TheBRRR’s Thoughts

GM!

Markets have remained flat since Tuesday’s monster surge.

Seasonality typically dictates strong continuation to the upside to close the year, as hedge funds buy the year’s top performers to posture and attract inflows.

We covered the fallout in California’s luxury real estate marketing in the wake of a new “Mansion Tax” and some commentary from Ray Dalio about the US debt.

Have a great weekend.

Editor’s Note: We’ve released V1 of our technical analysis chatbot. Premium subscribers can see the link in the premium section at the bottom of the email. I released a preview of what it can do in this post, where I ask it to analyze the daily and hourly bitcoin charts.

Macro News

Economic Red Alert: Dalio Decodes U.S. Debt

What's New:

Alarming Rise in U.S. Debt: Bridgewater Associates' founder Ray Dalio draws attention to the U.S. government's debt, which has reached a staggering $33.7 trillion. This represents a significant 45% increase since the onset of the Covid pandemic in early 2020.

Record Spending on Debt Interest: In fiscal 2023, the U.S. government incurred $659 billion in net interest costs to finance its debt. This figure not only sets a historical high but also highlights the increasing financial strain of maintaining the nation's burgeoning debt load.

Shift in Foreign Treasury Holdings: Data reveals a notable decrease in foreign holdings of U.S. government debt, dropping by $253 billion or 3.3% over the past year. Specifically, China has reduced its holdings by 17%, signaling a significant shift in international confidence and investment strategies.

Why It Matters:

Financial Health Warning: Dalio emphasized the importance of a country being financially strong, which means earning more than it spends. He expressed concern that the U.S.'s financial health is deteriorating as its debt increases, indicating potential long-term economic problems.

Foreign Investment Retreat: There has been a notable decline in foreign investment in U.S. government debt. This retreat contributes to a supply-demand imbalance, complicating the U.S.'s ability to manage its growing debt.

Debt-Driven Economic Risks: The U.S. faces escalating risks due to its debt trajectory, which has been accelerated by the Covid pandemic. The high cost of servicing this debt is a clear indicator of these risks, potentially leading to more severe economic and social challenges.

Market News

Rental Boom in LA; U.S. Housing's Cautious Rise

What's New:

LA's Luxury Rental Surge: In Los Angeles, luxury homes are entering the rental market, with rates like $150,000 per month for a 13,000 sqft Manhattan Beach estate, as a response to a sales market dampened by the "mansion tax" and a 26.6% year-over-year drop in home sales.

National Housing Development Growth: U.S. residential construction increased by 1.9% in October to 1.372 million units, with a 1.1% rise in authorized residential permits to 1.487 million units, signaling a cautious but ongoing expansion in housing development.

Multifamily Sector's Prominence: Multifamily construction starts reached 382,000 units in October, with permits for these structures slightly increasing to 469,000 units, reflecting a growing focus on this sector amidst a nationwide slowdown in rent growth.

Why It Matters:

Economic and Policy Influence on Real Estate: The luxury rental market's shift in LA, alongside the national uptick in housing development, underscores the real estate sector's responsiveness to economic forces, policy changes like the "mansion tax," and a 4.2% decrease in construction compared to the previous year.

Insights for Housing Market: The increase in multifamily developments, contrasted with luxury rental trends and a forecasted 35% drop in rental prices in LA, provides a view of the housing market's future indicating diversification in housing needs and preferences.

Guidance for RE Strategy: These trends offer insights for stakeholders, with public homebuilders like D.R. Horton Inc. showing caution in forecasts, and analysts at UBS adjusting predictions for single-family housing starts, highlighting the importance of strategy in a fluctuating market.

Today’s Reader Poll

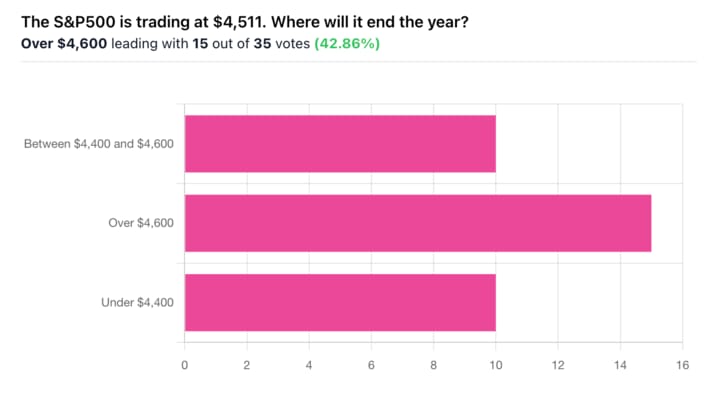

Where do you think S&P 500 will land for the year? Price is unchanged since we opened the poll on Wednesday.

The S&P500 is trading at $4,511. Where will it end the year?

Here’s a look at how readers have voted so far. Looks like the bull market is back in business:

AI Art of the Day

Premium Subscriber Section

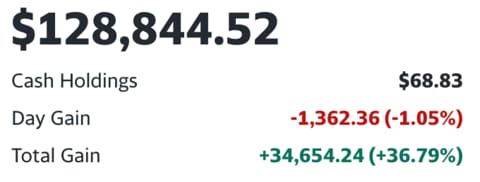

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $12.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Notes

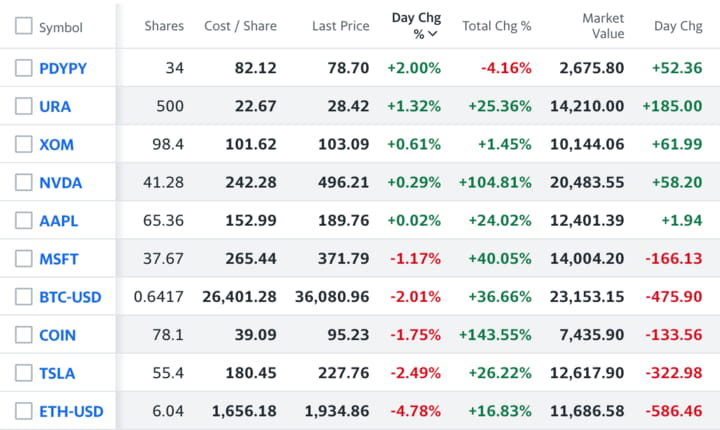

Wednesday 11/15/23: We think our allocation remains strong so we haven’t actively traded much. Sometimes there is benefit to doing nothing and letting your winners run.

Latest Trades

Friday 10/13/23 9:30 AM: BUY 34 PDYPY @82.12

Monday 8/21/23 9:30 AM: BUY 500 URA @ $22.67

Wednesday 8/16/23 10 AM: SELL 103.9 $AMZN @ $136.6

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

Portfolio

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.