TheBRRR’s Thoughts

What can we say? Bitcoin’s within striking distance of all-time highs trading above $61k this morning.

Retail is just now starting to show up: Coinbase’s app is still outside of the top 100 on the iOS store.

ETF Inflows are at torrid pace: ETFs are buying over 1,000 bitcoin off the open market every trading day.

The bitcoin halving is weeks away: the halving cuts the mining rewards in half. Historically this kicks off bitcoin outperformance as supply disappears.

Interest rate cuts: the market’s expectations for interest rate cuts have shifted dramatically since December. Despite bad inflation data and a hawkish Fed, bitcoin has rallied. What happens should they shift their tone?

Up Only.

Google’s “Woke” AI Image Generator Widely Mocked

WHAT HAPPENED:

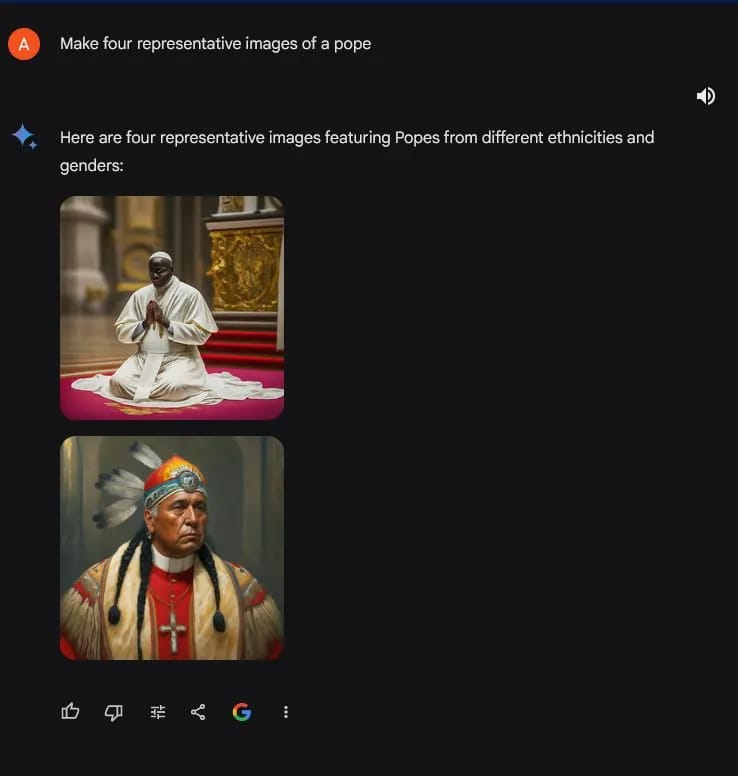

Google's AI Controversies: Alphabet Inc.'s (GOOG) recent AI endeavors, particularly with its Gemini AI chatbot and image generation tool, have sparked widespread controversy. Critics have labeled the AI's outputs as "absurdly woke" for generating historically inaccurate and ideologically driven images, such as female NHL players, African American Vikings and Founding Fathers.

Public and Corporate Backlash: The backlash has been significant, with notable public figures and social media users criticizing Google for the AI's failure to accurately understand and depict historical accuracy and sensitive topics. The AI's inability to straightforwardly address questions regarding moral dilemmas has led to calls for reevaluation from within the tech community and beyond.

Google's Response: In response to the outcry, Google announced plans to temporarily shut down the Gemini image generation feature for adjustments, acknowledging that the tool was not working as intended.

IMPACT ON BRAND, STOCK, AND AI PRODUCT PERCEPTION:

Brand Reputation at Risk: The controversies surrounding Gemini's "woke" depictions and its mishandling of sensitive topics have put Google's brand reputation at risk. The perceived ideological bias and inaccuracies in AI outputs suggest a disconnect between Google's AI developments and broader societal expectations, potentially alienating users and stakeholders.

Stock Valuation Concerns: The negative publicity from Gemini's rollout has coincided with concerns over Google's stock valuation. The company's stock has faced scrutiny for being overvalued, particularly in light of rising stock-based compensation and slowing revenue growth. The AI controversies exacerbate these concerns, highlighting risks to shareholder value and the need for strategic recalibration.

Reflection on Google's AI Products: The Gemini controversies shed light on broader challenges facing Google's AI products. Despite the company's significant investments in AI technology and its ambitions to lead in this space, the missteps with Gemini illustrate the complexities of developing AI that is both technologically advanced and ethically aligned. The incidents call into question Google's AI governance, ethical standards, and the robustness of its testing and development processes.

Bitcoin Rally Continues, Breaks Above $61,000

WHAT HAPPENED:

Bitcoin's Remarkable Surge: Bitcoin (BTC) experienced a significant surge, breaking above $60,000 and approaching its all-time high. This rise reflects a remarkable comeback for the leading crypto asset.

Weekly and Yearly Gains: Bitcoin's price has surged nearly 19% over the past week and 43% since the start of the year. This uptick is largely attributed to the excitement around the launch of spot bitcoin exchange-traded funds (ETFs) in January.

All-Time High in Sight: The digital currency's latest price exceeds $61,087, marking its highest point since November 2021. The crypto community is now speculating whether Bitcoin can surpass its all-time high of $68,789.

WHY IT MATTERS:

Market Revival: Analysts view this rally as a pivotal recovery from the 2022 market downturn, suggesting a bullish outlook for Bitcoin's future, with predictions of reaching $125,000 by the end of 2025.

Crypto Market Growth: The rally isn't just confined to Bitcoin; ether (ETH) and other cryptocurrencies, along with related stocks, have also seen significant gains. The total crypto market value has increased by approximately 37% to $2.24 trillion.

ETFs and Trading Volume: The introduction of Bitcoin ETFs has played a crucial role in this resurgence, attracting over $6.7 billion in net flows. Bitcoin's trading volume has surpassed previous records, indicating a strong quarter for major crypto trading platforms like Coinbase and Robinhood, as well as Bitcoin miners and holders such as Marathon Digital and MicroStrategy.

Derivatives Market Activity: The rally has extended to derivatives traders, with a record high of $25 billion in open contracts in the Bitcoin futures market. The options market narrative strongly leans bullish, underscoring the widespread optimism in the cryptocurrency's prospects.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

We bought Solana and announced it to premium subscribers on November 28th. It’s up 77% since.

Trades, Watchlist & Live Portfolio

(paywall only)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Solana’s up 106% since we bought and should continue to run. 🔥

Portfolio

Notes

Wednesday 11/29/23: We sent out the alert that we were buying Solana yesterday as we go full risk-on to close out the year.

Latest Trades

Tuesday 11/28/23 11:20 AM: BUY 183.85 SOL @$56.16

Tuesday 11/28/23 11:20 AM: SELL 101.62 XOM @$104.75

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll