TheBRRR’s Thoughts

GM, I hope everyone touched grass and enjoyed the weekend.

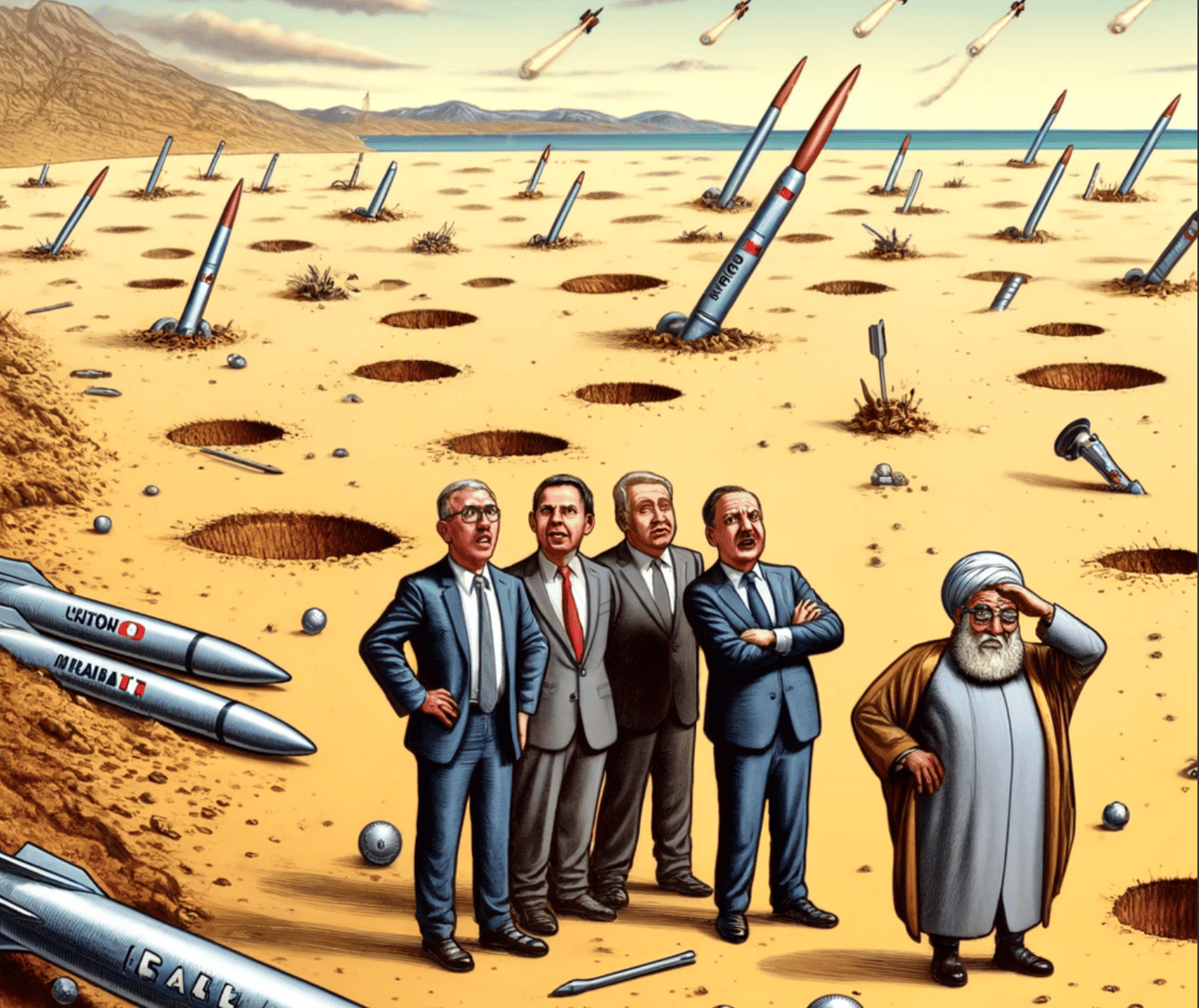

Iran finally executed on its long-awaited, telegraphed and scripted retaliation to Israel’s recent attack on its embassy in Syria.

