TheBRRR’s GM

This morning’s PPI (producer price index) suggests inflation is starting to perk back up, with producer prices rising by 0.5% m/m vs the 0.3% initially expected. We’ll see if tomorrow’s CPI (consumer price index) strengthens the narrative or not.

Vote and comment in today’s poll to express your view on inflation - we’ll highlight the best comments on Friday.

In today’s deep dives, we’re covering the above mentioned PPI report and a pair of acquisitions made by companies in the BRRR's portfolio - AMD and Exxon.

AMD’s acquisition helps them on the software side, where they’re notoriously weak, while Exxon’s acquisition bolsters their position as the world’s leading oil producer in a $60B all-stock takeover of Pioneer.

Other stories catching our attention:

The housing markets are feeling the pain. Major RE associations opined a letter to the Fed to halt further interest rate hikes, warning that continued actions could destabilize the housing market. Already grappling with high mortgage rates and reduced transactions, fears continue that their policies could exacerbate the downturn.

In revelations unearthed during Sam Bankman-Fried’s trial, FTX's "Insurance Fund" was falsely calculated using a random number generator, as revealed by co-founder Gary Wang.

The evidence continues to mount that SBF was more nefarious than negligent, making it easier to lock him up and throw away the key.

Should we make any changes to our portfolio, premium subscribers will be the first to know with the actual assets and sizing involved.

Today’s newsletter is brought to you by The AI Tool Report. Please consider subscribing and opening their emails - it’ll directly support us at The BRRR. 👇

What Else I’m Reading

The AI Tool Report Learn AI in 5 Minutes Per Day. The AI Tool Report does an outstanding job surfacing the most practical AI breakthroughs that you can actually leverage today.

Here’s your link to subscribe for free.

Market News

AMD’s Strategy: If You Can’t Beat Nvidia, Nod

Advanced Micro Devices (AMD) has announced its intention to acquire Nod.AI, an open-source AI software startup, as a strategic move to bolster its AI software operations. This decision is in line with AMD's AI growth strategy, especially in the face of stiff competition from Nvidia.

Learning Prowess: Nod.AI, also known as Nod Labs, is renowned for its expertise in reinforcement learning, where systems adapt and "learn" through a process of trial and error.

Founding Team: Before establishing Nod in 2013, CEO Anush Elangovan was a key player in Google's first Chromebooks team and a lead engineer at Cisco. Additionally, Nod's CTO, Harsh Menon, has a background with Kitty Hawk, an electric aircraft company supported by Google's co-founder.

From Hardware to Software: Initially, Nod Labs was recognized as an AI hardware firm, concentrating on gesture recognition and motion-tracking wearables. They developed innovative products like Bluetooth rings for VR gaming and secured significant funding from top-tier venture capital firms.

Exxon Doubles Down on Shale with Pioneer

Exxon Mobil Corp. is set to acquire Pioneer Natural Resources in a monumental all-stock deal valued at $59.5 billion. This acquisition, the largest for Exxon in over two decades, is poised to significantly bolster its shale oil production, potentially sparking another shale revolution in the US energy sector.

The transaction is expected to conclude in the first half of 2024.

Historic Takeover: The deal, with an implied total enterprise value (including net debt) of approximately $64.5 billion, stands as the world's largest corporate takeover announced this year. It surpasses Exxon's previous major acquisition of Mobil Corp. in 1999.

Boost in Production: Post-acquisition, ExxonMobil's production in the Permian region is projected to double, reaching 1.3 million barrels of oil equivalent per day (MOEBD) based on 2023 figures. By 2027, this could surpass 2 MOEBD. The merger will position Exxon as the top shale producer in the Permian Basin, with daily production soaring to nearly 4.5 million barrels.

Strategic Value: ExxonMobil Chairman and CEO, Darren Woods, emphasized the merger's potential for long-term value creation, highlighting the combined strengths of both companies. Pioneer CEO, Scott Sheffield, also lauded the merger, noting that the unified entity would be a diversified energy powerhouse with an unparalleled presence in the Permian Basin.

Macro News

Inflation's Hot, But August Was Hotter

In September, the U.S. experienced an increase in wholesale prices, showing persistent inflationary pressures in the economy.

