GM and BRRR.

With Q2 earnings in the rearview mirror, markets turn the spotlight to economic data hitting the tape.

Earnings were broadly positive and better than expectations this quarter, but market reaction remained muted. The biggest tech winners of the quarter are trading 5-10% higher (META, GOOG, MSFT), the losers are trading similarly lower (AAPL, TSLA, COIN), while the indexes (Sp500 & Nasdaq) are mostly flat.

On the economic data side, CPI (consumer price inflation) and PPI (producer price inflation) are due on Thursday and Friday, respectively. Markets expect the data to show that inflation has continued to cool this summer, although a recent rise in gas prices gives credence to the theory that inflation will reaccelerate this year.

We don’t buy the reacceleration theory, as China is expected to report y/y deflation in their respective CPI and PPI reports this week.

Today’s email is brought to you by the AI Tool Report. It’s an amazing free resource to help you stay on top of the tech world with the most impactful stories.

Please consider subscribing and opening their emails - it’ll support us at The BRRR. 👇

What Else I’m Reading

The AI Tool Report: Leverage AI for productivity. Leverage AI for creativity. Leverage AI so the robots don’t replace you. This newsletter brings the best AI Tools to your inbox. Here’s your link to subscribe for free.

Looking Ahead

Earnings Wrap Up as Markets Obsess Over Inflation

This week offers several critical data releases that could demonstrate inflation pressures are finally easing from 40-year highs reached earlier in 2022. The main event is Thursday's CPI report, which is expected to show a continued, yet modest, moderation in price increases. Still, risks remain from factors like surging oil prices with a stunning 16% surge in July. Friday brings PPI data and the University of Michigan consumer sentiment survey, which contains closely watched inflation expectations.

Meanwhile, earnings season enters its final stretch, with Disney, Alibaba, Siemens and other major companies set to report. While markets may be reassured if prices are cooling, corporate results and guidance will offer insight into how inflation is impacting consumer behavior and business operations.

CPI/PPI Data Key for Inflation Outlook: Core CPI is expected at +0.21% month-over-month, which would lower the headline year-over-year rate to 4.8%. More importantly, the 3-month annualized rate is seen falling about 80 basis points to 3.3%, and the 6-month rate dropping 40 bps to 4.2% - providing hope that persistent inflation pressures are abating. However, an acceleration in oil and gasoline prices poses a risk.

China’s Deflation Concerns: China's Wednesday CPI and PPI reports will provide insight into disinflationary forces, as estimates point to -0.5% CPI and -4% PPI year-over-year. PPI has been negative for over a year, but CPI dipping below zero would signal meaningful consumer price deflation is taking hold in the world's second largest economy.

Mixed Earnings Season Close Ahead: With nearly 90% of S&P 500 companies having reported, earnings season enters its final stretch. Disney and AMC will be closely watched in the entertainment sector. Siemens and Allianz results will shed light on economic trends in Europe. Alibaba's report comes as China crackdowns and COVID have hammered tech firms.

Crypto News

PayPal Launches U.S. Dollar-Pegged Stablecoin

PayPal has announced the launch of a new stablecoin fully pegged to the U.S. dollar, called PayPal USD or PYUSD. This represents a major move by the payments giant into the cryptocurrency and blockchain space. The stablecoin is being issued by Paxos Trust Company and will gradually roll out to eligible U.S. PayPal customers over the coming weeks. PYUSD is designed to integrate digital currencies into PayPal's payments system and make transactions faster, cheaper, and easier. It will be fully backed by dollar deposits and short-term U.S. Treasuries held in reserve by Paxos.

Enabling transfers between PayPal wallets and external crypto wallets: One key feature of PYUSD is that customers will be able to easily transfer the stablecoin back and forth between their PayPal account and compatible external cryptocurrency wallets. This will facilitate seamless flows between traditional fiat currencies and cryptocurrencies, allowing PayPal customers to leverage the speed and cost benefits of crypto for payments and transfers.

Providing infrastructure for developers in the web3 space: As an ERC-20 token issued on the Ethereum blockchain, PYUSD is designed to be easily integrated into Ethereum-based applications, crypto exchanges, and web3 wallets. This will help expand PayPal's presence and utility in the rapidly growing web3 ecosystem. PayPal is aiming to provide key infrastructure for developers building decentralized apps, metaverse environments, and other web3 projects.

Powering faster, cheaper payments: With PYUSD, PayPal aims to reduce fees and friction associated with traditional cross-border payments and remittances. PYUSD will enable faster and lower-cost transfers within PayPal's network. The stablecoin can also facilitate payments for virtual goods and services, especially in metaverse environments where blockchain-based tokens provide advantages.

Today’s Reader Poll

Vote and leave a comment - we’ll feature the top comment tomorrow!

Will Bitcoin outperform the Nasdaq over the next 10 years?

AI Art of The Day

Trump trying (and failing) to enjoy his tumultuous summer.

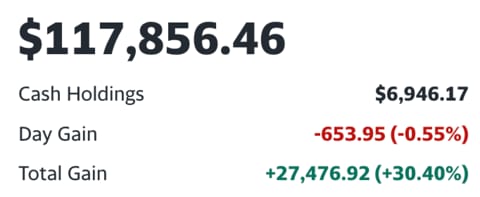

The BRRR’s Portfolio Update

The strongest AI plays are rising today with everything else sinking. We still have 5% cash - may deploy it into the watchlist soon.

On Watchlist:

$ASML: They make the machines that make AI machines

$ISRG: Robot Surgeons

$META: Sleeper in AI race and ad biz is proving resilient

$OPRA: Growing web-browsing solution

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.