in three words: “sound and resilient”

GM and BRRR

The week has kicked off with dovish data and a proclamation from a famous hedge fund manager that the Fed is finished raising interest rates.

On the data side, while we’ve seen consumer spending slow amongst low and medium income households for months, this morning we’re seeing the first signs of a slowdown amongst high income households - a likely biproduct of the dramatic corporate layoffs we’ve seen recently.

With the White House and Federal Reserve remaining hyper sensitive to economic conditions and fearful of tipping the economy into a recession as we enter the 2024 presidential election cycle, a fearful consumer may spook them into more accommodative financial conditions earlier than anyone expected.

Here’s what we brrr’d today:

Slow and Steady: Paul Tudor Jones Expects Gradual Market Rise

Manufacturing Challenges & Consumer Spending Headwinds

Slow and Steady: Jones Expects Gradual Market Rise

Rate-Hiking Ends: Billionaire hedge fund manager Paul Tudor Jones suggests that the Federal Reserve has concluded its campaign of interest rate hikes against inflation, and he believes the stock market has potential for gradual growth.

Inflation “Victory”: Jones points out that the Consumer Price Index (CPI) has declined for 12 consecutive months, which is an unprecedented occurrence in history, indicating that the central bank could declare victory in its fight against inflation.

Predicts Slow Growth: The Federal Reserve has raised interest rates 10 times since March 2022, reaching a target range of 5%-5.25%. However, the CPI has cooled significantly from its peak of around 9% in June 2022, dropping to 4.9% in April.

Spooky Parallels: Jones draws parallels between the current market conditions and the period leading up to the global financial crisis in mid-2006, noting that stocks continued to rise for over a year after the Fed stopped tightening monetary policy.

Buy the Dip: While Jones expresses a positive outlook for equity prices, he anticipates a slow and steady upward grind. He acknowledges potential short-term volatility due to political factors like the U.S. debt ceiling, but considers it a buying opportunity.

CNBC

Manufacturing Challenges & Consumer Spending Headwinds

Empire Fed Manufacturing Survey Collapses: The Empire Fed Manufacturing Survey takes a sharp downturn in May, reversing the surprising upside from April, with a significant drop of 42.6 points, the largest MoM drop on record.

Orders and Shipments Plummet: Both the orders index and shipments gauge experience significant declines, reaching their lowest points in months, indicating a notable slowdown in U.S. factory activity.

High-Income Earners Feel the Pinch: The slowdown in the labor market, particularly among higher-income earners with Bank of America data revealing a slowdown in credit and debit card spending per household, slowing to -1.2% YoY in April, raising concerns about the strength of the economy.

Support through Savings: Despite weakening spending, consumers maintain elevated deposit balances of near 50% higher than 2019 levels, providing a cushion of support. However, survey data suggests that the erosion of spending power due to inflation has tempered sentiment and expectations.

AI ART OF THE DAY

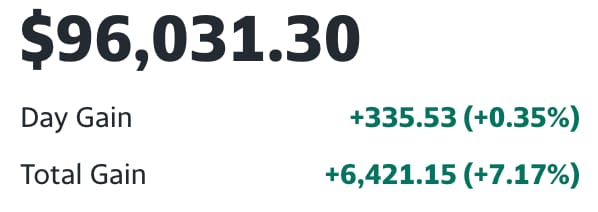

The BRRR’s Portfolio

Markets are mixed today with energy and crypto broadly positive

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Fed decisions can be a real pain in the assets. Join our Facebook group for industry insights and tricks to stay ahead of the curve. Memes for days, too.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.