GM and BRRR.

There are multiple indications that we’re at the apex of the Fed’s tightening cycle.

1. Weakening Labor Market: Today’s data from the Department of Labor points to a jobs market that is rapidly cooling, with one of the largest month on month drops in job openings on record.

2. Renewed Stress in the Regional Banking Sector: Depositors continue fleeing small banks for big banks as First Republic reveals $100b in deposit flight.

However, markets still expect the Fed to raise interest rates by another 0.25% this week. We’ll see if these recent events convince the Fed to instead pause.

Here’s what we brrr’d today:

No New Jobs: JOLTS Report Says Job Market Collapsing

Third Time’s A Charm: JP Morgan Buys FRC, Holds 14% of US Deposits

Godfather of AI: I’ve made a terrible mistake

Prediction Contest Update

FOMC meeting tomorrow, where do you think it lands?

On May 3rd, the FOMC will announce the following

No New Jobs: JOLTS Report Says Job Market Collapsing

US job openings down in March: Fell to 9.6 million, the lowest level in two years, according to the Labor Department's Job Openings and Labor Turnover Survey (JOLTS). Layoffs rose to 1.8 million, with the number of workers voluntarily leaving their jobs unchanged. The ratio of open jobs per available unemployed worker decreased slightly to 1.6, the lowest level since October 2021.

Federal Reserve closely watching JOLTS: In order to gauge its efforts to slow the economy and ease inflation without spurring widespread layoffs. The Fed has been raising interest rates for more than a year to bring down rapid inflation, widely expected to raise rates by a quarter percentage point to just above 5 percent.

Labor Market loses it heat: Employers added 236,000 jobs in March and wages and salaries for private-sector workers rose 5.1 percent in March from a year earlier. However, higher interest rates are taking a toll on the job market, with job growth slowing to an average of 334,000 jobs added over the prior six months.

NYTimes

Third Time’s A Charm: JP Morgan Saves Another Failing Bank

JP Morgan CEO says crisis is over: After rescuing California's First Republic bank, there could be further trouble in the banking system given higher interest rates. JPM CEO recommends taking a "deep breath" as the system is "very stable"

“Too Big to Fail” deja vu: Growing concerns as JP Morgan holds an estimated 14.2% of US deposits; already controls more than 10% of US deposits, but banks in receivership are not subject to regulatory approval. This deal with First Republic strengthens its position as the US's foremost lender, triggering concerns about its systemic importance.

$10B to FDIC: JP Morgan pays $10.6bn to the Federal Deposit Insurance Corp. to take on First Republic's $173bn of loans and $92bn of deposits after regulators seized the troubled bank.

Godfather of AI: “everybody chill on the AI”

Pioneer Warns of AI Dangers: Geoffrey Hinton, a pioneer in artificial intelligence, has resigned from Google and joined a growing number of critics warning of the dangers of generative artificial intelligence.

Revolution or Evolution: Industry leaders believe that new A.I. systems could be as significant as the introduction of the web browser in the 1990s and could revolutionize areas such as drug research and education.

AI on the Loose, Risks to Humanity: However, there is a growing concern among many in the industry that they are releasing something dangerous into the wild, and that generative A.I. could be a risk to jobs and even to humanity.

No sign, but regret: Hinton did not sign an open letter calling for a six-month moratorium on the development of new systems, but he said he has come to regret his life’s work in A.I.

“NYTimes”

AI ART OF THE DAY

Chaos in the banking sector

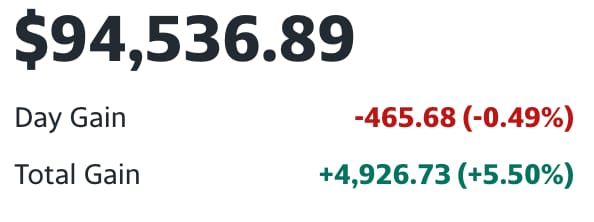

The BRRR’s Portfolio

Still down compared to previous weeks, but looking ahead for moves after rate hike news…

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Fed decisions can be a real pain in the assets. Join our Facebook group for industry insights and tricks to stay ahead of the curve. Memes for days, too.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.