TheBRRR’s Thoughts

Markets were jittery on the first day back from the long weekend, and the weakness has continued into this morning with the Nasdaq down another 0.6% after falling by 1% yesterday.

As we wrote on Monday in our NVDA earnings preview, the company’s report, due after the close today, will have a massive impact on overall tech sentiment.

Analysts expect the company to report $4.60 EPS against $20.4B in revenue for the quarter - that’s up from $0.88 EPS and $6.81 in rev just one year ago.

Options markets are pricing in a 11% move for NVDA in either direction, implying $350B in marketcap volatility for the $1.7T company.

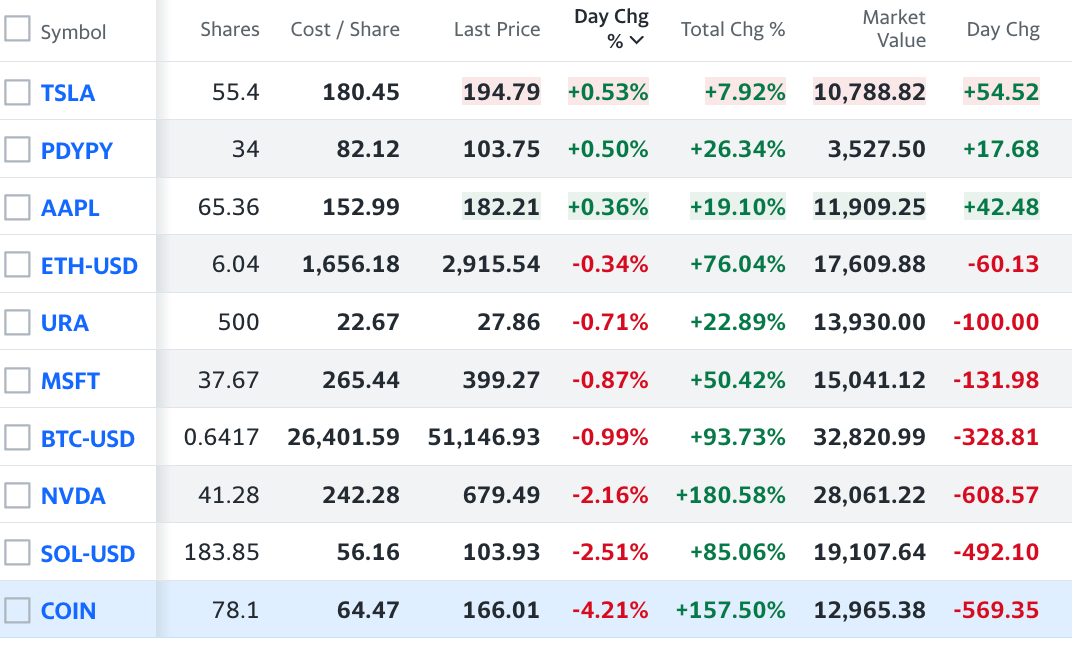

We’re holding the stock in the newsletter’s portfolio from $242, but aren’t looking to add ahead of the closing bell.

Chinese Stocks Soar To Kick Off Year Of The Dragon

WHAT HAPPENED

China Stocks Surge: Chinese stocks experienced a significant rally, with the Hang Seng China Enterprises Index climbing 2.2% to hit its highest level in seven weeks, buoyed by state support measures and a crackdown on quant fund trading.

Regulatory Crackdown: Authorities are taking a tougher stance on quantitative trading and leveraged products to reduce market volatility. This includes state funds buying shares and tighter supervision of quant trading by China’s main stock exchanges.

Market Optimism: These measures have sparked optimism, with property developers leading gains after reports of approved funding for the sector. The HSCEI gauge saw a 13% increase, its largest since early last year, following a significant cut to a key mortgage reference rate.

Concerns and Expectations: While the crackdown aims to stabilize the market, there are concerns it might deter foreign investors. The focus now shifts to the upcoming National People’s Congress for further support measures.

WHY IT MATTERS

Market Stability: The Chinese government's intervention reflects efforts to stabilize the market and protect retail investors from volatility caused by quantitative trading strategies.

Economic Signals: These moves indicate China’s readiness to support its stock market and economy, crucial for investor confidence amid ongoing challenges in the property sector and broader economic concerns.

Global Implications: China's stock market dynamics can have significant implications for global markets, affecting investor sentiment and international capital flows.

Policy Watch: The upcoming National People’s Congress is a key event for investors, looking for signs of further economic support measures that could determine market direction in the near term.

Pink = Nasdaq

Orange = Asian Tech

Chart starts in q4 2021

Canada’s Inflation Cools In Jan, Stemming Global Inflation Fears

WHAT HAPPENED

Inflation Eases in Canada: January saw Canada's annual inflation rate slow to 2.9%, surpassing economists' expectations who had anticipated a dip to 3.3% from December's 3.4%. This deceleration was primarily due to decreased gasoline prices and a general slowdown in food price growth.

Core Inflation and Monetary Policy: Even with the decline, core inflation remains above 3%. The Bank of Canada has signaled a cautious approach, seeking more evidence of sustained inflation slowing before adjusting monetary policy. However, this latest report makes future rate cuts more likely, with speculation of trimming beginning in June.

Market Reactions: Following the report, money markets adjusted their expectations, significantly increasing the likelihood of a rate cut by April to 58% from a previously estimated 33% chance.

Sector-Specific Insights: The report detailed specific price movements, including a 4% drop in gas prices and varying changes in food categories. Additionally, shelter costs saw an uptick from December, highlighting nuanced inflationary pressures across different sectors.

WHY IT MATTERS

Policy Implications: This slowdown brings inflation within the Bank of Canada's target range of 1-3%, potentially signaling a shift towards easing monetary policy later this year, a move anticipated by several economists and market strategists.

Economic Outlook: The easing inflation and the possibility of rate cuts could influence consumer spending, business investments, and overall economic growth, reflecting a cautiously optimistic outlook for Canada's economy.

Market Dynamics: Adjusted market expectations for rate cuts underscore the impact of inflation data on financial markets, influencing investment strategies and currency valuations.

Consumer Impact: The mixed changes in prices, especially in essential sectors like food and shelter, continue to affect household budgets, highlighting the importance of monitoring inflation's broader impact on living costs.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

We bought Solana and announced it to premium subscribers on November 28th. It’s up 77% since.

Trades, Watchlist & Live Portfolio

(paywall only)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Solana’s up 85% since we bought and should continue to run. 🔥

Portfolio

Notes

Wednesday 11/29/23: We sent out the alert that we were buying Solana yesterday as we go full risk-on to close out the year.

Latest Trades

Tuesday 11/28/23 11:20 AM: BUY 183.85 SOL @$56.16

Tuesday 11/28/23 11:20 AM: SELL 101.62 XOM @$104.75

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll