TheBRRR’s GM

Hello everyone, I’m now a married man and back from my honeymoon. We had a perfect wedding in Miami - I’m blessed.

The week has begun with a mild selloff across risk assets, as war has tragically broken out in the Middle East with Gaza militants attacking Israeli territory.

On the news, crude oil pice predictably surged +4.25%, reversing the recent selloff that had prices down 11% since Sept 29th’s YTD high.

Despite the escalation and rising tensions, risk assets are still generally holding up okay - the Nasdaq Index, as a proxy for risk, has held key support at $13,000 and has regained $13,300 in early trading today.

With current market conditions established, I’d like to take a moment to zoom out and remind readers of our broader positioning.

We remain bearish on the dollar, bearish financials and regional banks, and bullish big tech and crypto majors.

We also believe there may be a black swan on the horizon, so we’re on the lookout for forced selling and overleveraged players in commercial/office real estate, and its potential adverse impact on regional banks.

Should we make any changes to our portfolio, premium subscribers will be the first to know with the actual assets and sizing involved.

Today’s newsletter is brought to you by The AI Tool Report. Please consider subscribing and opening their emails - it’ll directly support us at The BRRR. 👇

What Else I’m Reading

The AI Tool Report Learn AI in 5 Minutes Per Day. The AI Tool Report does an outstanding job surfacing the most practical AI breakthroughs that you can actually leverage today.

Here’s your link to subscribe for free.

Market News

Fed's Rate Hike Tease

Following the release of the September jobs number, markets initially feared a potential rate hike in November. However, sentiments changed as the odds of the Fed leaving rates unchanged increased from 70% to now 88% at its next meeting.

This shift was attributed to the Financial Conditions Index (FCI) tightening, which some argue replaces the need for rate hikes. The tightening of FCIs is seen as a more effective monetary policy tool than aggressive rate hikes by the Fed.

FCI's Role in Policy: The FCI has tightened significantly in recent weeks, impacting risk assets and the USD. This tightening is viewed as a more effective way of monetary policy transmission than the Fed's aggressive rate hikes over the past year and a half.

Equivalent Impact: A 25bp of FCI tightening is roughly equivalent to a 25bp rate hike and can reduce growth by 25bp over the next year. The recent 75bp tightening from the summer average equates to about three 25bp rate hikes.

Fed's Reaction to Bond Market: Comments from various Fed officials, including Mary Daly and Lorie Logan, suggest that the recent surge in long-term Treasury yields might reduce the need for the US central bank to raise its benchmark interest rate again. This sentiment is due to the belief that rising term premiums could cool the economy, reducing the need for further monetary policy tightening.

Middle East Conflict Jolts Oil Prices

The Israel-Hamas war presents a precarious situation for global investors by instigating subtle yet noteworthy oscillations in the market. Although the immediate market responses to the conflict and consequent casualties were relatively muted, the potential escalation of the war, especially involving Iran and its oil production, looms as a significant concern. Enhanced geopolitical tensions and potential disruptions in Saudi-Israeli relations further compound the scenario, nudging investors toward strategic hedges such as investment in oil and defense stocks amidst the geopolitical volatility.

Market Reactions to Conflict: The severe attack on Israel, resulting in over 1,000 casualties from both Israeli and Palestinian sides, prompted a 3% increase in oil prices, a slight decline in stock futures, a 1% ascent in gold prices, and a rise in Treasury futures, subsequently lowering yields.

Potential Sanctions and Oil Price Implications: Anticipated sanctions against Iran, following its involvement in the Hamas attack, could notably impact global oil prices. With Goldman Sachs predicting a $1 increase in oil prices for every 0.1-million-barrel-a-day cut to Iranian production, sanction-induced production reductions have the potential to substantially elevate oil prices.

Geopolitical Ramifications on Saudi-Israeli Relations: The conflict jeopardizes the improving Saudi-Israeli relations, introducing additional volatility in oil prices and broadening the scope of instability and unpredictability within the Middle East, consequently influencing global markets and investment avenues.

More Macro News

Washington Stuck as Debt Piles Up

The sustained rise in U.S. government borrowing costs has triggered concerns among investors and economists regarding the sustainability of the nation’s escalating debt pile, which now exceeds $33 trillion.

The Federal Reserve has raised interest rates to about 5.3% to curb inflation, and the rate on 10-year Treasury bonds, pivotal in determining other borrowing costs, has hit a nearly two-decade high.

