GM and BRRR.

Microsoft and Google saved the market with great earnings after the closing bell yesterday. Despite a -1.89% trading day for the Nasdaq, the index recovered over half of the loss in the afterhours session as the good news spread.

Bitcoin and the top crypto assets all bounced off of their local bottoms. Bitcoin cleanly broke back above $29,500 this morning.

There’s also some weakness in the banking sector to look out for, as the market did not react kindly to news about First Republic’s recent decline in deposits on hand, as customers continue to flee to higher-yield, safer arrangements than savings accounts with small and medium--sized banks. First Republic’s stock is down 50% since Monday.

Here’s what we brrr’d today:

Volatile Markets Saved By Microsoft and Google

American Consumer Confidence Plummets: Fewer vacations, more ramen noodles

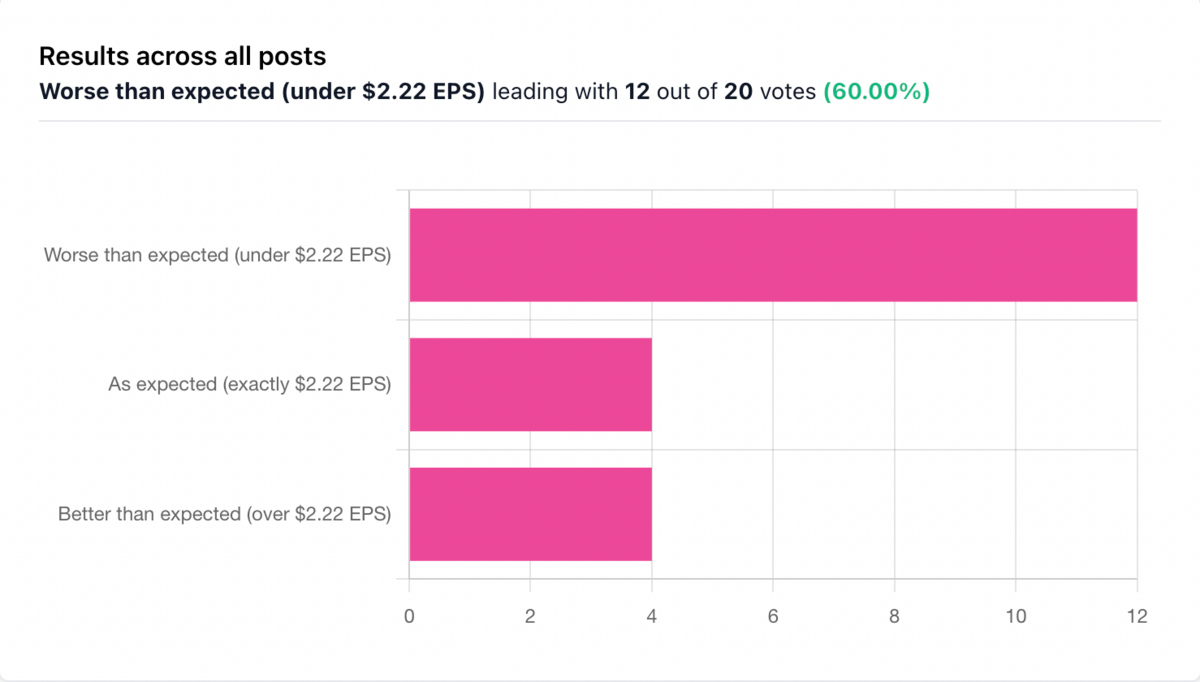

Prediction Contest Update

Microsoft’s smashed earnings reported $2.45 per share, and only 4 of you predicted it. 🥶

Next question soon.

an

Tech Titans Trump Wall Street Woes, Report High Profits

Wall Street’s Tuesday was worst day in a month: The S&P 500 fell 1.6%, the Dow Jones Industrial Average dropped nearly 345 points, or 1%, while the Nasdaq composite sank 2% on Tuesday, April 25th, 2023, due to concerns about corporate profits and the economy following some mixed reports.

Majority beat low expectations: The majority of companies have been topping expectations, but the bar was set considerably low. Analysts are forecasting the worst drop in S&P 500 earnings since the pandemic in the spring of 2020. First Republic Bank, which had the biggest loss in the S&P 500, saw its stock nearly halve after it said customers withdrew more than $100 billion during the first quarter.

Microsoft and Alphabet profits: Microsoft and Google's parent company, Alphabet, both rose in after-hours trading after reporting profits above expectations. Their stock movements carry extra weight on the S&P 500 and other market indexes.

Economists expect growth to cool: On Thursday, the U.S. will give its first estimate of how much the economy grew during the first three months of the year. Economists expect to see growth cooled to a 1.9% annual rate, down from 2.6% at the end of 2022.

Fed expected to raise rates: The Federal Reserve meets next week, and much of Wall Street expects it to raise interest rates at least one more time before pausing. Wall Street is also worried that the struggles of the U.S. banking industry could tighten the brakes even further on the economy.

Vacations Cancelled, Appliances Delayed: Welcome to the Thrilling World of Inflation

US consumer confidence drops to nine-month low in April: The consumer confidence survey from the Conference Board showed that Americans were getting ready to hunker down as dark clouds gather, with the share of them planning to buy major household appliances over the next six months falling to the lowest level since 2011.

Fed’s rate-hiking hits home: Consumers are growing more sensitive to higher prices, and the Federal Reserve's campaign to raise interest rates may be starting to have a broader impact on the economy.

Still optimistic about labor market: Despite their concerns about the economy, consumers remain upbeat about the labor market, with the share of them viewing jobs as "plentiful" rising, while the proportion of those saying jobs were "hard to get" dipped.

Buying plans weaken: The share of those planning to buy household appliances over the next six months dropped to 41%, the smallest since September 2011, from 44.8 in March. The proportion planning to buy motor vehicles was the smallest in nine months.

Home purchase plans maybe slow: Fewer consumers intended to purchase a home, according to the survey. However, a separate report from the Commerce Department showed new home sales surged 9.6% to a seasonally adjusted annual rate of 683,000 units in March, the highest level since March 2022.

AI ART OF THE DAY

Jay Powell is preparing to drop the “helicopter money”

The BRRR’s Portfolio

We bounced at the open today thanks to the good tech earnings. It also looks like the US is nearing a deal to raise the debt ceiling, further cementing the rally.

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Fed decisions can be a real pain in the assets. Join our Facebook group for industry insights and tricks to stay ahead of the curve. Memes for days, too.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.