TheBRRR’s Thoughts

GM.

We’ve got a big week ahead with critical core PCE inflation data and mega-cap earnings due to hit the tape.

The Fed is in a commentary blackout window ahead of their July 30 FOMC meeting and its accompanying interest rate decision. Markets are pricing in a mere 3% chance of a rate cut at the July meeting, but nearly 95% odds of a cut at the September meeting.

Here's what you need to know about the week ahead:

Political Shifts:

Joe Biden has withdrawn from the presidential race, endorsing Kamala Harris.

Potential rivals Newsom and Buttigieg have also endorsed Harris, solidifying her position as the likely Democratic nominee.

Economic Indicators:

Tuesday: Richmond Fed manufacturing index, existing home sales.

Wednesday: Global flash PMIs, Bank of Canada rate decision, new home sales.

Thursday: Q2 GDP advance estimate, durable goods orders, initial jobless claims.

Friday: Core PCE inflation report, personal income and spending data.

Market Expectations:

DB economists predict a 0.14% MoM increase in the core PCE deflator, potentially rising to 0.2% due to downward revisions in prior months.

The annual core PCE rate is expected to dip to 2.5%, below the Fed's year-end prediction of 2.8%.

Market Catalysts:

Major companies reporting this week include Tesla, Alphabet, LVMH, Verizon, Coca-Cola, IBM, AT&T, Nestle, Roche, and more.

Ether spot ETFs will begin trading on Tuesday, improving access to the crypto asset class for institutional investors. Bitcoin’s spot ETF has been more successful than pre-launch expectations, attracting billions in inflows.

Crypto Prediction Market Proving Useful & Prescient Amidst Political Turmoil

Polymarket is a prediction market platform where users can bet on the outcomes of various events, ranging from political elections to economic indicators. It operates on the principles of decentralized finance (DeFi), using cryptocurrency for transactions.

Prediction markets are having a moment, and Polymarket is leading the charge:

Biden's Dropout:

Polymarket predicted a high probability (66%) of Biden dropping out, even when he insisted he was staying in the race.

Biden's decision not to seek re-election spurred a record $28 million daily volume on Polymarket.

A Polymarket user betting on Joe Biden to win the Democratic Presidential nomination, race, and popular vote has lost $2 million following the President’s announcement that he is stepping down as his party’s nominee.

Another trader scored a 6,000% increase in their initial bet that Kamala Harris would be the nominee.

Market Dynamics:

Polymarket has seen a significant increase in usage, with over $150 million in volume in July 2024, up from $6.6 million in December 2023.

Major political contracts on Polymarket have pooled over $500 million, including $319 million for the U.S. presidential election winner market.

Investment Surge:

Polymarket's recent $45 million Series B round, led by Founders Fund, has propelled its growth.

The platform's odds are increasingly cited in mainstream media as a relevant source for electoral probabilities.

Challenges and Considerations:

While prediction markets offer a fresh perspective, they aren't infallible and can be influenced by "degen gamblers" and unreliable polls.

Nate Silver, now an adviser at Polymarket, highlights the issue of "dumb money" skewing predictions in large elections.

Future Outlook:

With Biden's exit and Kamala Harris as the Democratic frontrunner, the market for election-related contracts continues to thrive.

Polymarket's volume and relevance are expected to grow as political events unfold.

China Unexpectedly Cuts Rates to Boost Economy

China made an unexpected move by cutting key policy rates to stimulate its economy:

Rate Cuts:

Seven-day reverse repo rate: Lowered from 1.8% to 1.7%.

One-year loan prime rate (LPR): Reduced from 3.45% to 3.35%.

Five-year LPR: Decreased from 3.95% to 3.85%.

Context:

This marks the first broad rate cuts since August 2023.

The cuts come shortly after the Third Plenum, which ended without major economic announcements.

Economic Impact:

The rate cuts aim to boost financial support for the real economy.

Analysts expect further rate cuts but highlight the need for substantial fiscal measures to meet growth targets.

The cuts are seen as a reactive measure to the recent economic slowdown.

Future Projections:

More rate cuts are anticipated following potential rate-cutting cycles by the US Federal Reserve.

Additional reductions in the reserve ratio requirement are expected in the upcoming quarters to enhance liquidity.

Government Initiatives:

Plans to increase affordable housing supply and reform property market regulations were outlined.

Local governments will have more flexibility to adjust housing policies.

Expert Opinions:

Analysts caution that without adjustments to other policy rates, pressures on Chinese banks could rise.

Economic growth and inflation forecasts face slight downside risks due to the reactive nature of these measures.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Most Recently Revealed Trade:

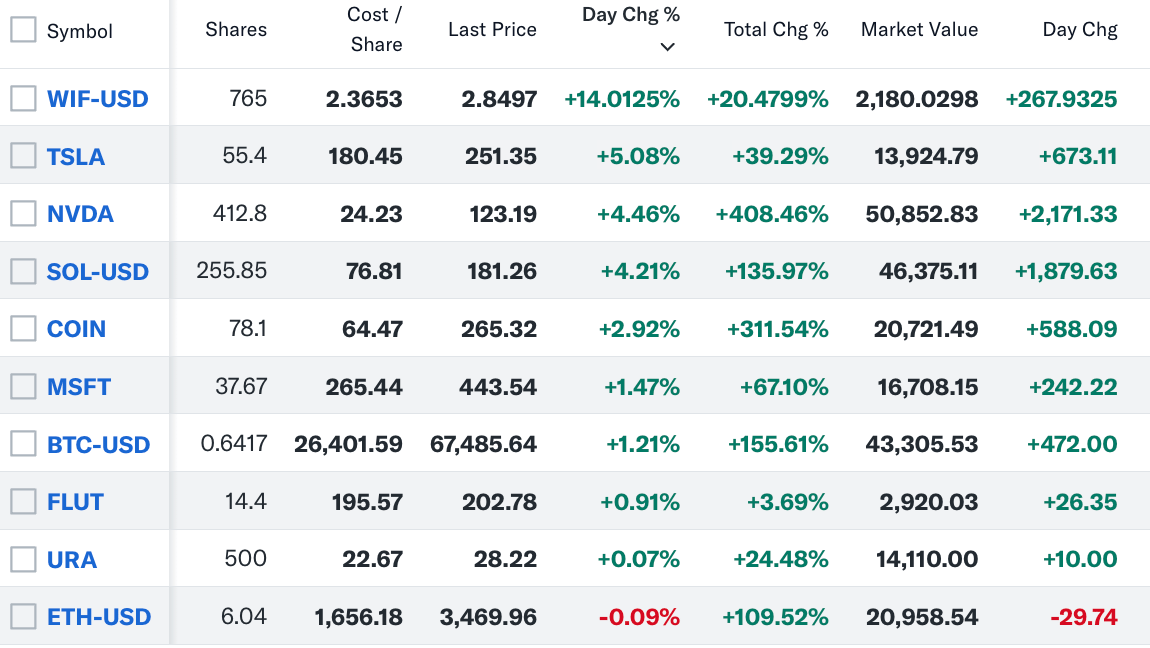

Wednesday April 17 2024: We bought more Solana at $131 and added Solana’s top memecoin WIF at $2.36 on the heels of a leverage wipeout dip after the WW3 scare.

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio Notes

June 12: These assets all look great for continuation higher.

We are considering moving on from Tesla as it has lagged the rest of our portfolio badly and doesn’t have an obvious catalyst. We’ll monitor and let you know if we decide to move on.

Older Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll