Trump Going Down?

GM and BRRR. Welcome to our new subscribers - with yesterday’s 190 sign ups, we’re up over 2,500 readers.

Monday was an uneven day for the market. The S&P 500 crawled up 0.4%, the Dow climbed 1% and the Nasdaq fell 0.3%.

On the heels of Sunday’s OPEC oil production cut (we wrote about it yesterday), Crude Oil made an aggressive move higher. It closed at $80/ barrel, up about 6% from Friday’s close.

While our portfolio’s Exxon Mobile ($XOM) rallied 5.8% on the news, the rest of our tech-heavy portfolio did not react well. With higher oil prices, the Fed could be compelled to raise interest rates at their next meeting - further harming risk assets and the economy at large. That’s how traders interpreted the news, but we don’t quite buy it.

The Fed’s manipulation of the money supply has banks and commercial real estate on the brink of collapse. A rate hike could spoil the Fed’s delicate balance, pushing a new cluster of institutions into insolvency so we continue to hodl.

We’ve got diamond hands at these prices.

Looking ahead, the entrée this week will be the non-farm payrolls report on Friday with a political circus unfolding as an exciting appetizer on Tuesday. Donald Trump will surrender in New York today, for paying off a pornstar while campaigning back in 2015. With that impending circus, Wall St’s Republican donor class is reportedly kicking the tires on Florida Governor Ron DeSantis as a replacement.

DeSantis, perhaps most famous for his contrarian and successful COVID policies, earned a landslide reelection last year in a state that’s historically evenly split.

Here’s what we brrr’d today:

OPEC’s Production Cut Makes Monday Choppy

Traders bet on Fed’s next move as oil affects literally everything

Wall St Examines DeSantis

Choppy Monday with Oil Up

Tech underperformed, with the Nasdaq weighed down by Tesla closing lower by 6% after quarterly deliveries missed expectations.

The surprise OPEC production cut saw oil futures gap higher and bonds gap lower on the open.

The rise in oil prices helped energy companies, but it weighed on the rest of the market by raising gasoline prices and other costs.

It also dented one of the main themes that helped stocks rise in Q1 2023: that turmoil in the banking system and a continued slowdown in inflation could push the Federal Reserve to ease its hikes to interest rates.

Economists surveyed by Reuters are split between a 25bps hike in the Cash Rate to 3.85% or a pause at the upcoming RBA meeting.

Traders are betting on how much further the Fed will raise rates, and following Monday's leap for oil prices, bets built that the Fed may hike rates by another quarter of a percentage point in May.

Higher interest rates tend to hit high-growth companies the hardest, putting extra pressure on the Big Tech stocks that have an outsized effect on the S&P 500 and other indexes because of their immense size.

Wall St Eyes DeSantis

DeSantis is the only Republican who has polled competitively with Trump in recent polls.

Some Republican fundraisers on Wall Street are hesitant to jump in because they fear backing a candidate that could lose to Trump and don’t want to make an enemy of the former President.

DeSantis has not officially declared his candidacy for president, and the first GOP primary debate is scheduled for August.

DeSantis has kept fairly quiet on national issues over the years. His anti-lockdown COVID policies earned him points broadly, as has his non-interventionist foreign policy rhetoric.

AI ART OF THE DAY

NY Bankers confused by oil

Yesterday’s art was so enjoyable we’re sharing it again

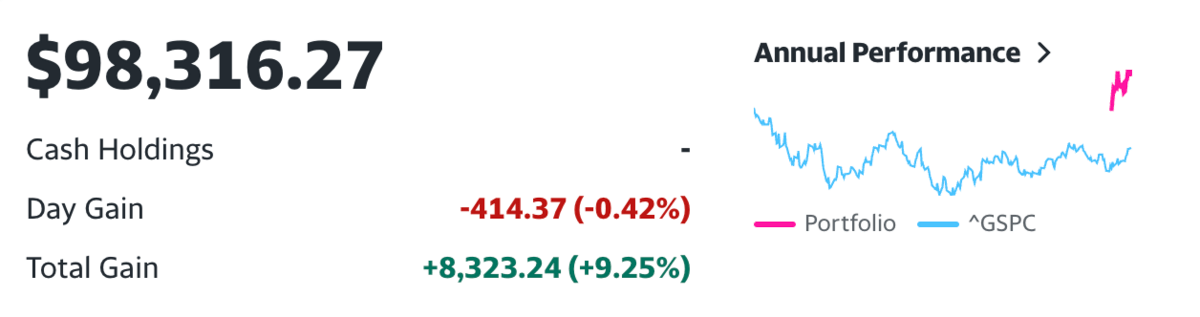

What We Own

$BTC, $ETH, $NVDA, $AAPL, $COIN, $XOM, $TSLA, $MSFT, $AMZN

XOM and ETH buoyed our portfolio today. Notable strength from ETH after underperforming BTC throughout March.

Want our concise thesis on each asset? Have a friend sign up through your custom link below. When you do, we’ll send you the doc.

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.