The producer price index (PPI), tracking the costs producers pay for finished goods, rose by 0.5% m/m and 2.2% y/y. This was higher than the Dow Jones' anticipated rise of 0.3%, but still less than the 0.7% increase observed in August.

When food and energy are excluded, the core PPI saw a rise of 0.3%, slightly above the forecasted 0.2%. The market's reaction was relatively muted, with only minor shifts in stock futures and Treasury yields.

This PPI data is crucial as it serves as a precursor to inflation trends, gauging the costs of goods that eventually reach consumers.

Gasoline's Impact: The inflationary pressures were predominantly driven by final demand goods, which saw a 0.9% increase. A major contributor to this was the surge in gasoline prices, which rose by a substantial 5.4% within the month.

Banking Services Rise: In the realm of services, a standout observation was the cost for deposit services at commercial banks, which skyrocketed by 13.9%. Other service areas, such as final demand services excluding trade, transportation, and warehousing, also saw a 0.3% increase.

Federal Reserve's Measures: The Fed, being highly reliant on such data to shape its policies, has been increasing interest rates to curb inflation. However, recent signals from central bank officials and market trends suggest that there might be a pause in further rate hikes, even though one more increase is anticipated before the year concludes.

Today’s Reader Poll

For today’s poll, we want to hear your predictions on tomorrow’s CPI print:

Based on the year-over-year (y/y) change, what do you expect tomorrow's CPI to reveal?

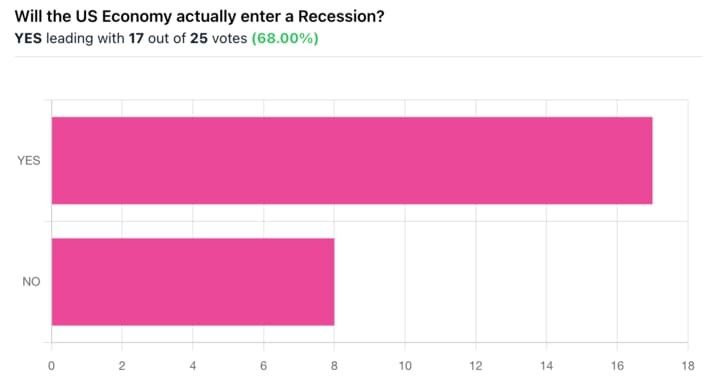

Here are the results from Monday’s poll, where we kept our recession question up. Responses seem still fearful 😬

We’re highlighting an insightful comment by longtime reader and all-around lovely lady “Jackie” today:

"Student loans have resumed, causing borrowers to redirect discretionary funds to loan obligations. Also, with people continuing to work from home, businesses that supported office personnel will continue to be affected."

AI Art of The Day

Janet Yellen comments on everything from military spending to social issues with such irrational confidence - there’s nothing she doesn’t think she can do.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $12.99/year.

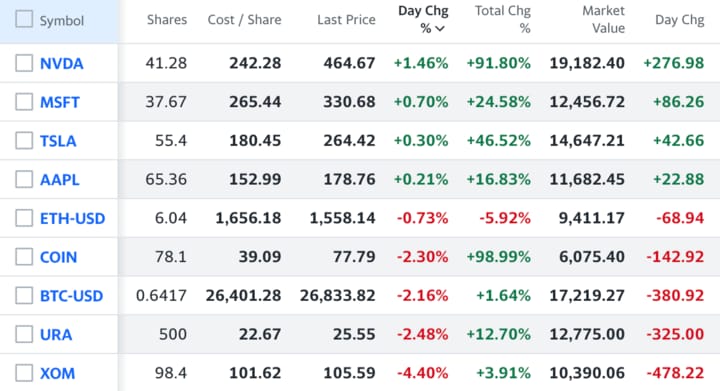

Trades, Watchlist & Live Portfolio

(paywall only)

-We added Flutter Entertainment ($PDYPY) to the Watchlist previously, and it has since sold off 10%. Still waiting on a true bottom to be formed before we allocate.

-We initiated a position in $URA in August that ran up nearly 25% before giving back half of the gains. We’re strongly considering adding to the position, but again would like to see true support form first.

Latest Trades

Monday 8/21/23 9:30 AM: BUY 500 URA @ $22.67

Wednesday 8/16/23 10am: SELL 103.9 $AMZN @ $136.6

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

$PDYPY: Leading US sports betting operator

Portfolio

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.