TheBRRR’s Thoughts

GM!

OpenAI’s DevDay shocked and awed, crypto assets have continued their gradual rise, and markets are now pricing in rate cuts beginning May 2024 after digesting the totality of last week’s disappointing employment data.

Deep dives below 👇

Tech News

OpenAI Opens Up Custom Bot Building for All

What's New:

OpenAI has unveiled GPT-4 Turbo, a more potent and cost-efficient AI model capable of text and image analysis. Users can now easily create custom GPTs for specific tasks without coding, and a forthcoming GPT Store will enable the sharing and monetization of these AI bots.

Additionally, a new Assistants API, DALL-E 3 API, and Audio API have been launched, broadening the scope of AI applications. The company also introduced the Copyright Shield program to protect businesses using AI-generated content.

Why It Matters:

Rapid mainstream adoption of AI: OpenAI marks a milestone with ChatGPT hitting over 100 million weekly users and a developer community of 2 million.

More powerful AI applications: The new models and APIs will enable developers to build more powerful, customized AI apps and assistants.

Democratizing AI development: OpenAI's offerings aim to democratize AI development and empower creators to build unique solutions.

Monetization opportunities: The planned API store and rewards for popular GPT models provide monetization opportunities for developers.

Crypto News

ETH's Upbeat Tempo: Cash and Burn Cue $3K

What's New:

Ethereum (ETH) is showing signs of a strong recovery, with network activity propelling the cryptocurrency towards a potential $3,000 mark. The network's transaction fees have rebounded, hitting over $30 million weekly, and the blockchain has settled a record $250 billion in transactions in just one week.

The network “burns” revenue (permanently taking coins out of circulation) to reduce total supply, counteracting the emissions paid to network validators for securing the blockchain.

Why It Matters:

Revenue Resurgence: The spike in Ethereum's transaction fees suggests a renewed investor interest amidst surging network activity.

Deflationary Turn: For the first time in months Ethereum has become deflationary, with the burn rate outpacing the minting of new ETH. This reduces the total supply of Ether, reducing potential sell pressure.

Transaction Milestone: The record transaction settlements indicate a robust and growing demand for Ethereum's blockchain, underpinning the bullish sentiment in the crypto market.

Read more

Today’s Reader Poll

Are you a crypto investor?

As a percentage of all of your investments, how much is in crypto?

Monday’s poll results yet again show a diversified response group:

Subscriber “hogget” gave us a peek into his investing ethos (we admire his commitment): “Ive been working a few years on a 1/3 philosophy. 1/3 in traditional savings which are instantly accessible when required. 1/3 in the stock market spread over different currencies. Stocks in USD, Euro, GBP, JPY 1/3 in crypto of which 50% is Bitcoin and Etherium, the other 50% spread over various altcoins”

AI Art of The Day

Altman announcing GPTs for all

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $12.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

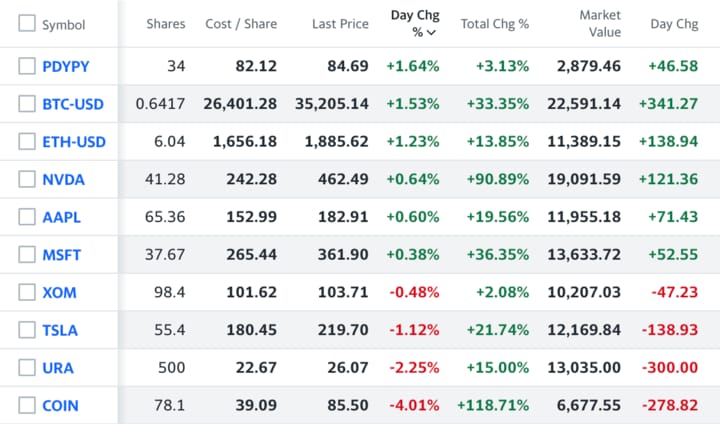

-Continued gains in the portfolio here, back near our YTD highs.

-PDYPY surging on no news

-NVDA bounced 10% off $400 support it touched earlier this week

-COIN beat on earnings last night, holding onto 10% gains this week

Latest Trades

Friday 10/13/23 9:30 AM: BUY 34 PDYPY @82.12

Monday 8/21/23 9:30 AM: BUY 500 URA @ $22.67

Wednesday 8/16/23 10 AM: SELL 103.9 $AMZN @ $136.6

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

Portfolio

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.