TheBRRR’s GM

Happy Friday - we’ve gotten a ton of data since we last wrote on Wednesday. We’ll focus on the tech earnings first:

Microsoft (MSFT):

Revenue: $56.5 billion, +13% YoY, +12% vs expectations

EPS: $2.99, +27% YoY, +26% vs expectations

Stock reaction: +4.3%

Meta Platforms (META):

Revenue: $34.15 billion, +23% YoY, +2.1% vs expectations

EPS: $4.21 vs $3.62 expected

Stock reaction: -2.6%

Intel (INTC):

Revenue: $14.2 billion, -8% YoY, +4.4% vs expectations

EPS: $0.41 vs $0.22 expected

Stock reaction: +8%

Amazon (AMZN):

Revenue: $143.1 billion, +13% YoY, +11% vs expectations

EPS: $0.94 vs $0.58 expected

Stock reaction: Flat

Market indexes are down on the week despite the mega cap tech stocks broadly reporting good earnings for Q3.

Expectations for Q4 and 2024 were mostly in-line, but some level of weakness was observed in the forecasts from Amazon (“muted holiday expectations”) and Meta (“big brands are advertising less because of war”).

We’re observing companies that report less than perfect earnings getting battered, so it’ll be interesting to see where 2023 portfolio darling Nvidia lands when it reports on November 21st.

Market News

Price Inflation Tamed, but Spending Rages & Savings Deplete

The economic data from September shows a blend of slowing and rising inflation indicators, but it appears the worst is over for the inflation quagmire.

Consumer spending continues to outpace expectations, broadly providing a tailwind to the economy.

Key Inflation Indicators: Core PCE Deflator, the Fed’s favorite inflation measure, slowed to 3.7% YoY, the lowest level since May 2021, which met pre-release expectations.

Government Spending Boosts Average Wage: Government workers experienced a wage increase of 7.8% YoY, contrasting with private sector workers, whose wage growth declined 3.9%.

Faltering Savings Cushion: The personal savings rate continued its downward trajectory for the fourth consecutive month. This decline, despite several upward revisions in the past year, mirrors the financial strain on households amidst the new, elevated normal in cost of living.

Yellen’s Eternal Optimism Amid Stocks Dip

Treasury Secretary Janet Yellen, during a Bloomberg event, again dismissed the possibility of a recession in the U.S. following a robust economic growth report showing a surge in GDP for the third quarter, primarily driven by consumer spending.

Though she anticipated a dip in growth to 2.5% for the year, she remained optimistic about the economy's resilience amidst falling stocks and rising long-term yields, attributing the latter to strong economic indicators and consumer demand.

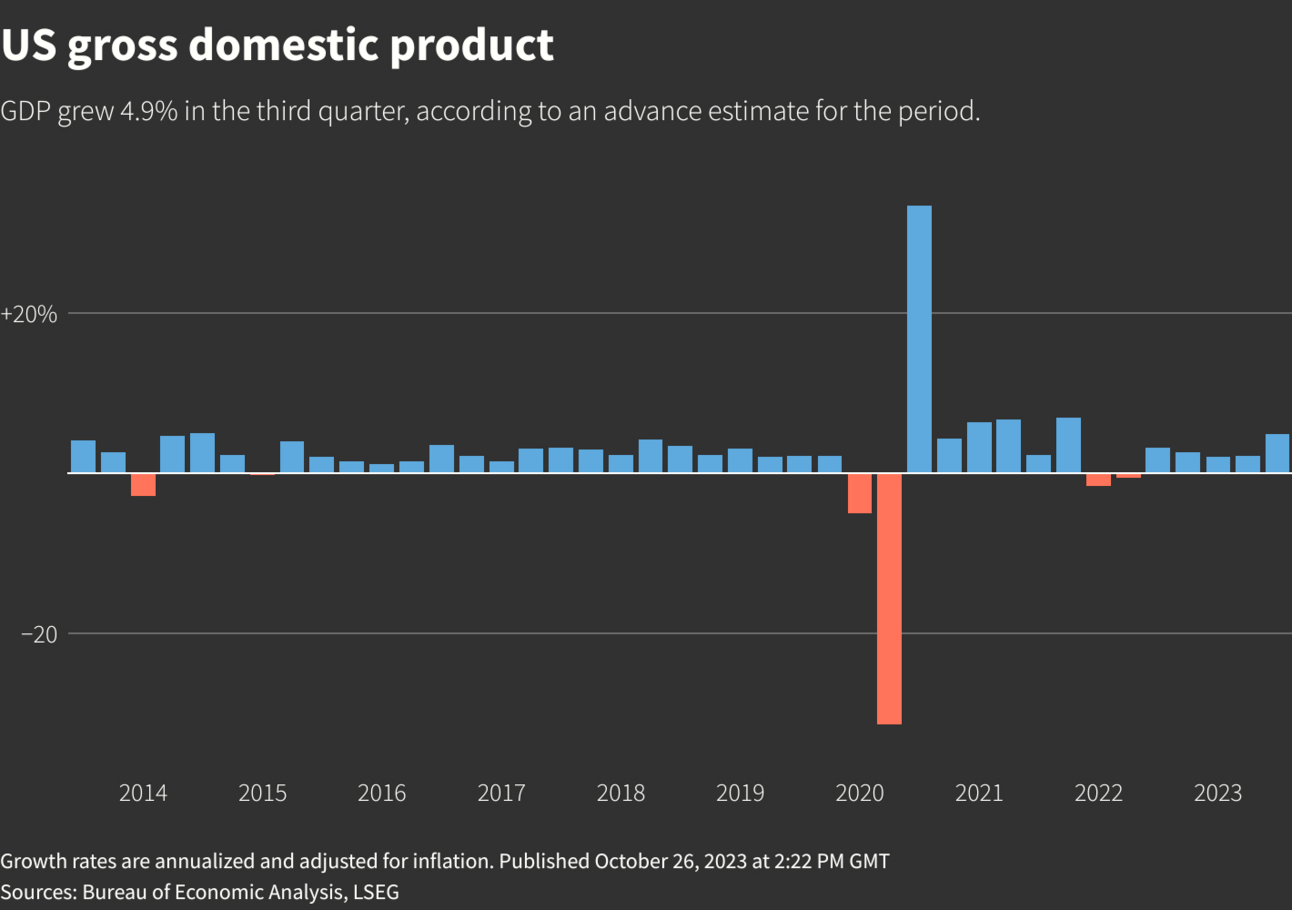

Consumer Spending Driving Growth: The significant 4.9% GDP growth in Q3 is largely attributed to a substantial increase in consumer and government spending, showcasing the direct impact of consumer behavior on economic expansion.

Long-term Yields Reflecting Resilience: The rise in long-term yields, dancing around the 5% mark, is seen as a reflection of the U.S. economy's “robustness and an indicator that interest rates might remain elevated for a longer period”, according to Yellen.

Market Reactions: Despite this positive economic outlook, U.S. stocks experienced a downturn, with the Nasdaq Composite sliding further into correction territory following a series of disappointing corporate earnings, indicating a complex interplay of factors affecting market dynamics.

Read more and here

$100 Reader Giveaway

The AI Tool Report highlights fantastic AI tools. We’re giving away $100 to a reader that subscribes to the AI Tool Report and tells us about their favorite AI Tool they learn about as a subscriber.

To participate, subscribe below and email us about the best thing you’ve learned from them by November 15th. Only 1 submission so far - you’ve got great odds to win. 👇

Learn About AI

The AI Tool Report Learn AI in 5 Minutes Per Day. The AI Tool Report does an outstanding job surfacing the most practical AI breakthroughs that you can actually leverage today.

Here’s your link to subscribe for free.

Macro News

Wallets and Blueprints Fuel U.S.'s 5% Growth

The U.S. economy exhibited a GDP growth of 4.9% in Q3 2023, propelled by higher consumer spending due to increased wages, business restocking to meet demand, and a rebound in residential investment.

Despite concerns over a recession, the economy demonstrated “resilience” even amid Federal Reserve's aggressive interest rate hikes.

