except in the Middle East

Editor’s Note: We started a daily podcast version of the newsletter. If you’d like to subscribe, it’s called Money Printer Go BRRR Podcast across all the podcast players. Here are the links to it on Spotify and Apple.

GM and BRRR.

A barrage of US Jobs data hit the wire on this beautiful Friday morning. On balance of a slight uptick in unemployment coinciding with a surge in overall payroll numbers, markets are reacting positively.

Also driving sentiment today is news that Congress officially agreed to lift the debt ceiling last night, avoiding what would have been an unprecedented default on the US’ public debt. The irreproachable spending show goes on.

If the day’s news bores you, we encourage you read a long-form piece written by Author Hayes, a fascinating macro-thinker and founder/former-CEO of crypto exchange Bitmex.

Hayes details his view of the near and long term future of the United States, the next shoe to drop banking system (sooner than you might think), how the Fed will screw things up, and what it all means for risk assets and crypto.

We’ve summarized his long-form , but it’s challenging to do the piece justice in our format. Here’s the link to his full writeup.

Here’s what we’ve BRRR’d:

Jobs Data & Debt Ceiling News

Arthur Hayes On The Inevitable

Jobs Data Mixed, Debt Ceiling Deal Reached

Job Growth in May: Employers added 339,000 jobs in May, surpassing expectations and demonstrating the economy's enduring strength, according to the Labor Department. Various industries, including construction, restaurants, and healthcare, continue to hire to meet consumer demand and restore pre-pandemic workforce levels.

Unemployment Rate Increases: The unemployment rate rose from April's historic low of 3.4% to 3.7% in May, based on a different survey than the one used to calculate job gains. This mixed signal reflects the complexity of the employment market and the challenges of accurately capturing its dynamics.

Wage Growth Slows, Work Week Shortens: The average hourly pay increased by 11 cents to $33.44 in May, marking a 4.3% growth from the previous year. While wage growth remains higher than pre-pandemic levels, it has cooled compared to last year's nearly 6% rate. The length of the average work week declined, contributing to an unusually complicated employment market picture.

Legislation Passes Preventing Default: The Senate approved legislation to lift the government's $31.4 trillion debt ceiling, averting the risk of a first-ever default. The bill received bipartisan support in both the House and Senate and was promptly signed by President Biden, ensuring economic stability.

Treasury Against Bargaining: Treasury Secretary Janet Yellen emphasized that the full faith and credit of the United States should never be used as a bargaining chip, referring to recent Republican actions. While the debt ceiling issue has been resolved, future budget battles and spending discussions are expected to continue among lawmakers.

Fiat Follies: Money Printing, Bank Failures, and Bitcoin's Time to Shine

Fiat Facing Insolvency: Major fiat monetary systems, regardless of their position on the economic spectrum, are highly indebted, have declining working-age populations, and feature low-yielding assets in their banking systems. The global rise in inflation has rendered these systems functionally insolvent. Foreign ownership of US Treasury bonds is declining, with governments selling existing USTs and not buying new ones.

Dire Situation in Pax Americana: The United States, being the largest global economy and the issuer of the reserve currency, is experiencing the aforementioned problems more acutely than other nations. Central bankers worldwide tend to follow the lead of the US Federal Reserve, creating a domino effect across monetary systems.

Banking System Challenges: The US banking system and other major banking systems are facing significant challenges. Due to COVID-19 stimulus measures, banks lent deposits at low rates, but inflation and aggressive rate hikes by central banks have led depositors to withdraw their money. Banks struggle to compete with higher-yielding alternatives, and their solvency is in question.

US Treasury's Debt: The US Treasury needs to issue trillions of dollars in debt to fund the government, but market demand is concentrated in short-term debt. Foreign buyers are hesitant due to geopolitical uncertainties, and a significant increase in long-term debt issuance would lead to a spike in long-term yields, jeopardizing financial stability.

The Fed's Dilemma: The Federal Reserve faces conflicting pressures. Raising rates to fight inflation intensifies banking system challenges, further driving depositors towards alternative investments. Alternatively, cutting rates would improve banks' profitability but could accelerate inflation. The net effect of monetary policy remains stimulative, increasing the quantity of money in circulation and benefiting assets like Bitcoin.

