Like the best Robinhood traders do

GM and BRRR.

Editor’s Note: We started a daily podcast version of the newsletter. If you’d like to subscribe, it’s called Money Printer Go BRRR Podcast across all the podcast players. Here are the links to it on Spotify and Apple.

As China continues to crack down on crypto and web3 innovation, Hong Kong is beginning to embrace it - announcing a regulatory framework for crypto exchanges to operate in the territory. This is a significant development that indicates Hong Kong may have more autonomy over its policies and economic development than markets believed.

Domestically here in the US, the dollar has seen strength to start the week as Fed officials continue to make hawkish statements, promising to slay the inflation dragon at nearly any cost. Despite this positioning, markets are still pricing a mere 30% chance of an interest rate increase at the next FOMC meeting.

Today’s manufacturing and service data did little to clarify the inflation picture, as manufacturing costs have cooled dramatically while service costs continue to rise as pandemic-related supply change issues are largely resolved while demand for travel and leisure continues to surge.

Tomorrow morning, the meeting minutes from the last FOMC meeting will be released, so we’ll have the chance to digest a bit more context and the nuance behind the Fed’s decision to raise rates by 0.25% at their last meeting.

Here’s what we brrr’d today:

Hong Kong To Open Crypto Trading

Dollar Strength & Debt Jitters

Hong Kong To Open Crypto Trading

Retail Trading of Cryptocurrencies in Hong Kong: The Securities and Futures Commission (SFC) of Hong Kong has announced plans to allow retail trading of cryptocurrencies as early as the latter half of this year. The SFC will begin accepting applications from exchanges to offer these services from June 1.

Effort to Become a Crypto Hub: This move aligns with Hong Kong's goal to become a hub for the cryptocurrency industry, despite the caution exhibited by other jurisdictions following the collapse of the cryptocurrency exchange FTX last year. Cryptocurrency exchanges will decide which cryptocurrencies they offer to investors, but they should ideally have a large market capitalization and liquidity

Challenges to Growth: Despite these positive developments, there are practical obstacles to the growth of the cryptocurrency industry. For instance, several crypto companies have reported difficulties opening bank accounts in Hong Kong, which the Hong Kong Monetary Authority is addressing.

Bitcoin Reaction: Crypto markets climbed roughly 2% this morning in the afterglow of the announcement. Bitcoin is hovering above $27,000.

Dollar Strength & Debt Jitters

Rising U.S. Dollar: The U.S. dollar climbed for a second day on Tuesday, momentarily reaching a six-month high against the Japanese yen. This rise is linked to expectations that U.S. interest rates will stay higher for longer. Ongoing negotiations about the U.S. debt ceiling also contributed to investor unease.

Federal Reserve's Stance on Rates: Several Federal Reserve officials suggested on Monday that the central bank still has room to tighten monetary policy. Minneapolis Fed President Neel Kashkari indicated that U.S. rates may need to exceed 6% to bring inflation back to the Fed's 2% target, and St. Louis Fed President James Bullard proposed another half-point rate increase this year.

Hawkish Sentiment Boosts Dollar: As U.S. policymakers indicated a preference for higher rates, traders increased bets that the Fed funds rate will remain high. Markets are currently pricing in a nearly 30% chance of a rate hike in June, with the Fed funds rate expected to be around 4.75% in December.

U.S. Debt Ceiling Concerns: Investors are also concerned about the impending debt ceiling deadline in the U.S., which has curbed risk sentiment and bolstered the safe-haven U.S. dollar. There is currently no agreement on how to raise the U.S. government's $31.4 trillion debt ceiling, with only 10 days remaining before a possible default.

Impact on Global Currencies: The rising U.S. dollar kept the offshore yuan near its recent five-month low. China kept its benchmark lending rates unchanged on Monday, limiting the scope for substantial monetary easing to boost the country's post-COVID economic recovery. Other currencies, including the Aussie and the New Zealand dollar, also fell against the U.S. dollar.

AI ART OF THE DAY

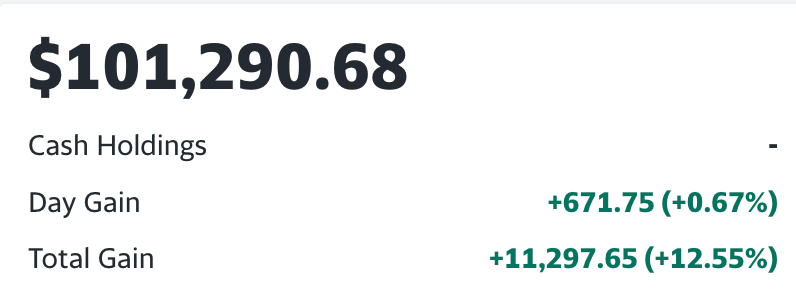

The BRRR’s Portfolio

Portfolio has cracked $100k for the first time yesterday, up 12.55% in 6 weeks.

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Join our Facebook group to connect with the community.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.