TheBRRR’s Thoughts

We got a hot inflation report on Tuesday, leading to a broad sell off in risk assets as markets repriced the likelihood of interest rate cuts throughout the year.

The Nasdaq lost 2% on the day, but bitcoin remained remarkably strong, closing the day nearly flat after losing as much as 4% from the recent highs.

Bitcoin’s relative strength tipped its hand and its subsequent followthrough today.

As markets rebounded overnight and into early trading today, the Nasdaq is up by 0.9% while bitcoin has gained 4%, setting new multi-year highs.

In contrast, gold sold off by 1% yesterday and has continued lower today.

We’ve identified the fastest horse in current race conditions. Buckle up!

Check out today’s sponsor for the best in AI coverage, The Rundown AI:

Stay up-to-date with AI.

The Rundown is the world’s fastest-growing AI newsletter, with over 500,000+ readers staying up-to-date with the latest AI news, tools, and tutorials.

Our research team spends all day learning what’s new in AI, then distills the most important developments into one free email every morning.

Bitcoin Tops $1 Trillion As Gold ETFs Dumped In Favor Of Crypto

WHAT HAPPENED:

Bitcoin's market cap hits $1 trillion, a milestone not seen since November 2021, with its price surpassing $52,000.

Bitcoin now ranks as the 10th most valuable asset globally, overtaking giants like Tesla and Berkshire Hathaway.

Significant inflows into Bitcoin Spot ETFs have been observed, with a record net inflow yesterday.

$11 billion has been invested in Bitcoin via ETFs, excluding Grayscale's Bitcoin Trust (GBTC).

Conversely, Gold ETFs experienced $858 million in outflows last week, with a year-to-date total of $3.2 billion in redemptions.

The upcoming Bitcoin halving is anticipated to boost its market price further by altering the demand-supply dynamic.

WHY IT MATTERS:

The shift from gold to Bitcoin among investors signals a broader acceptance and confidence in cryptocurrencies as a viable investment class.

The inflows into Bitcoin ETFs, especially amid the outflows from traditional gold ETFs, highlight a changing landscape in asset allocation preferences.

The anticipation around the Bitcoin halving event underscores the significant impact of supply mechanisms on Bitcoin's price and the cryptocurrency market at large.

INSIGHT: The transition of investment from gold to Bitcoin and the massive inflows into Bitcoin ETFs reflect a remarkable shift in investor sentiment and market dynamics, potentially reshaping the landscape for both traditional and digital assets. With the halving event on the horizon, the balance between supply and demand could further tilt in Bitcoin's favor, although investors should heed the caution signaled by the current market sentiment index.

Macroeconomic Shock: Stubborn Inflation Delays Fed's Victory Lap

WHAT HAPPENED:

January delivered a nasty surprise: hotter-than-expected inflation of 3.1%, defying forecasts and dousing Wall Street's hopes for an imminent Fed rate cut.

Core inflation, excluding volatile food and energy, defied expectations by holding steady at 3.9%, indicating underlying price pressures remain entrenched.

Stocks plunged, with the Dow experiencing its worst one-day decline since March, as investors adjusted to the possibility of delayed rate cuts. Bond yields, anticipating the Fed's hawkish stance, soared to multi-month highs.

WHY IT MATTERS:

This inflation report throws a wrench into the Fed's carefully crafted narrative of a disinflationary victory. Their hopes of celebrating a smooth return to 2% inflation by year-end are looking increasingly shaky.

Investors cheering for rate cuts to boost stock prices face a reality check. The Fed's dovish pivot may be postponed, potentially until mid-2024, putting a damper on market exuberance.

While disinflation is underway, it's far from smooth sailing. Prices for everyday essentials like groceries remain stubbornly high, impacting consumer sentiment and purchasing power.

The Fed now has a delicate balancing act. They need to ensure inflation doesn't become entrenched without triggering a recession through aggressive rate hikes.

This delay in rate cuts might have longer-term implications. Consumer confidence, already dampened by high prices, could take longer to recover, impacting spending and economic growth.

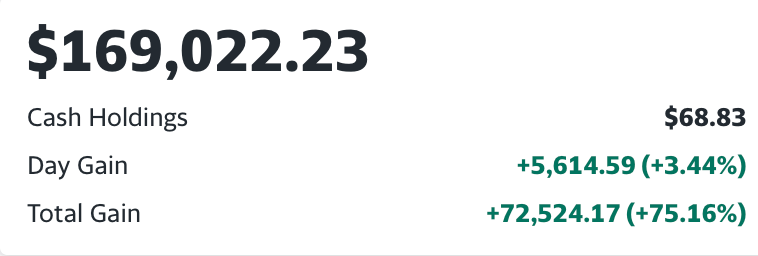

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

We bought Solana and announced it to premium subscribers on November 28th. It’s up 77% since.

Trades, Watchlist & Live Portfolio

(paywall only)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Solana’s up 90+% since we bought and should continue to run. 🔥

Portfolio

Notes

Wednesday 11/29/23: We sent out the alert that we were buying Solana yesterday as we go full risk-on to close out the year.

Latest Trades

Tuesday 11/28/23 11:20 AM: BUY 183.85 SOL @$56.16

Tuesday 11/28/23 11:20 AM: SELL 101.62 XOM @$104.75

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll