TheBRRR’s Thoughts

Editor’s note: the podcast is back! We generate a full conversation between two AIs covering the day’s most interesting stories. Subscribe on Spotify and Apple to get notifications when a new episode drops.

GM.

We appear to be in a holding pattern headed into the US election. Markets hate uncertainty, and there is not larger uncertain variable in the world at the moment than the party in control of the largest government and military in the world.

We ultimately expect risk assets go higher regardless of the election’s outcome, but a divided government - executive branch does not have an overly friendly house/senate - would be the most optimal setup.

Polls and betting markets are trending for Trump, but with 2 weeks to go anything can still happen.

Hedge fund legend Paul Tudor Jones is worried about the debt and is long gold and bitcoin headed into the final quarter of the year.

Polymarket’s Election Odds Moving Bond Market

Synopsis:

Online betting platform Polymarket has become a key driver in shaping the U.S. Treasury and FX markets, influencing bond prices based on its prediction markets for the upcoming U.S. presidential election. With Donald Trump emerging as the favorite, according to Polymarket, U.S. Treasury yields, particularly the 10-year yield, have closely tracked these election odds. This has led to a notable divergence from traditional polls that favor Kamala Harris, signaling that Polymarket is having an outsized influence on financial markets.

The Details:

Polymarket's influence: The platform has rapidly become a major player in financial markets, particularly the $28 trillion U.S. Treasury market and FX markets like the Mexican peso (USDMXN). As Polymarket shows increasing odds of Trump winning the 2024 election, both bond and FX markets have reacted accordingly.

Bond market reaction: The 10-year Treasury yield has risen by 50 basis points (bps) since the Fed's emergency 50 bps rate cut a month ago, reaching levels not seen since Trump’s previous election victory in 2016. This move contrasts with the Fed’s attempt to ease monetary conditions, underscoring the market’s focus on election outcomes rather than central bank policy.

Impact on FX: USDMXN has also mirrored the rising Trump odds, suggesting traders expect tariffs and other Trump-era policies to return, weakening the Mexican peso.

Market memory: Traders are reacting similarly to the sharp bond sell-off seen after Trump's 2016 win, when yields spiked 80 bps in a month.

WHY IT MATTERS:

Polymarket’s data-driven betting on the U.S. election has surpassed traditional polling in market influence. Investors should track election-related market movements closely, particularly in U.S. Treasuries and FX markets. Yields could continue to rise if Trump’s odds strengthen, which may put pressure on equities, especially as the 10-year yield nears 4.30%, a level that historically triggers a negative response in the stock market.

Key Takeaways:

Polymarket: Emerging as a critical force in setting bond market expectations.

10-year yield up 50 bps since the Fed’s emergency cut.

FX markets: Mexican peso weakens as Trump odds rise.

Watch: 4.30% on the 10-year yield, a critical level for equity markets.

Tudor Jones: We’re F’d, But Gold & Bitcoin

Synopsis:

Billionaire hedge fund manager Paul Tudor Jones has raised concerns about an impending market reckoning tied to U.S. government spending after the 2024 election. He highlighted that current fiscal policies are unsustainable, warning of a potential bond market sell-off and spiking interest rates. Jones suggests that without serious reforms to U.S. spending, a financial crisis could unfold, referencing a possible “Minsky moment” where markets sharply reprice risk.

The Details:

Key concern: Paul Tudor Jones believes that unchecked government spending will lead to severe consequences in the bond market. He’s betting against long-term fixed income and avoiding owning bonds.

Minsky moment: He referenced the concept of a "Minsky moment," a term used to describe a sudden collapse in asset values after an extended period of growth fueled by debt.

Fiscal deficits: The U.S. federal deficit surged over $1.8 trillion in 2024, increasing the strain on government finances and raising concerns about how the government will continue funding its debt.

Market prediction: Jones pointed out that both presidential candidates are contributing to rising fiscal deficits, and either outcome could lead to higher inflation or spending cuts, which could destabilize financial markets. He is particularly concerned about inflation if Trump wins.

WHY IT MATTERS:

For investors and traders, Jones's warnings highlight the increasing fragility of U.S. financial markets, driven by unsustainable government spending. His predictions suggest potential volatility in the bond market, especially for longer-dated treasuries. Those with exposure to bonds or interest-rate-sensitive investments should be cautious as rising rates could lead to significant losses in fixed income markets.

Key Takeaways:

$1.8 trillion deficit: Fiscal deficit continues to climb, signaling future instability.

Jones betting against bonds: Avoids long-dated bonds due to expectations of rising yields.

Market reckoning post-election: Potential bond market collapse tied to runaway spending.

There’s a reason 400,000 professionals read this daily.

Join The AI Report, trusted by 400,000+ professionals at Google, Microsoft, and OpenAI. Get daily insights, tools, and strategies to master practical AI skills that drive results.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Most Recently Revealed Trade:

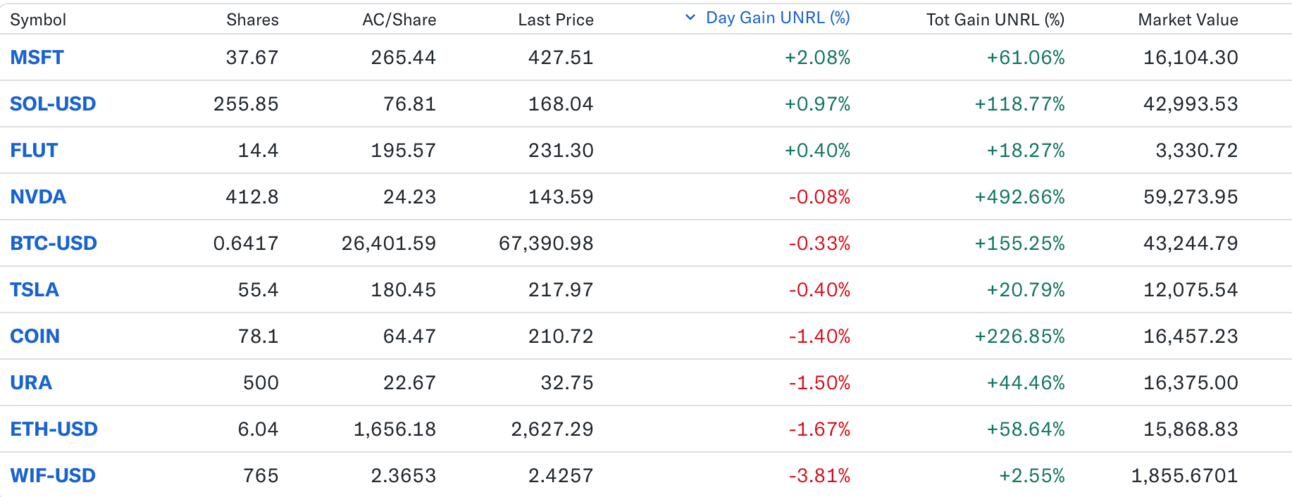

Wednesday April 17 2024: We bought more Solana at $131 and added Solana’s top memecoin WIF at $2.36 on the heels of a leverage wipeout dip after the WW3 scare.

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio Notes

June 12: These assets all look great for continuation higher.

We are considering moving on from Tesla as it has lagged the rest of our portfolio badly and doesn’t have an obvious catalyst. We’ll monitor and let you know if we decide to move on.

Older Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll