Americans booing everything

GM and BRRR.

In a survey by NBC News and The Wall Street Journal, a record 69% of Americans expressed negative views about the economy now and in the future. Two-thirds of the respondents said their wages were falling behind inflation, and they believed the nation was headed for a recession or already in one. President Biden's approval rating dipped to 39%, while his disapproval rating rose to 55%.

The gloomy outlook on the economy was the lowest reading of the survey's 17-year history on the question of whether now is a good time to invest in stocks, which only 24% answered yes. However, the survey also found that despite negativity, 63% of employed Americans were not worried about losing their jobs, indicating some degree of confidence.

Amidst the uncertainty and volatility in traditional investments, investors are turning to alternative assets for diversification and returns. Vintage cars, for example, have seen their value surge by 185% over the past decade, outpacing other luxury assets like wine, watches, and art. Asset managers are offering funds that focus on classic cars, with some targeting 10% returns.

Meanwhile, artificial intelligence in finance is gaining momentum, as evidenced by research that showcased the potential of OpenAI's ChatGPT. The chatbot outperformed Google's BERT in analyzing Federal Reserve statements and predicting stock price movements by interpreting news headlines. Fake news, anyone?

Here’s what we brrr’d today:

Trifecta of Doom: Interest Rates, Inflation, and Recession on American’s Minds

Classic Vehicles more than a hunk of junk?

ChatGPT gets access to Bloomberg Terminal

Prediction Contest Question #4

Tesla reports earnings on Wednesday, April 19. How will they do?

Inflation, Interest Rates, and Recession: Trifecta of Economic Doom

Pessimism prevails: A record 69% of the public holds negative views about the economy both now and in the future, according to the latest CNBC All-America Economic Survey.

Biden's economy blues: President Joe Biden’s approval rating fell by 2 percentage points to 39% and his disapproval rating rose by a point to 55% compared with the November survey.

Investor anxiety on the rise: Just 24% say now is a good time to invest in stocks, also the lowest reading in the survey’s 17-year history.

Inflation impacts lifestyles: Because of inflation, large majorities say they are altering their spending and lifestyles, such as spending less on entertainment, traveling less, or using savings to pay for purchases.

Mixed reactions to interest rates: 1 in 5 adults have taken some action to benefit from higher rates, either moving bank accounts, buying a money market fund or purchasing a CD, while a majority of Americans say they are less likely to buy a car or a new home due to higher interest rates.

Classic Cars as New Investment Vehicles?

Vintage cars zoom past luxury rivals: Vintage cars have increased in value by 185% over the past decade, outpacing luxury rivals like wine, watches, and art.

Rev up your portfolio: Asset managers are offering funds focused on vintage vehicles as an alternative asset.

High-Octane funds: Azimut is launching what it describes as the world's first "evergreen" fund to invest in vintage vehicles. Hetica Capital launched a 50 million euro 'closed-end' fund in 2021 targeting returns of 9%-15% after seven years.

Vintage cars - a high-end investment: The classic car market is expanding globally, and there are about $80 billion collector vehicle transactions a year globally, including all auctions and private sales. Electrification will favor classic cars and make them cult objects over time.

A.I. Market Predictors (Bots Day Trading)

ChatGPT outperforms Google's BERT: OpenAI researchers have published two papers showing the potential of ChatGPT in finance, including its ability to beat BERT in determining Federal Reserve statements' hawkish or dovish stance.

Chatbot predicts stock prices: Using natural language processing, ChatGPT can interpret corporate news headlines to predict stock price movements.

New insights for finance pros: The research findings suggest that ChatGPT's ability to parse nuance and context could provide new worlds of information for finance professionals.

AI reliability questioned: Although ChatGPT shows promise in finance, there are concerns about the accuracy and reliability of using AI technology in financial decision-making, particularly in light of "fake news" and media manipulation.

AI ART OF THE DAY

Matt Damon, Christian Bale and incredible driving scenes…watch Ford vs Ferrari if you haven’t seen it.

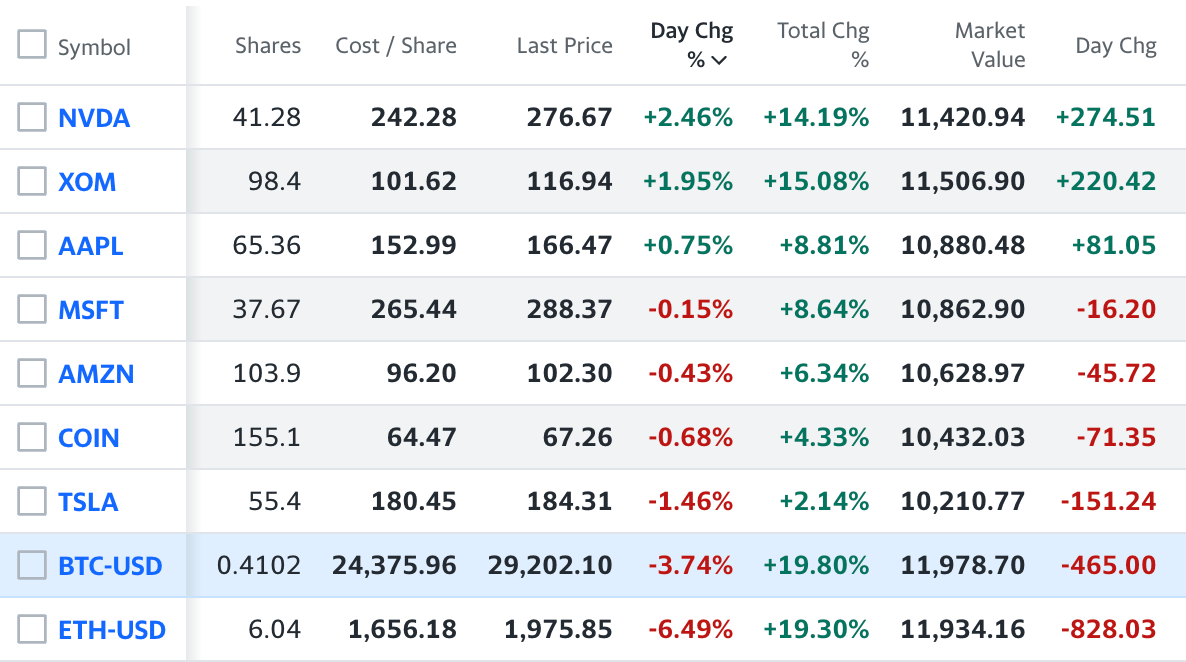

The BRRR’s Portfolio

Crypto weakness overnight has us off portfolio highs.

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Fed decisions can be a real pain in the assets. Join our Facebook group for industry insights and tricks to stay ahead of the curve. Memes for days, too.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.