The retaliation was largely symbolic as no casualties or injuries were reported. Many of the missiles and drones exploded safely in remote areas.

Crypto responded to the fog of war with large dips across the board - nearly all of which were bid back up to pre-attack levels into Monday morning.

With US stocks climbing higher at the open, it appears risk-assets will be unaffected barring a significant escalation.

Bolstering confidence that the tit-for-tax is largely over, the US, UK, Germany & France have all called for Israeli restraint.

Markets Stabilize As Iranian’s Retaliatory Drone Attack Proves Mostly Futile

Iranian Drone Retaliation Attack on Israel: Iran launched a significant drone and missile attack on Israel, marking the first direct assault of this nature. The attack was largely intercepted with minimal damage reported, designed as a controlled retaliation, with no further strikes planned as long as Israel does not respond aggressively. This incident has heightened regional tensions but, so far, has resulted in restrained market reactions due to effective interception and diplomatic efforts to prevent escalation.

S&P and NASDAQ Futures Rise: Futures for major US indices (S&P 500 up 0.5%, NASDAQ futures up 0.6%) show positive movement, indicating investor optimism despite geopolitical tensions.

Drop in Oil Prices: West Texas Intermediate crude fell below $85 a barrel. This decline reflects market sentiments that the recent Iran-Israel military skirmish won't escalate further.

Gold and Bitcoin React: Gold prices rebounded, rising above $2,350 an ounce. Bitcoin also reversed its losses, moving back to pre-conflict levels, demonstrating its role in risk management during geopolitical tensions.

Aluminum Prices Surge: Following new US and UK sanctions against Russian metal exports, aluminum prices jumped over 9% due to supply concerns.

Equities React Differently: Defense stocks like Dassault Aviation and Saab AB rose by more than 2%, benefiting from increased geopolitical risks. Meanwhile, energy stocks declined as Brent oil prices fell.

Mixed Responses in Tech and Banking: Tech giants saw mixed premarket activities; META and NVDA saw increases, whereas Apple experienced a decline due to a significant drop in iPhone shipments in China.

Geopolitical Stance and Market Sentiment: Despite the potential for escalation, global markets are somewhat reassured by diplomatic calls for restraint, keeping the broader market sentiment stable but cautious.

Zerohedge

Tesla Lays Off 10% of Workers Ahead of Q1 Earnings

WHAT HAPPENED:

Tesla to Cut Workforce: CEO Elon Musk announced in an internal memo that Tesla will lay off more than 10% of its global workforce, equating to over 14,000 employees, as part of cost reduction and productivity enhancement measures.

Stock Reaction: Tesla's stock experienced a downturn, dropping about 1.5% in early trading following the announcement.

WHY IT MATTERS:

Strategic Shifts: The layoffs are framed as a necessary adjustment as Tesla gears up for its "next phase of growth," emphasizing efficiency amid escalating operational costs.

Market Pressures: Tesla faces significant challenges, including declining demand for electric vehicles, intensified competition from Chinese automakers like BYD, and a recent downturn in its vehicle delivery numbers.

Operational Challenges: External factors such as supply chain disruptions from geopolitical tensions and localized issues like suspected arson near its Berlin Gigafactory have compounded Tesla's operational difficulties.

Financial Outlook: Investors are cautioned that Tesla’s vehicle volume growth for the year might notably decrease, reflecting ongoing logistical challenges and market saturation concerns.

UPCOMING EVENTS:

Q1 Financial Results: Tesla is scheduled to release its first-quarter financial results on Tuesday, April 23, which will provide further insights into the company’s current financial health and future outlook.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio

Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Latest Trades

Tuesday 11/28/23 11:20 AM: BUY 183.85 SOL @$56.16

Tuesday 11/28/23 11:20 AM: SELL 101.62 XOM @$104.75

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll