GM and BRRR.

As we prepare for Labor Day - a day that celebrates the advancement in labor rights over time, I’d like to remind everyone that the average American used to work 12 hours/day 7 days/week during the Gilded Age. Child labor was standard.

People didn’t work 80 hour weeks because they were required to - people worked that much because they wanted to improve the standard of living for their families.

The economy boomed.

Exports soared 11x ($20m to $220m)

Cost of goods like wheat plummeted by 60%, raising living standards

The US laid 30,000 miles of railroad and interstate commerce boomed, allowing for specialization

There’s a lesson about American ingenuity here. Chew on it alongside your $8 hotdog this holiday weekend.

In the newsletter today we’re covering two stories.

1) New labor market statistics just dropped. July’s data was fine, but massive revisions to May & June are driving market sentiment.

2) The SEC decided to delay its decision to approve/deny bitcoin ETF applications, including BlackRock’s.

We haven’t made any trades to the BRRR’s portfolio today, but am eyeing a rebalance for next week.

If we do make the move, premium subscribers will be the first to know.

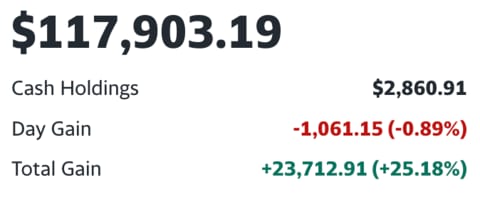

For $2/month or $12.99/yr, you’ll unlock trade notifications and a full view of our actively managed portfolio (+26% since inception in March).

Today’s newsletter is brought to you by The AI Tool Report. Please consider subscribing and opening their emails - it’ll directly support us at The BRRR. 👇

What Else I’m Reading

The AI Tool Report Learn AI in 5 Minutes Per Day. The AI Tool Report does an outstanding job surfacing the most practical AI breakthroughs that you can actually leverage today.

Here’s your link to subscribe for free.

Market News

The Hits Keep Coming: August Jobs Whiff

The U.S. labor market is showing signs of unexpected strain, as revealed in the latest data from the Bureau of Labor Statistics (BLS). Despite beating consensus estimates by adding 187,000 jobs in August, the unemployment rate surged from 3.5% to 3.8%, with 514,000 newly unemployed workers.

Furthermore, the BLS revised every single monthly payroll number for 2023 downward, casting doubt on the integrity and stability of the labor market. Wage growth also missed expectations, rising only 0.2% month-over-month.

CME Marketwatch tool now shows only a 7% chance of rate hike at next Fed meeting, down from 12% earlier this week.

Downward Revisions: Every payroll number for 2023 has been revised downward. June’s payroll was slashed by 50%, from an initial 209,000 to a revised 105,000. July’s numbers were also revised down by 30,000 to 157,000. These revisions suggest a 12-sigma probability, raising questions about political pressure to initially inflate the numbers.

Unemployment Surge: The unemployment rate jumped to 3.8%, defying the expected 3.5%. This was due to 514,000 newly unemployed workers and 597,000 new entrants into the labor market, the highest level since October 2019. The economy absorbed only a net 77,000 of these new entrants.

Stagnant Wage Growth: Monthly wage growth was only 0.2%, missing the expected 0.3%. On an annual basis, it was 4.3%, down modestly from 4.4% last month. This suggests that the influx of new workers is suppressing wages.

Shift to Part-Time Work: A total of 670,000 full-time jobs were lost in July and August, but this was offset by a gain of 1 million part-time jobs, indicating a precarious shift in employment types.

Macro News

Bitcoin ETFs: Maybe Next Year, Says SEC

The U.S. Securities and Exchange Commission (SEC) postponed its decision on 7 proposed Bitcoin ETFs, including one from BlackRock. This delays approval of spot Bitcoin ETFs in the U.S. until at least mid-October. The SEC can delay decisions up to 240 days and has consistently blocked spot Bitcoin ETFs despite approving futures-based ones.

This latest postponement came despite a recent court ruling against the SEC in favor of Grayscale, stating the SEC failed to justify rejecting spot ETFs. However, the delays poured cold water on the crypto market.

Despite growing industry frustration, experts think approvals may come in 2024 due to SEC wariness about crypto regulation.

ETF FOMO is Real: A survey shows nearly half of US financial advisors own bitcoin personally, but only 12% recommend it to clients, with the lack of an ETF as the primary deterrent. These advisors oversee $8 trillion in assets, representing massive potential inflows.

SEC Skepticism Still Strong: Despite the court verdict for Grayscale, SEC Chair Gary Gensler stated in July crypto is "rife with noncompliance" and likened it to the "Wild West." This underscores the SEC's wariness about crypto regulation and spot ETFs.

Tick Tock Gets Louder: With over 25 crypto ETF applications now pending before the SEC, industry pressure is rapidly building. Firms like Fidelity have joined the queue, with VanEck expecting an ETF "race" come 2024 due to pent-up demand from advisors overseeing trillions in assets.

Today’s Reader Poll

In our last poll, we asked Is Powell's cough indicative of a lie about his inflation target intentions?

People voted that JPow’s cough was actually indicative of him lying about his thoughts on inflation targeting. 😬

And for today’s question, let’s see if readers are bullish/bearish headed into the Fall:

AI Art of The Day

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $2/month or $9.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Trades

We opened a position in $URA last week - it’s an ETF that tracks the price of Uranium. We’ll publish our longer thesis on the reason soon, but as we wrote last week, we believe the Nuclear Energy narrative is gaining steam very quickly.

Latest Moves

Monday 8/21/23 9:30 AM: BUY 500 URA @ $22.67

Wednesday 8/16/23 10am: SELL 103.9 $AMZN @ $136.6

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

$PLTR: AI for government intelligence

Portfolio

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.