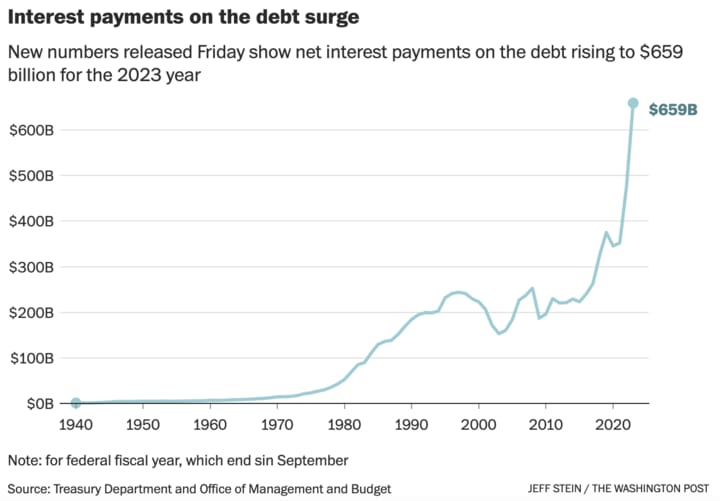

Of note, US debt growth increased by over $600 billion in one month. This year’s sum almost doubled from two years previous, when the government spent $476 billion paying off the interest on its debt last year and $352 billion in 2021.

However, challenges like the initiation of student loan repayments and potential spending dents due to lower savings rates pose uncertainties for the upcoming quarter.

Labor Market Fuels Spending: The tight labor market led to higher wages, enhancing consumer spending which accelerated at a 4.0% rate, contributing significantly to the GDP growth.

Business Activity Rebounds: Businesses actively restocked to meet strong demand, and a rebound in residential investment after nine consecutive quarters of contraction showcased a positive trend in business activity.

Monetary Policy Stance: Despite the economic growth, the Federal Reserve is expected to maintain the current interest rates, with the underlying inflation easing and the core PCE price index aligning closer to the Fed's 2% target.

Today’s Reader Poll

We want your opinion of Treasury Secretary Yellen:

What is your opinion of Janet Yellen?

Here are the previous poll results on Bitcoin price:

AI Art of The Day

Premium Subscriber Section

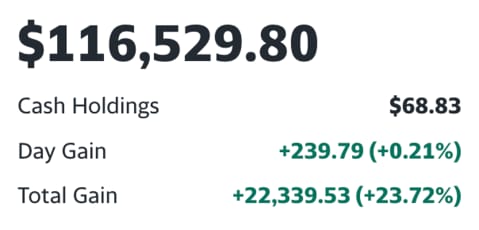

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $12.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

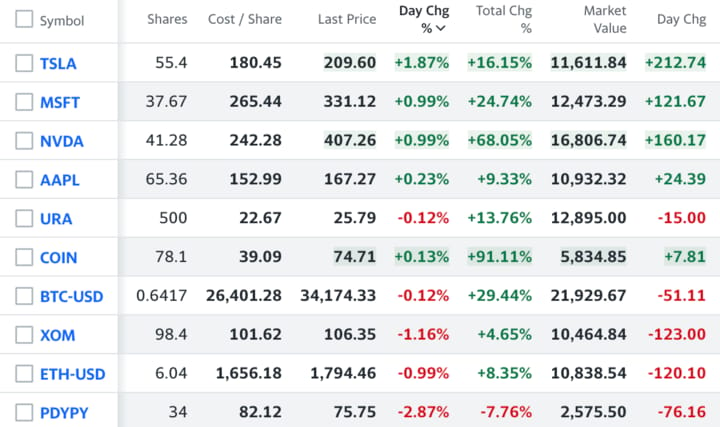

-We added Flutter Entertainment ($PDYPY) to our portfolio, after its stabilization over the past few weeks amidst the ever-growing sports betting industry. NFL season is in full-swing, and more competitors seek to enter the arena.

-We initiated a position in $URA in August that ran up nearly 25% before giving back half of the gains. We’re strongly considering adding to the position, but again would like to see true support form first.

Latest Trades

Friday 10/13 9:30 AM: BUY 34 PDYPY @82.12

Monday 8/21/23 9:30 AM: BUY 500 URA @ $22.67

Wednesday 8/16/23 10 AM: SELL 103.9 $AMZN @ $136.6

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

Portfolio

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.