Editor’s note: the podcast is back! We generate a full conversation between two AIs covering the day’s most interesting stories. Subscribe on Spotify and Apple to get notifications when a new episode drops.

You can always read previous updates on thebrrr.com.

TheBRRR’s Thoughts

GM.

It’s been a rollercoaster over the last few months.

Announce unimaginably high tariffs - walk them lower.

Announce a regime change war with Iran - negotiate a ceasefire the next day.

Risk assets and commodities have reacted violently, so let’s recap where we are today:

S&P500, Nasdaq, bitcoin, and gold are all at or near all time highs

Oil pumped and dumped back to the lows

The 10Y US Treasury bond is unchanged from the November election

Year-on-year Inflation continues to decline, with nearly all measures of prices landing below economist consensus month after month

The Fed has refused to cut interest rates despite the encouraging inflation data - Powell has pointed to the unknown impact of tariffs as the sole reason for the hesitation

Despite the political volatility, fundamentals remain strong for select tech companies and a short list of crypto assets - and that’s what we’ll continue to focus on.

Crypto Update

Synopsis:

U.S. crypto policy has seen a seismic shift in 2024–2025, with Congress, federal regulators, and state governments aligning behind a more pro-innovation stance. The House passed the comprehensive FIT21 bill, and the Senate approved the first federal stablecoin framework via the GENIUS Act.

Stablecoin issuer Circle soared at IPO this month, as trad-fi signals it has strong appetite for the right kind of crypto exposure.

Meanwhile, President Trump signed executive orders boosting crypto freedom and creating a national Bitcoin reserve. States like Texas, New Hampshire, and Arizona signed bills to begin stockpiling Bitcoin, while California launched a massive blockchain pilot.

Markets are interpreting this as a structural tailwind for digital assets.

The Details:

GENIUS Act (Stablecoin Regulation): Senate passed June 2025 by 68–30. Sets strict standards for USD-backed stablecoins, bans interest-bearing models, mandates 1:1 reserve backing, and opens market to licensed fintechs.

Executive Orders:

Jan 2025: Legalizes crypto mining, self-custody, P2P use; bans Fed CBDC.

Mar 2025: Creates Strategic Bitcoin Reserve, ending auction of seized BTC. Establishes a broader Digital Asset Stockpile.

Ripple and Grayscale Legal Wins (2023): Ripple’s XRP sales ruled not securities in public markets. Grayscale's court win forced SEC to reassess spot BTC ETF, catalyzing future approvals.

Uniswap Lawsuit Tossed: Federal judge dismissed liability claims against DeFi platform Uniswap, setting precedent for protecting open-source protocol developers.

State-Level Highlights:

Texas: Allocated $10M for a state-run Bitcoin reserve, shielding it from budget raids.

New Hampshire: Legalized crypto in reserves up to 5%, held in secure custody.

Arizona: Collects unclaimed crypto under state property laws, stakes assets for growth.

Kentucky: Passed a "Bitcoin Rights" law ensuring custody, mining, and node operation freedoms.

Wyoming: Prepping the U.S.'s first state-issued stablecoin, launching by July 2025.

California DMV: Tokenized 42M car titles on Avalanche blockchain in a landmark public-sector blockchain application.

WHY IT MATTERS:

The U.S. is finally establishing a legal framework that legitimizes and regulates crypto instead of stifling it. Clearer federal rules slash legal uncertainty, attract institutional capital, and make the U.S. more competitive in digital finance.

State actions further decentralize adoption and innovation, insulating crypto from future federal overreach. With Bitcoin now part of government reserves and regulatory pathways clarified, the investment case for digital assets in America has materially strengthened.

AI Update

Apple: Style Over Substance?

WWDC 2025 (June 9): “Apple Intelligence” Launch

Apple finally unveiled its AI platform—"Apple Intelligence"—with on-device LLMs powering features like Genmoji, AI writing assistance, and image generation.

➤ Reality check: These tools lag OpenAI/Gemini in capability and originality. Apple outsourced key functionality to ChatGPT integration.

➤ Valuation impact: No real move. Analysts viewed this as catch-up wrapped in privacy marketing. Still, it signals a future AI services layer that could matter—if Apple stops playing it safe.