Political Influence: Politicians often spend money they don't have to gain support from the majority of the population. The U.S. government is likely to continue borrowing money to fund its programs without making significant changes in spending habits.

Banks have two choices: Sell assets at a loss and offer higher interest rates on deposits or rely on government support (the BTFP program) by exchanging assets for newly printed money.

Arthur Hayes via Substack

AI ART OF THE DAY

Today’s AI Art of the Day features Elizabeth Warren as a crypto YouTuber, pump and dumping memecoins.

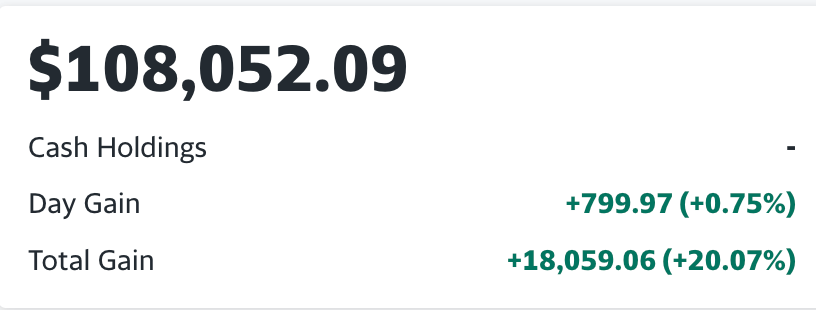

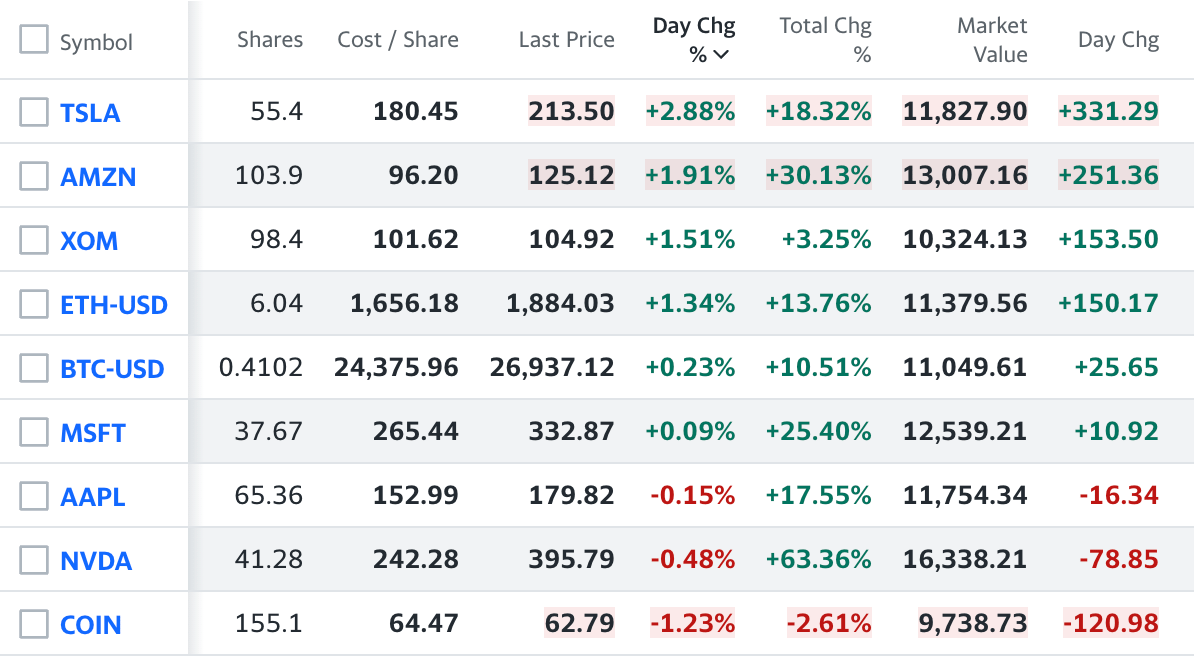

The BRRR’s Portfolio

Up again? This is all far too predicable.

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Join our Facebook group to connect with the community.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.