TheBRRR’s Thoughts

GM. The more reading and introspection I’m doing, the more I believe 2024 will be a wild year.

Despite geopolitical turmoil and overbearing global anti-tech regulation, the key technological trends in progress cannot not be stopped.

AI’s deflationary impact on the economy has only just begun.

Crypto’s disruption of power structures is only just underway.

We’re here to help you understand and capitalize on these trends from an investor’s perspective as they reach escape velocity.

While today’s news coverage presents a bleaker view on the short term outlook for risk assets, we’re firmly optimistic and bullish on these tech trends over the medium and long term.

Today we’re covering:

1. Apple Gets Downgraded on Weakening iPhone sales

2. Hedge Fund CIO Predicts Banking Turmoil in March

Tech News

Apple Under Pressure

Synopsis: Apple Inc. faced a rocky start to 2024 with its stock receiving downgrades from major analysts and experiencing a sharp decline in iPhone sales in China. The tech giant's market value saw a significant drop, highlighting concerns over product demand and intensifying competition in global markets.

WHAT HAPPENED:

Analyst Downgrade: On January 2, Barclays downgraded Apple's stock from 'Equal Weight' to 'Underweight', citing unsustainable price-to-earnings ratios and weak iPhone 15 sales. On January 4, Piper Sandler followed suit.

Market Value Impact: Apple's market value decreased by approximately $170-$176 billion in the opening week of 2024.

Sales Decline in China:

30% Drop in iPhone Sales: iPhone sales in China plunged 30% in the first week of 2024 compared to the same period last year, as reported by Jefferies analyst Edison Lee.

Competition from Huawei: Apple is facing rising competition from Huawei, spurred by patriotic fervor among Chinese consumers.

WHY IT MATTERS:

Demand and Competition Concerns: The downgrades were driven by concerns about lagging demand for Apple products, particularly the iPhone 15, and increased competition from domestic brands in China.

Market Sensitivity: Apple's stock appears to be more affected by bearish notes than bullish ones, reflecting the market's sensitivity to negative news about the company.

Broader Implications: Apple's challenges in China and the impact of analyst downgrades underscore the global influence of market dynamics and consumer trends on major tech companies.

Macro News

Arthur Hayes Predicts Macro Turmoil

Synopsis: Arthur Hayes is the former CEO of BitMEX and current CIO of Maelstrom, a family office/hedge fund in the crypto space. He wrote about the macro events he sees unfolding over the next 3 months and the related markets impact. We’ve summarized the key events and takaways below.

RRP: Hayes predicts a significant decline in the Reverse Repo Program balance, speculating it could reach around $200 billion in early March. A decline would indicate increased stress and a liquidity crunch in the banking sector.

BTFP: The Band Term Funding Program is set to expire on March 12th. The program was created during 2023’s banking crisis to allow banks to redeem underwater bonds at par value. Hayes anticipates that this program may not be renewed, which could lead to liquidity challenges for banks.

Japan's Influence: The author notes that the Bank of Japan (BOJ) is gradually allowing Japanese Government Bond (JGB) yields to rise.

This increase in JGB yields could incentivize Japanese corporates, pension and insurance funds, and households to to sell US Treasuries and buy JGBs due to better yields onshore, pressuring the US Treasury to inject liquidity.

China’s Influence: The author speculates on the outcome of the Taiwan elections. If a pro-China candidate wins, Xi Jinping might turn on the yuan money printing taps.

The influx of yuan credit into the global markets could overwhelm any troubles in the US banking system, potentially leading to a continued rise in cryptocurrencies even if the RRP runs dry and the BTFP is not renewed.

Trading Strategy: Specifically for Bitcoin, the author expects a sharp decline initially, followed by a potential rebound after the Fed’s March meeting. This prediction is based on the belief that Bitcoin, as a neutral reserve currency, may respond differently once the Federal Reserve potentially resumes liquidity injections.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $12.99/year.

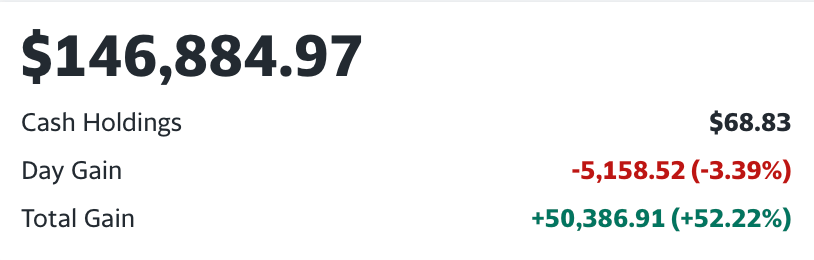

We bought Solana and announced it to premium subscribers on November 28th. It’s up 35% since.

Trades, Watchlist & Live Portfolio

(paywall only)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Solana’s up 30+% since we bought and should continue to run. 🔥

Portfolio

Notes

Wednesday 11/29/23: We sent out the alert that we were buying Solana yesterday as we go full risk-on to close out the year.

Latest Trades

Tuesday 11/28/23 11:20 AM: BUY 183.85 SOL @$56.16

Tuesday 11/28/23 11:20 AM: SELL 101.62 XOM @$104.75

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.