GM, BRRR, and happy Friday.

Fed Chair Jay Powell just finished his speech from the annual Federal Reserve symposium in Wyoming.

Memorably, when he discussed “the path forward”, he coughed and cleared his throat before proclaiming that the Fed will maintain its 2% inflation target.

After a barrage of statements from prominent economists suggesting the Fed should raise the target to 3%, a cynical observer could interpret the cough and uncomfortableness as the sign of Powell feeling the heat, or lying about his actual intentions.

Here’s the 9-second clip. You tell us if we’re right or reaching in today’s poll.

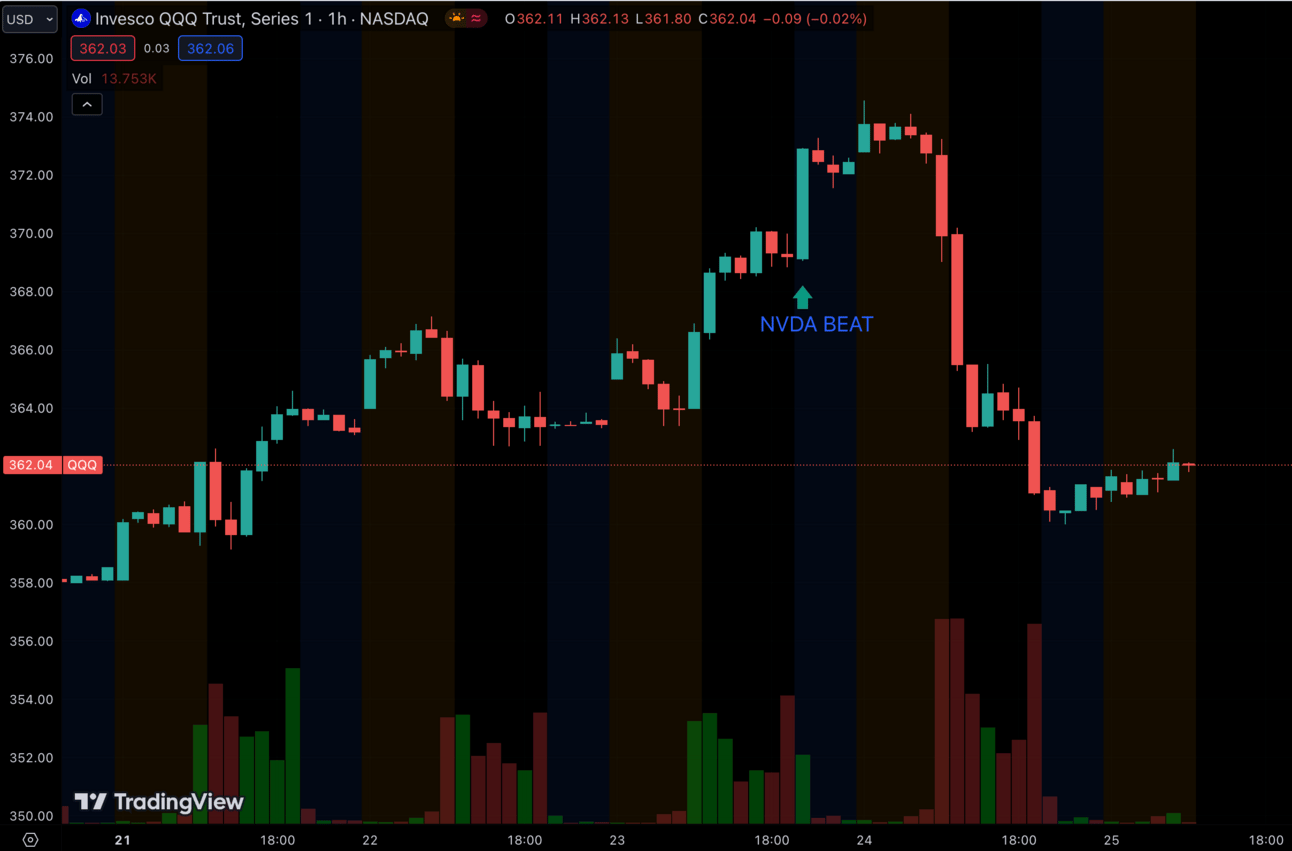

Overall, markets have had a bizarre week. Amidst a massive earnings beat from bellwether AI darling Nvidia, US equities have grinded mildly higher through frantic price action.

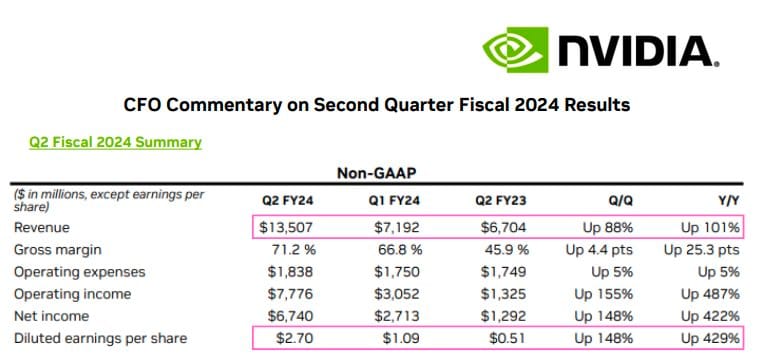

For its merits, Nvidia smashed all expectations for both Q2 and its projections for Q3.

Most impressively, NVDA reported revenue in Q2 doubled y/y, up from $6.5B last year to over $13B this year, far above Wall Street’s $11B expectation.

