TheBRRR’s Thoughts

We thought this would be a crazy week.

It didn’t disappoint.

Meta and Amazon earnings blew expectations out of the water after market close yesterday, and the stocks have soared 15% and 7% respectively.

Apple also reported an earnings beat, but the stock fell 3% as investors were spooked by their poor sales in China.

Not to be outdone by the magnitude of big tech’s earnings shocker, the Bureau of Labor Statistics (BLS) stunned the market with a report that defied odds this morning - achieving a 4 standard deviation surprise (1 in ~15,000 odds).

The report showed that the US economy added 353,000 jobs in January - more than double the consensus estimate of 185,000.

Additionally, the report’s wage data revealed a 0.4% spike m/m increase in hourly wages (4.5% y/y), which also exceeded estimates, although this was mildly dampened by avg number of hours worked coming in below expectations.

On the whole, this jobs report gives credence to the idea that the economy is actually running hot overall, which will make it difficult for Powell’s Federal Reserve to start cutting interest rates as aggressively as the market had expected it to.

But that’s not all - the picture isn’t so clearcut.

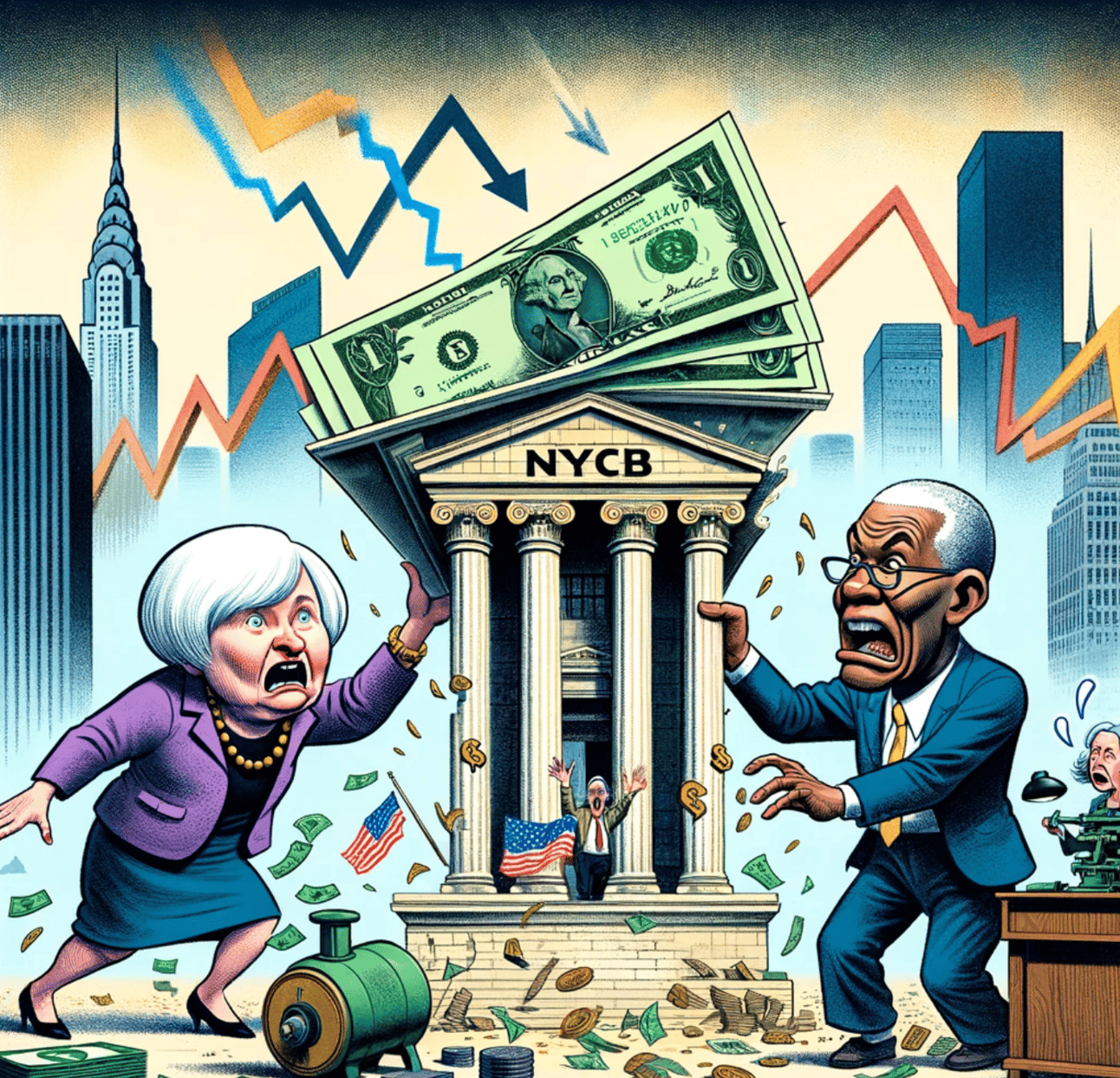

Regional banks have been clobbered this week with the sector’s most prominent ETF (KRE) losing 5% since Monday on the heels of New York City Bancorp’s shockingly bad earnings report and 70% dividend slash.