Meanwhile, consistent budget deficits, attributed to various factors including tax cuts, spending increases, and economic stimuli from both Democratic and Republican administrations, further compound the debt issue.

The annual interest on the debt is nearly $600B alone, over half as much as the actual annual deficit itself. The interest burden will only accelerate in coming years given the higher interest rates.

Debt and Deficit Levels: The U.S. gross national debt is slightly above $33 trillion, surpassing the total annual output of the economy. The federal budget deficit is projected to have doubled from $1 trillion in 2022 to an estimated $2 trillion in 2023. The deficit, as a percentage of the economy, increased this year under President Biden even with economic growth.

Government Bond Market: The Treasury Department sold close to $16 trillion of debt through September of the year, up about 25% from the same period last year. Net debt issuance was around $1.7 trillion, a peak level over the past decade, excluding the pandemic-induced bond surge in 2020. Government debt sales are forecasted to increase by another 23% in 2024.

Policy and Political Considerations: Despite the increasing cost of sustaining high debt levels, no consensus has been reached in Washington for deficit reduction via tax hikes or notable spending cuts. President Biden’s existing deficit-reduction proposals amount to $2.5 trillion and primarily include tax increases on corporations and high earners.

Today’s Reader Poll

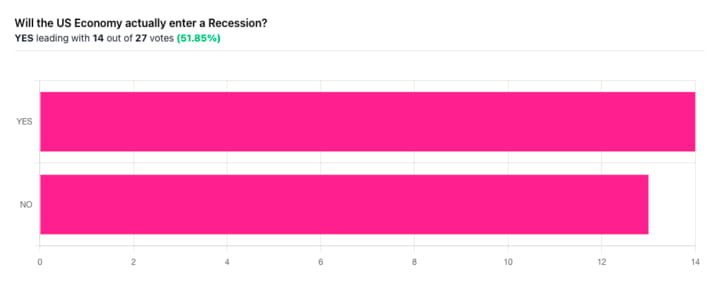

Lots of interesting views, we will ask one more time:

Below are the results from Friday’s poll, where we asked the same. The results showed a near even split. 😬

Highlighting a comment submitted by user “gls” on the issue:

"The counterproductive actions between the Fed and Biden Admin have just been delaying an inevitable recession. The longer it gets pushed, the more severe the recession will get."

AI Art of The Day

Candid photo from my honeymoon last week. We’ll bring back the satire and sarcastic swipes at Jay Powell and Janet Yellen on Wednesday. Go to my Twitter if you want to see old ones.

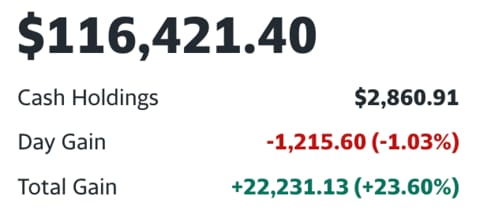

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $2/month or $9.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

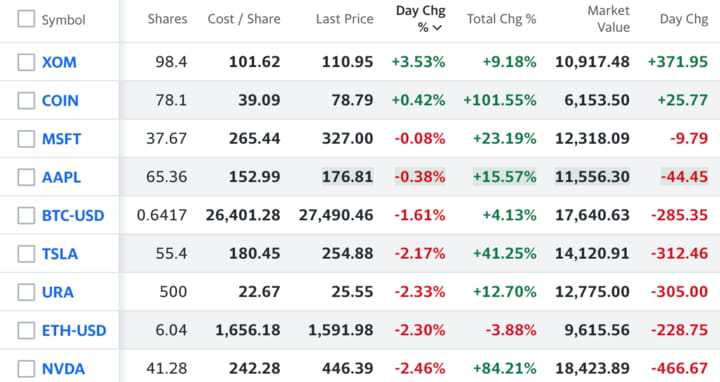

-We added Flutter Entertainment ($PDYPY) to the Watchlist previously, and it has since sold off 10%. Still waiting on a true bottom to be formed before we allocate.

-We initiated a position in $URA in August that ran up nearly 25% before giving back half of the gains. We’re strongly considering adding to the position, but again would like to see true support form first.

Latest Trades

Monday 8/21/23 9:30 AM: BUY 500 URA @ $22.67

Wednesday 8/16/23 10am: SELL 103.9 $AMZN @ $136.6

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

$PDYPY: Leading US sports betting operator

Portfolio

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.