While NVDA initially dragged up the rest of the Nasdaq with its earnings report, the rally was short-lived as sellers dumped stocks throughout a bloody Thursday.

More on the NVDA earnings below in our featured story today.

Nasdaq (QQQ) since Monday’s open

NVDA since Monday’s open

The choppy price action we’re seeing is typical for the late-stages of summer vacation, but we expect higher volume once the calendar turns to September after Labor Day.

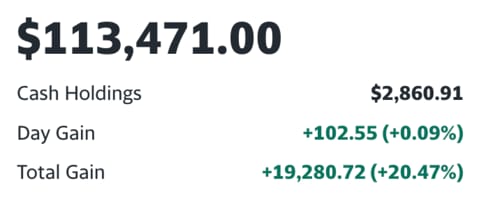

No portfolio moves today - but subscribing to the BRRR ($2/month or $10/yr) unlocks trade notifications and a full view of our actively managed portfolio (+18.5% since inception in March).

Today’s newsletter is brought to you by The Rundown AI. Please consider subscribing and opening their emails - it’ll directly support us at The BRRR. 👇

What Else I’m Reading

The Rundown AI Join 250k+ reading AI news and learning about AI tools every week. The Rundown does an outstanding job surfacing the most important breakthroughs from this powerful technology. Here’s your link to subscribe for free.

Market News

Nvidia Blowout Earnings, Announces $25B Stock Buyback

Nvidia $NVDA posted blockbuster earnings and the stock is hovering around all-time highs. Here are the key numbers from the report:

Rev: $13.51B (vs. $11.04B exp.), +101% Y/Y

EPS: $2.70 (vs. $2.07 exp.), +429% Y/Y

Revenue guidance: $16B (vs. $12.5B exp.), +170% Y/Y

In tandem, the company also announced a massive $25 billion share repurchase program despite its stock already surging over 200% year-to-date. Nvidia's buyback announcement came on the heels of blowout Q2 2023 earnings on Wednesday after market close that sent shares to new heights, fueled by AI demand.

Continued Growth: Revenue grew 54% to $13.5 billion, exceeding expectations, and Nvidia guided for continued growth next quarter. The strong results were driven by its data center business, which saw 61% revenue growth as hyperscalers adopt Nvidia GPUs for AI workloads.

Making Time for Games: Nvidia's gaming division delivered 33% growth to $3.06 billion even as PC shipments declined over 20% year-over-year, underscoring the resilience of its gaming franchise. During COVID, many gamers previously upgraded their components, but with GPUs as the lifeblood of the industry many will upgrade again soon.

Concern over prioritizing buybacks over investment: Some shareholders have expressed a preference for Nvidia to invest its sizable earnings back into operations, R&D, and potential growth avenues rather than repurchasing stock, given the company's steep growth trajectory and leadership position in the critical AI/data center chip space.

Macro News

Jackson Hole Preview: To Tighten or Not to Tighten, That is The Question

The Federal Reserve officials convened at Grand Teton National Park for their annual economic symposium this week, reflecting on a brighter economic landscape than the previous year.

Interest rates have been raised to a 22-year high, marking the most aggressive sequence of rate hikes in four decades, aimed at combating inflation. Despite these measures, the U.S. economy remains robust with an unemployment rate of 3.5%. Core inflation, excluding volatile components like food and energy, is almost double the Fed's 2% target.

The Jackson Hole conference, hosted by the Kansas City Fed, is a significant event for global investors, often compared to the "Super Bowl of central banking."

Historically, it has been a platform for major policy announcements. This year, the focus is on whether global central bankers need to further increase interest rates to address inflation.

Jerome Powell, the Fed chief, is scheduled to speak about the economic outlook, and his remarks will be scrutinized for hints about the future trajectory of U.S. interest rates.

Historical Context of the Conference: The Jackson Hole event has been a stage for significant policy shifts in the past. In 2008, it was the backdrop for discussions on the deepening financial crisis, and in 2014, then-European Central Bank President Mario Draghi introduced the idea of a bond-buying campaign to stimulate the European economy.

Inflation and Economic Growth: While the Fed has been clear in its expectation for inflation to decline further, anticipating the economy to grow below its long-run trend of around 2% over the next year, there's a debate on how the central bank's interest-rate outlook would change if the recent surge in economic activity persists.

Conference Theme and Global Implications: This year's theme, "Structural Shifts in the Global Economy," seeks to explore the long-term impacts of the Covid pandemic on the global economic landscape, including changes in trade networks, monetary policy shifts, and the surge in public debt. Christine Lagarde, president of the European Central Bank, is among the key speakers, highlighting the global significance of the discussions.

Today’s Reader Poll

In our Wednesday poll, we asked for your predictions for NVDA’s earnings report. Not a single person predicted a “Big Beat”, so no one gets the free month. 😬

Is Powell's cough indicative of a lie about his inflation target intentions?

AI Art of The Day

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $2/month or $9.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Trades

We opened a position in $URA this week - it’s an ETF that tracks the price of Uranium. We’ll publish our longer thesis on the reason soon, but as we wrote last week, we believe the Nuclear Energy narrative is gaining steam very quickly.

Monday 8/21/23 9:30 AM: BUY 500 URA @ $22.67

Wednesday 8/16/23 10am: SELL 103.9 $AMZN @ $136.6

Wednesday 8/9/23 9am: BUY 0.2315 $BTC @ $29,990

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

$PLTR: AI for government intelligence

Portfolio

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.