TheBRRR’s Thoughts

GM.

After taking a pause on Wednesday and Thursday, risk assets continued to nuke lower this morning.

After an initial rise on yet another mixed employment report, sellers stepped in shortly after the US open to take the Nasdaq down 2.5% lower by lunchtime.

The report showed a stronger-than-expected rise in wages and a mildly lower-than-expected unemployment rate.

The odds of the half-point interest rate cut at the Sept 18 FOMC meeting tumbled from 40% to 23% on the news.

Odds of a quarter-point cut soared from 60% to 73%.

There’s no change in our structural views on the path forward for risk assets.

We still expect a constructive conclusion to the calendar year as uncertainty around the US election dissipates and central banks around the world ramp liquidity to support debt markets.

Markets Tank On Mixed Employment Data

WHAT HAPPENED:

August payrolls grew by 142K, missing expectations of 165K but a jump from July’s downward revised 89K. Previous months also saw downward revisions, totaling 86K fewer jobs.

Unemployment rate dropped to 4.2% from 4.3%, avoiding the "Sahm Rule recession" trigger.

Wages increased 0.4% MoM and 3.8% YoY, both above expectations.

Mixed sector performance: Manufacturing lost 24K jobs, while construction (+34K) and healthcare (+31K) gained.

The Household survey showed a 168K increase in employed workers.

WHY IT MATTERS:

Fed rate cuts: The unemployment dip reduces chances of a 50bps cut, leaning toward a 25bps cut at the next FOMC meeting. Markets will look to upcoming inflation data for clarity.

Recession concerns: Downward revisions and weak payrolls raise questions, but no panic yet.

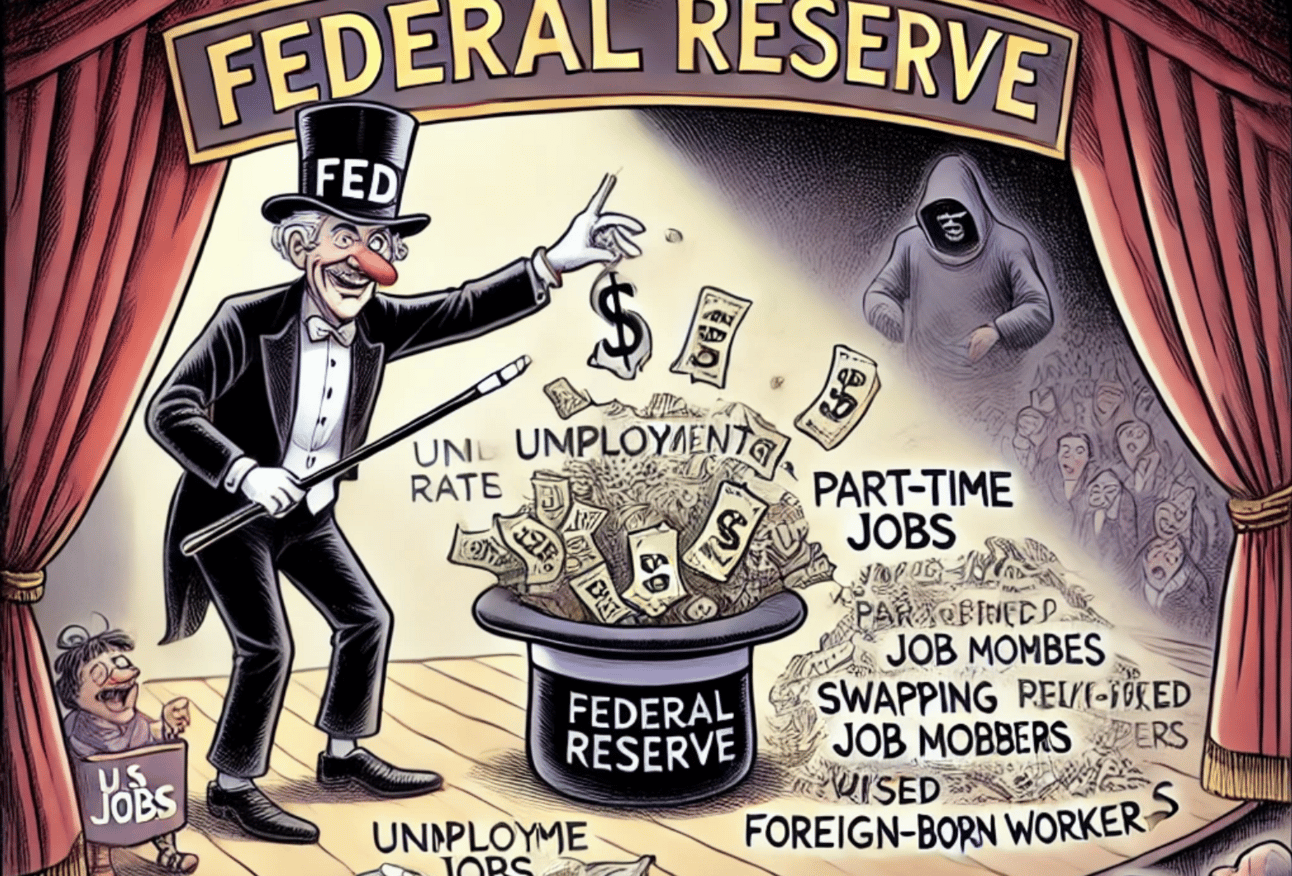

Labor market shifting: Surge in part-time work and foreign-born employment, with full-time jobs declining, reveals deeper structural issues.

BIG PICTURE: Despite the surface-level improvements, the underlying data suggest the economy isn't out of the woods. More adjustments ahead, especially as inflation and employment trends evolve.

VCs Sidelined as AI Startups Chase Big Tech Dollars

WHAT HAPPENED:

The AI frenzy is distorting the VC market, with tech giants like Microsoft, Amazon, Alphabet, and Nvidia pouring billions into AI startups like OpenAI, Anthropic, and Cohere.

Traditional VC firms are largely sidelined, as these capital-heavy AI companies don’t need immediate IPOs or VC funding. Big Tech is not just throwing money but also offering strategic advantages like cloud credits and partnerships.

Venture exits are drying up: IPO value in 2024 is down 86% from 2021, with few AI companies expected to go public soon.

WHY IT MATTERS:

VCs Squeezed Out: The usual VC exit route—IPOs—is locked, while Big Tech gobbles up AI investments, offering startups better terms than VCs can.

Money Shift: VCs are being forced to invest “up the stack,” focusing on applications rather than infrastructure, which requires less capital but offers potentially lower returns.

Market Distortion: The AI bubble isn’t giving VCs the traditional outs, leaving them at the mercy of high interest rates and fewer exit opportunities.

BIG PICTURE: VCs are sidelined, Big Tech controls the AI boom, and traditional IPO pipelines remain stalled.

🦾 Master AI & ChatGPT for FREE in just 3 hours 🤯

1 Million+ people have attended, and are RAVING about this AI Workshop.

Don’t believe us? Attend it for free and see it for yourself.

Highly Recommended: 🚀

Join this 3-hour Power-Packed Masterclass worth $399 for absolutely free and learn 20+ AI tools to become 10x better & faster at what you do

🗓️ Tomorrow | ⏱️ 10 AM EST

In this Masterclass, you’ll learn how to:

🚀 Do quick excel analysis & make AI-powered PPTs

🚀 Build your own personal AI assistant to save 10+ hours

🚀 Become an expert at prompting & learn 20+ AI tools

🚀 Research faster & make your life a lot simpler & more…

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Most Recently Revealed Trade:

Wednesday April 17 2024: We bought more Solana at $131 and added Solana’s top memecoin WIF at $2.36 on the heels of a leverage wipeout dip after the WW3 scare.

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio Notes

June 12: These assets all look great for continuation higher.

We are considering moving on from Tesla as it has lagged the rest of our portfolio badly and doesn’t have an obvious catalyst. We’ll monitor and let you know if we decide to move on.

Older Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll