Frank’s GM

Stocks have had a rough week, as a strong negative reaction to Wednesday’s FOMC meeting has driven the price action downward. The tech-heavy Nasdaq has been the weakest index, and is set to close the week down by roughly 3%.

Fed Chair Jay Powell spooked nervous traders by going off-script, introducing some new language into his approach to managing interest rates and inflation going forward.

With Powell pledging to “proceed carefully” for the first time since March’s bank run and subsequent contagion, traders believe Powell is suddenly worried about fragility in the system.

He used the phrase 6 times during his Wednesday press conference.

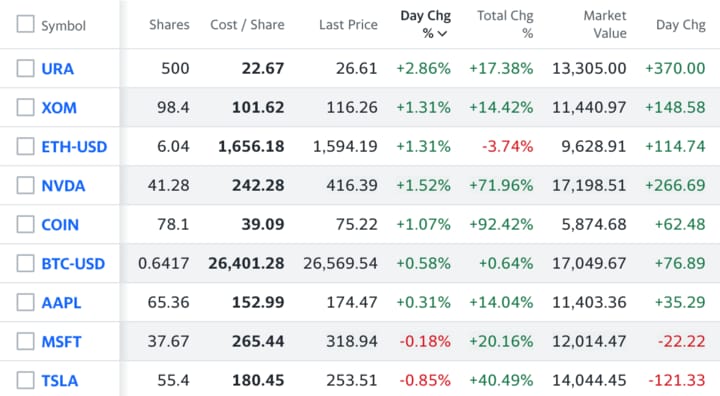

Elsewhere, Uranium and other energy-related equities continue to soar. We added Uranium ETF $URA exactly one month ago and it’s up by 20% and we’re considering adding to the position.

It’s served as a beautiful hedge against the re-emerging inflation narrative over the last 30 days, which hedges our tech-heavy portfolio nicely during these challenging periods.

As a reminder, for just $2/month or $12.99/yr, you’ll unlock trade notifications and a full view of our actively managed portfolio (+21.8% since inception in late March) and watchlist as a premium subscriber.

We’re raising prices next week, so lock in now to save a little coin.

Today’s newsletter is brought to you by The AI Tool Report. Please consider subscribing and opening their emails - it’ll directly support us at The BRRR. 👇

What Else I’m Reading

The AI Tool Report Learn AI in 5 Minutes Per Day. The AI Tool Report does an outstanding job surfacing the most practical AI breakthroughs that you can actually leverage today.

Here’s your link to subscribe for free.

Market News

Green Glow: Uranium Shines in Net-Zero Race

Uranium prices have surged, spurring significant gains in uranium-related exchange-traded funds (ETFs), as global demand for nuclear energy increases. Despite the rise in uranium prices, they remain below historical peaks and continue to be driven by a shift toward nuclear power to achieve net zero carbon emissions.

Despite the robust performance, uranium-related ETFs have seen relatively muted inflows, reflecting mixed investor sentiment and possibly limited awareness about the sector's potential in clean energy transition.

Nuclear Profits: The Global X Uranium ETF (URA), with over $2 billion under management, has risen by nearly 30% in 2023, while the Sprott Uranium Miners ETF (URNM) has seen a jump of over 37% year to date.

Price Surge: Uranium prices have reached $66.25 per pound, marking the highest level since the 2011 Fukushima disaster, but remain significantly below the last peak of around $137 per pound in April 2007.

Demand and Deficit Dynamics: The demand for uranium in nuclear reactors is projected to increase by 28% by 2030 and almost double by 2040, as nations amplify their nuclear power capacity to achieve zero-carbon targets. However, there exists a yearly deficit of 50 million pounds of uranium between mine outputs and nuclear power plant requirements.

Global Macro News

Economic Interplay: Equity & Currency Layers

Global markets experienced significant volatility, with US equity futures rebounding after a three-day selloff, marking the end of a tumultuous week. The S&P 500 and Nasdaq 100 saw modest rebounds, while European stocks mitigated their losses. The turmoil is attributed to investors adjusting to the idea of enduring higher interest rates.

Central banks worldwide are emphasizing their vigilance regarding inflation risks, and the possibility of monetary policy leading to recession is influencing rapid stock liquidation. The Bank of Japan maintained its interest rates, and the yen weakened subsequently. European stocks experienced a decline, with construction, retail, and real estate being the worst performers.

Yield Surges: The US 10-year Treasury yield surpassed the 4.5% mark for the first time since 2007, reflecting the market's adjustment to the Federal Reserve's hawkish stance and strong labor market data, impacting global bond and equity markets.

Central Bank Vigilance: Global central banks, including the Federal Reserve and the Bank of England, are maintaining a vigilant stance on inflation risks, with the BoE keeping policy rates on hold at 5.25% and signaling potential for more hikes, impacting investor sentiment and causing shifts in market dynamics.

Asian Market Resilience: Despite global market turmoil, Asian markets, excluding Japan, showed resilience and closed the week in green, with the Hang Seng and Shanghai Composite Index experiencing gains, showing regional variations in market responses to global economic developments.

Today’s Reader Poll

Here are the results of our Uranium poll. You guys can’t make your mind up 🤷♂️

AI Art of The Day

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $2/month or $9.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

We added Flutter Entertainment (PDYPY) to the Watchlist on Wednesday of last week and it’s fallen by 5%. We think it has a little further to go, but would take no issue with a buy in the $86 range.

We initiated a position in $URA in August - it’s an ETF that tracks the price of Uranium. We believe the Nuclear Energy narrative is gaining steam very quickly and that the asset class will continue to outperform.

Latest Trades

Monday 8/21/23 9:30 AM: BUY 500 URA @ $22.67

Wednesday 8/16/23 10am: SELL 103.9 $AMZN @ $136.6

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

$PLTR: AI for government intelligence

$DKNG: Sports betting revenue may beat expectations this quarter

$PDYPY: Leading US sports betting operator

Portfolio

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.