🧠 Google (Alphabet): Underrated AI Execution

Google I/O 2025 (May 20): Gemini Everywhere

Google pushed its Gemini models deep into the ecosystem—AI Mode in Search, Gemini assistants in Gmail, Maps, Android, and a $250/month Gemini Advanced enterprise suite.

➤ Valuation impact: Market underreacted (–1.5% move). But under the hood, this was a technical leap: Google’s AI stack is now fully integrated across billions of users.

➤ Bottom line: Google is shipping real AI at scale. The issue isn’t capability—it’s monetization. Wall Street wants to see more AI revenue, not just product features.

➤ Strategic outlook: Google’s moat is leaking, but it’s the most aggressive AI operator in big tech. If anyone defends market share with AI, it’s Alphabet.

🚗 Tesla: Robotaxi Reality Boosts AI Story

June 22: Paid Robotaxi Launch (Austin)

Tesla finally delivered: ~10 driverless Model Ys began carrying paid passengers in a small Austin pilot.

➤ Valuation impact: Stock spiked +9%, ~$100B added. First real-world commercial deployment of Tesla FSD.

➤ Caveat: This is tiny-scale (10 cars, geofenced area). But Wall Street took it as a proof point that Tesla’s AI claims aren’t vaporware.FSD Upgrade Roadmap (June 10): Neural Net Overhaul Coming

Musk teased a massive FSD upgrade with a 4× bigger neural net and Dojo-powered retraining pipeline.

➤ Investor read: Musk’s AI ambitions (incl. licensing FSD) are being taken seriously again—especially with the robotaxi demo backing it up.

🧠 Nvidia: Still the Pick-and-Shovel AI Winner

May 28: Q1 Blowout Earnings ($44.1B revenue, +69% YoY)

Data center revenue hit $39B, margins ballooned to 72%, and export bans to China only dented guidance slightly.

➤ Valuation impact: Stock jumped +5%. Nvidia is printing cash on AI infrastructure. Investors see durable demand, not just a bubble.GTC 2025 (Mar 18): New AI Chip Roadmap

Nvidia introduced Blackwell Ultra, previewed the “Rubin” architecture (2026), and launched new DGX workstations.

➤ Market reaction: Stock dipped –3.4%. The bar is insanely high. Any whiff of delay (e.g. Blackwell supply issues) hits hard.

➤ Bottom line: Still the AI backbone of the industry, but the market now demands perfection.

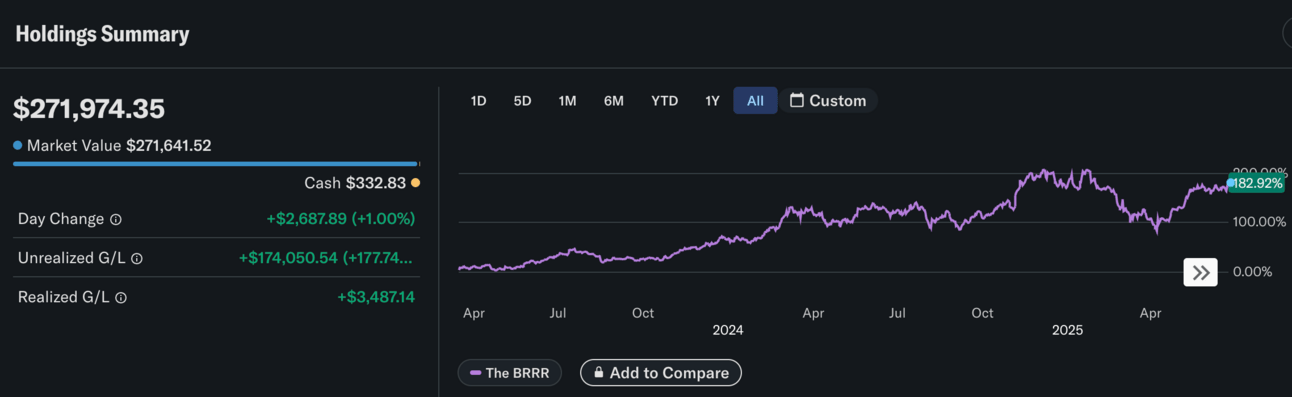

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.