somehow ahead of the curve

Editor’s Note: We started a daily podcast version of the newsletter. If you’d like to subscribe, it’s called Money Printer Go BRRR Podcast across all the podcast players. Here are the links to it on Spotify and Apple.

GM and BRRR.

Checking back into the Binance drama, more news comes forward about the relationship between the SEC and crypto. Specifically, amidst legal battles and regulatory scrutiny, a captivating narrative emerges between SEC Chair Gary Gensler and cryptocurrency exchange Binance. Recent revelations unveil a connection dating back to 2019 when Gensler offered advisory services to Binance's parent company. This, of course, comes as Gensler now takes an aggressive stance on crypto regulation, and so questions arise about the impact of their prior relationship.

Looking into AI news, advertisers express discontent over the lack of control and transparency in AI ad placements by tech giants like Google and Microsoft. Temporary pullbacks from major advertisers signal a demand for greater autonomy in AI-driven advertising. Even with the enormous amount of investment and support given to advancing AI, delegating placement and effectiveness along with moderation seems to be a practice not yet fully understood with these new tools.

Companies will be hesitant towards progress and forward thinking even with new technologies if overbearing regulation and/or a general lack of control undermines their purpose and vision. Freedom of innovation stifled by too much or not enough control, an eery prospect.

Here’s what we’ve BRRR’d:

From Lunch Buddies to Legal Battles: The Tale of Gensler and Binance

Lost in the AI Abyss: Advertisers Demand Map and Compass to Navigate Ad Placements

From Lunch Buddies to Legal Battles: The Tale of Gensler and Binance

Gensler offered to advise Binance in 2019: Documents filed by Binance's lawyers reveal that SEC Chair Gary Gensler offered to serve as an advisor to Binance's parent company in 2019. This offer came during Gensler's tenure as a teacher at MIT's Sloan School of Management.

Gensler's crackdown on crypto: Over the past year, SEC Chair Gary Gensler has been aggressively regulating the crypto industry. He has sued numerous companies for selling unregistered securities and has taken a firm stance on enforcing compliance.

Alleged contact between Gensler and Binance's founder: According to the filed documents, Binance's founder Changpeng Zhao stayed in touch with Gensler even after their initial meeting. Zhao participated in an interview with Gensler as part of a cryptocurrency course at MIT, suggesting an ongoing relationship.

Request for Gensler's recusal: Binance's lawyers requested that Gensler recuse himself from any actions related to the company due to his prior relationship with Zhao. However, they did not receive any acknowledgment from SEC staff regarding their request.

SEC's investigations into Binance: The SEC initiated investigations into Binance.US and Binance in 2020 and 2021, respectively, well after Gensler and Zhao's alleged contact. This suggests that the investigations were not influenced by their prior relationship.

Lost in the AI Abyss: Advertisers Demand Map and Compass to Navigate Ad Placements

Backlash for inserting ads into AI experiments: Ad buyers criticize Google and Microsoft for incorporating ads in AI experiments without providing an opt-out option for advertisers. The move risks pushback from the industry, especially as the search ad market is expected to reach $286 billion this year (MAGNA).

Advertisers concerned about lack of control: Some advertisers are wary of their budgets being spent on features accessible to a limited number of users. Advertisers typically want control over ad placements to avoid association with unsuitable content or inappropriate contexts.

Ad placements lead to advertiser pullback: Multiple large advertisers have temporarily withdrawn ad spending from Microsoft in response to the lack of consent for ad placements in AI experiments. Wells Fargo is among the companies keeping some of its ad budget off Microsoft due to concerns.

Lack of transparency in AI ad placements: Ad buyers express concerns about Microsoft's lack of transparency reporting and the inability to determine ad performance in generative AI experiences. Google's Performance Max, an AI tool for optimal ad placements, is considered an "analytical black box" by many, as it lacks transparency in determining where ads are served.

Questions over AI ads with false information: Media buyers raise questions about how Google and Microsoft will prevent ads from appearing alongside AI responses that contain false information or hallucinations. Microsoft argues that Bing's web information can act as a grounding mechanism for large-language models, reducing the risk of hallucinations.

AI ART OF THE DAY

Today’s AI Art of the Day features SEC Chairman Gary Gensler with his hands on multiple cookie jars…

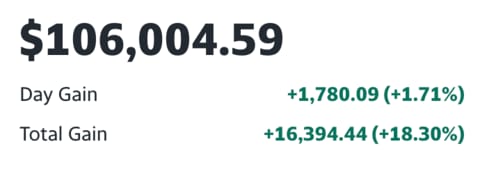

The BRRR’s Portfolio

Tesla keeps charging ahead, NVDA takes advantage of AI surge (still), and we wait to see AAPL’s VR results long-term. Overall, decently good ebbs and flows

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Join our Facebook group to connect with the community.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.