TheBRRR’s GM

The strength in crypto assets has continued since we last wrote on Monday, with bitcoin continuing above $34,000 to new YTD highs. The move indicates a significant decoupling from the big tech-heavy Nasdaq Index , which has sold off by 10% since making its high in July.

Is the market’s treatment of bitcoin evolving? In recent years it has directionally followed the Nasdaq, but this recent run marks the second time this year bitcoin has run significantly higher in the face of tech weakness and broad market fear - the first being March’s banking crisis.

It’s something we’re watching closely as bitcoin represents nearly 20% of the newsletter’s public portfolio.

Bitcoin (+109.9%) vs Nasdaq (+33.9%) YTD

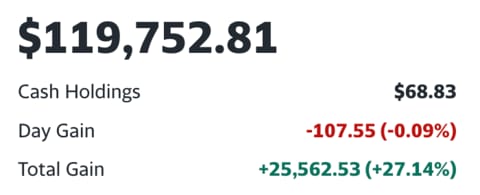

Benefitting from the bitcoin surge, The BRRR’s portfolio is now up 27% since inception in March - significantly outperforming the Nasdaq. Upgrade to view the breakdown.

Market News

Microsoft's Bets Paying Off Across the Board

Microsoft's fiscal Q1 2023 results beat expectations with EPS of $2.35 on revenue of $50.1 billion, up 11% year-over-year. The outperformance showcases Microsoft's durable double-digit growth despite macro concerns, partly driven by AI momentum and recovery tailwinds.

Azure saw strong AI uptake, reinforcing its infrastructure leadership as cloud spend recovers. The upcoming Microsoft 365 Copilot launch with AI productivity features taps into the company's massive subscriber base, presenting huge monetization potential.

Their new Activision deal also unlocks AI gaming opportunities. Microsoft's growth and margin profile warrants a higher valuation multiple versus peers.

Azure Spins Faster with AI: Azure's AI services revenue growth accelerated to 2 percentage points of its total 29% revenue growth in fiscal Q1 to $21.2 billion, validating Azure's strengths in AI development and deployment capabilities as the cloud market recovers from optimization headwinds. The flywheel effect continues as higher margin AI services boost Azure's overall growth and margins.

Uncorking the Software Genie: The upcoming launch of Microsoft 365 Copilot and its $30 per user monthly surcharge taps into the company's massive installed base of over 400 million Microsoft 365 subscribers and presents a huge monetization opportunity for AI-powered productivity features.

New Gaming Frontier: Completing the $68.7 billion Activision Blizzard acquisition provides Microsoft with synergies to explore innovations in AI gaming and better compete against rivals in the space by tapping into its own AI and machine learning talent.

NVIDIA and AMD Gang Up on Intel’s PC Empire

NVIDIA is making a strategic leap into the personal computer CPU market by utilizing Arm Holdings PLC’s technology, setting the stage for a direct confrontation with Intel’s long-established dominance.

This ambitious endeavor involves the creation of CPUs that are compatible with Microsoft’s Windows operating system, with plans for these products to hit the market as early as 2025.

The venture highlights a significant shift in the competitive dynamics of the semiconductor industry, as AMD, another major player in the field, is concurrently exploring Arm-based processors, further challenging Intel’s traditional technological hegemony.

Intel’s Declining Dominance: NVIDIA’s entry into the CPU market represents a formidable challenge to Intel, as NVIDIA holds a market capitalization of approximately $1.1 trillion compared to Intel's $142 billion. The 3.1% drop in Intel shares following the announcement reflects investor concern over Intel's market position. The move by NVIDIA and AMD mirrors Apple’s own transition.

Dominance in AI and Gaming: NVIDIA has established a strong presence in the artificial intelligence (AI) market, leveraging its success in graphics cards for gaming. The pivot to CPU production highlights its ambition to diversify and dominate across various segments of the semiconductor industry.

$100 Reader Giveaway

The AI Tool Report highlights fantastic AI tools. We’re giving away $100 to a reader that subscribes to the AI Tool Report and tells us about their favorite AI Tool they learn about as a subscriber.

To participate, subscribe below and email us about the best thing you’ve learned from them by November 15th. Only 1 submission so far - you’ve got great odds to win. 👇

Learn About AI

The AI Tool Report Learn AI in 5 Minutes Per Day. The AI Tool Report does an outstanding job surfacing the most practical AI breakthroughs that you can actually leverage today.

Here’s your link to subscribe for free.

Macro News

Bitcoin’s Leap: Nudging from Fringe to Finance

Bitcoin has witnessed a 17-month high, soaring over 10% in 24 hours to (temporarily) reach $35,000 per token, driven by growing optimism that the U.S. Securities and Exchange Commission (SEC) might soon approve exchange-traded funds (ETFs) that invest directly in cryptocurrency.

This surge has allowed Bitcoin to recover from the previous year's crash, sparked by the Terra stablecoin collapse, which also led to the downfall of several high-profile companies.

The SEC’s decade-long resistance to spot ETFs, which directly hold bitcoins, is under reconsideration with major financial entities showing interest. However, the regulator remains cautious, highlighting concerns about the bitcoin market’s susceptibility to manipulation.

Embracing Digital Assets: Major Wall Street firms like BlackRock and Franklin Templeton joining the race to launch Bitcoin ETFs signals a shift in how traditional financial institutions are embracing digital assets.

Boosting Credibility: The approval of a Bitcoin ETF by the SEC would mark a significant milestone, positioning Bitcoin as a legitimate asset class and closing the gap between cryptocurrency and traditional finance.

Enhanced Security: The availability of Bitcoin ETFs offers a safer and more regulated alternative for consumers, steering them away from potentially risky and unregulated crypto exchanges.

Today’s Reader Poll

Readers were still bearish on bitcoin on Monday - and the asset ripped 10% in your face. Oops. Here are the poll results:

Below are results from Monday’s poll, where the results seemed less than optimistic.

AI Art of The Day

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $12.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

-We added Flutter Entertainment ($PDYPY) to our portfolio, after its stabilization over the past few weeks amidst the ever-growing sports betting industry. NFL season is in full-swing, and more competitors seek to enter the arena.

-We initiated a position in $URA in August that ran up nearly 25% before giving back half of the gains. We’re strongly considering adding to the position, but again would like to see true support form first.

Latest Trades

Friday 10/13 9:30 AM: BUY 34 PDYPY @82.12

Monday 8/21/23 9:30 AM: BUY 500 URA @ $22.67

Wednesday 8/16/23 10 AM: SELL 103.9 $AMZN @ $136.6

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

Portfolio

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.