Just for fun today

GM and BRRR.

Markets are confused and mixed this morning, as a slew of good economic data was released.

Revised GDP data for Q1 suggests the economy is growing at twice the pace of the initial estimate (2.0% vs 1.1%). The number was revised dramatically due to a surprising surge in exports. (read more)

Revised core inflation data suggests 4.9% y/y increase, down from the initial 5.0% announced initially (read more)

For today’s coverage:

We’re looking at Opera ($OPRA), a small-cap tech company and creator of the Opera browser. We like their valuation and prospects going forward.

We’re also looking at Coinbase’s ($COIN) ongoing legal saga with the SEC. Coinbase claims the SEC has guided the crypto industry incoherently and makes a compelling case.

And in The BRRR News, 57% of our audience thinks SBF will go to jail for at least 2 years. I’m hopeful, but not convinced. Leaving the poll open for one more day. Vote below!

Will Sam Bankman Fried spend over 2 years in jail for the FTX fraud?

AI: The Money Robots

Opera: A beautiful symphony of fundamentals and narrative

Opera Limited, a software company primarily in the web browsing business, has exhibited substantial growth and adaptability, with its stock appearing undervalued according to multiple analyses.

The company has demonstrated a strong financial performance with a 20% revenue annual growth rate from 2016 to 2022 and a gross margin consistently above 60%. Its latest earnings showed a 33% growth YoY with a record $96.3 million revenue.

Despite certain risks such as dependence on its agreement with Google, where the Opera browser automatically defaults to Google Search (which contributed to 45% of 2022 revenues) and global economic conditions, the potential upside and company's strategic efforts like targeting higher ARPU markets and introducing AI tools present a compelling case for long-term investment.

Opera has launched Opera One, a revamped web browser featuring a native generative AI called Aria that provides detailed answers to user queries and can generate text or computer code, potentially driving user growth and monetization opportunities.

Developed in collaboration with OpenAI, Aria connects to the ChatGPT generative AI engine and accesses real-time web data, making it more advanced than standard GPT-based solutions, and it supports over 50 languages and available in over 180 countries.

Publicly-traded companies mentioned: OPRA

Our take: A small-cap high-growth tech stock with a clean balance sheet and reasonable earnings multiples is a rarity. Adding to our Watchlist as a solid buy.

Crypto: Digital Gold Rush

Coinbase vs. SEC: The Epic Battle of Regulators and HODLers

Coinbase has filed a motion to dismiss the SEC’s lawsuit against it, asserting that the case falls outside the SEC’s jurisdiction, as the tokens involved are not “investment contracts” and the regulator does not have statutory authority over the exchange.

The company’s defense includes that the tokens, such as SAND, FIL, ADA, SOL, Flow, and MATIC, are used for transaction fees or other services in their respective platforms, not as investment contracts. It also uses the Equitable estoppel defense doctrine, indicating that the SEC’s past actions contradict the current lawsuit, especially given that it previously approved Coinbase’s shares listing on the U.S. stock market.

Coinbase also highlighted an inconsistency in the SEC’s position. In May 2021, SEC Chairman Gary Gensler stated that only Congress could regulate cryptocurrencies, but by the end of 2022, he asserted that the SEC had enough authority to enforce regulation. Coinbase also accused the SEC of rejecting rulemaking efforts and ignoring public petitions, instead preferring punitive enforcement actions.

AI ART OF THE DAY

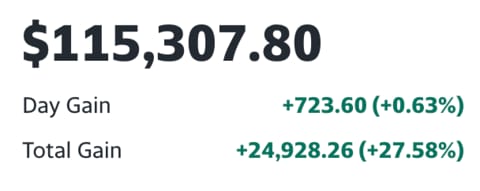

The BRRR’s Portfolio

Looking good with Coinbase continuing to surge while the AI tech takes a breather.

On Watchlist:

$AMD: NVDA’s strongest competitor

$ASML: They make the machines that make AI machines

$ADBE: Creativity & productivity software

$ISRG: Robot Surgeons

$OPRA: Growing web-browsing solution

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Join our Facebook group to connect with the community.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.