Should the regional bank pain spread deeper and further, the Fed and the Treasury will step in to inject liquidity one way or another - likely sending tech and crypto assets significantly higher, as it did in March.

Stay up-to-date with AI.

AI won’t replace you, but a person using AI might. That’s why 500,000+ professionals read The Rundown– the free newsletter that keeps you updated on the latest AI news, tools, and tutorials in 5 minutes a day.

Hot Jobs Report Hits The Tape

WHAT HAPPENED:

The Bureau of Labor Statistics (BLS) reported a significant and unexpected increase in January's job numbers, with 353,000 new jobs created, far exceeding the predicted 185,000 and even the highest forecast of 300,000.

Despite massive layoffs in the tech sector, this job growth has been reported, suggesting contradicted narratives.

The unemployment rate remained steady at 3.7%, defying expectations of a rise to 3.8%.

Notably, the report highlighted a discrepancy between the Establishment and Household Surveys, with the former showing a 353K job increase and the latter indicating a 31K drop in employment.

Full-time jobs actually declined by 63K, while part-time jobs increased by 96K.

Average hourly earnings rose by 0.6% from December, double the expected 0.3% increase, and up 4.5% year-over-year, surpassing the 4.1% estimate.

The increase in wages is attributed not to higher pay but to reduced average workweek hours, which fell to their lowest since the early COVID crisis.

WHY IT MATTERS:

The unexpected surge in job numbers contradicts the anticipated slowdown in employment growth and challenges the narrative of a weakening economy amidst tech layoffs.

The discrepancy between the two surveys and the rise in part-time employment cast doubt on the robustness of the job market recovery.

The sharp increase in wages, coupled with reduced work hours, suggests underlying inflationary pressures that could complicate the Federal Reserve's task of managing interest rates and inflation.

This report is seen as politically motivated to paint a favorable picture of the economy ahead of the November elections, raising questions about the reliability of official employment data.

The Federal Reserve may find it difficult to justify rate cuts, despite the seemingly strong labor market data, due to concerns about inflation and the integrity of the data.

NY Community Bancor Tanks After 80% Dividend Cut & Quarterly Loss

WHAT HAPPENED:

New York Community Bancorp (NYCB) saw its shares plummet for a second consecutive day, closing at their lowest level since 2000. This dramatic fall was triggered by a slew of Wall Street downgrades and a warning from Moody’s Investors Service about a potential credit-rating cut.

The stock's decline, which amounted to an 11% drop on Thursday, followed a record 38% plunge the previous day. This turmoil has also dragged down regional banking peers, with a key index experiencing an 8% drop over two days, marking the sector's most significant downturn since March's financial upheavals.

The negative reaction was sparked by NYCB's surprising announcement on Wednesday, which included a dividend cut, a quarterly loss, and increased loan-loss provisions. These developments heightened concerns over banks' exposure to commercial real estate and the challenges of adapting to stricter regulatory oversight, especially after NYCB's acquisition of assets from the collapsed Signature Bank last year.

WHY IT MATTERS:

Analyst Downgrades: Firms such as Compass Point Research, Jefferies, and RBC Capital Markets downgraded NYCB, citing the bank's need to navigate regulatory challenges and regain investor confidence through superior credit management.

Market Reaction and Opportunities: Despite the sell-off wiping out over $3 billion in market value and benefiting short-sellers, some analysts view the drop as an overreaction and a potential buying opportunity, especially within the regional banking sector.

Sector Impact: The incident raises broader questions about the health of the regional banking industry and its exposure to commercial real estate risks. It also echoes the volatility experienced in March and May, with the failures of several major banks, though the current concerns have been more focused on credit quality and real estate exposure.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

We bought Solana and announced it to premium subscribers on November 28th. It’s up 77% since.

Trades, Watchlist & Live Portfolio

(paywall only)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Solana’s up 70+% since we bought and should continue to run. 🔥

Portfolio

Notes

Wednesday 11/29/23: We sent out the alert that we were buying Solana yesterday as we go full risk-on to close out the year.

Latest Trades

Tuesday 11/28/23 11:20 AM: BUY 183.85 SOL @$56.16

Tuesday 11/28/23 11:20 AM: SELL 101.62 XOM @$104.75

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll