisions. Market reactions to these indicators could set the tone for trading, impacting investment strategies and economic forecasts.

Fed Communication Impact: Speeches from Fed officials, including Powell, might clarify or reshape market expectations regarding interest rates, especially following mixed signals on economic recovery and inflation risks.

International Data Relevance: Economic reports from China, Japan, and Europe will help assess global economic health, influencing global market sentiment and potentially impacting U.S. markets.

Retail Sales and Job Market Data: U.S. retail sales and jobless claims provide a snapshot of consumer confidence and labor market strength, key indicators of economic stability.

Tiny Bitcoin Miner Set to Rival Industry Giants

The name of the game in bitcoin mining?

Lowering costs.

This small stock has found a way to produce bitcoin for up up to 28% LESS* than the biggest players in the space!

And get this…

It’s 100% renewable energy…

Read Bullseye Trade to learn more.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Most Recently Revealed Trade:

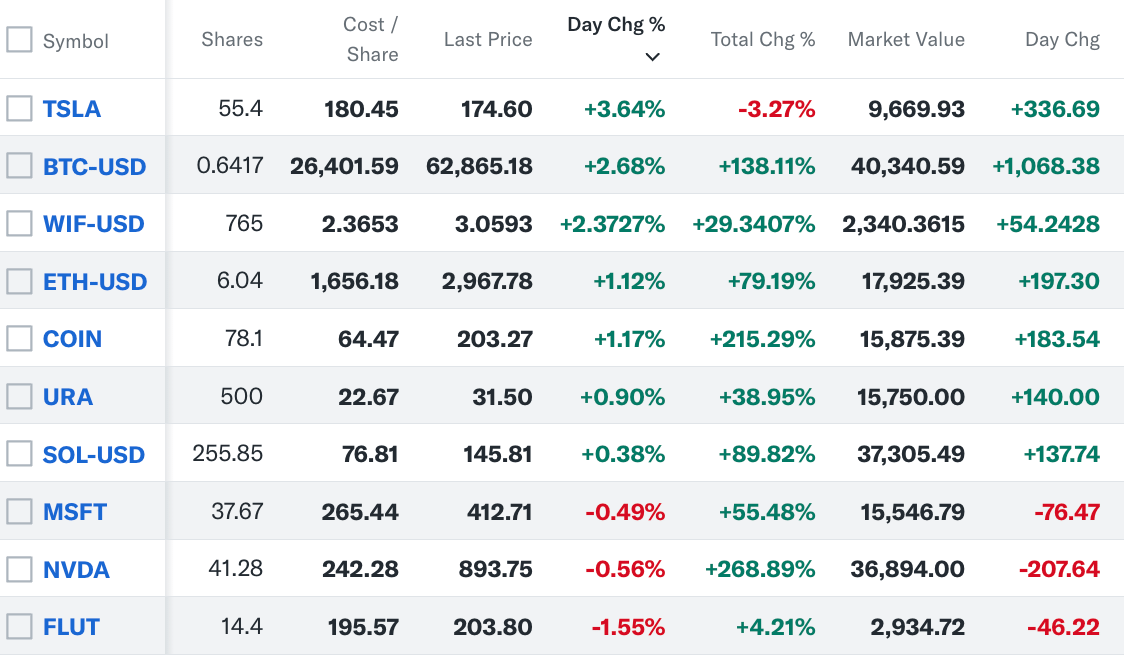

Wednesday April 17 2024: We bought more Solana and added Solana’s top memecoin WIF on the heels of a leverage wipeout dip after the WW3 scare.

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio

Older Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll