an oldie but a goodie

GM and BRRR.

It’s FOMC Day - a ritualistic event for markets.

The world expects Fed Chair Powell to dictate the cost of borrowing increases by another 0.25% until his next omnipotent proclamation, due in September.

In attempt to tame markets and enthusiasm, we expect Powell to ramp up the “higher interest rates for longer than you think” narrative that the Fed has failed to effectively sell to the public in recent statements.

Should the market buy what JPow is selling, risk assets will likely sell off. If they don’t buy it, or if Powell hints at anything besides “higher for longer”, we could see a crack-up-boom in risk assets as investors panic-buy growth.

In other news, tech earnings continue to come back mixed this week. Google impressed and Microsoft disappointed on Tuesday. Meta reports after the close today.

We’re still long tech, but have continued to reduce exposure. We’re sitting in about 23% cash, our highest amount on record.

Today’s email is brought to you by the TLDR Newsletter. It’s an amazing free resource to help you stay on top of the tech world with the most impactful stories.

Please consider subscribing and opening their emails - it’ll support us at The BRRR. 👇

What Else I’m Reading

The AI Tool Report: Leverage AI for productivity. Leverage AI for creativity. Leverage AI so the robots don’t replace you. This newsletter brings the best AI Tools to your inbox. Here’s your link to subscribe for free.

Central Banking

Fed's Rate Hike: The Last Dance or Just an Intermission?

Wall Street economists predict that the Federal Reserve will raise its benchmark interest rate by 25 basis points, marking the final hike of this cycle. However, they do not expect Fed Chair Jerome Powell to confirm this just yet. The Federal Reserve is expected to adopt a wait-and-see approach as job growth and inflation slow down. Despite the majority of Fed members advocating for more rate hikes, economists believe the economy will continue to decelerate, leading to a pause in rate hikes for the rest of the year. The market is also starting to believe that inflation is resolving itself, as evidenced by the June consumer inflation report.

Rate Hike Incoming: Wall Street economists anticipate a 25 basis point increase in the Federal Reserve's benchmark interest rate. This is expected to be the last hike in this cycle, bringing the federal funds rate to a range of 5.25%-5.5%. However, Fed Chair Jerome Powell is not expected to signal this shift yet.

Economic Deceleration: Despite some Fed members advocating for more rate hikes, economists predict the economy will continue to slow down. This slowdown is expected to result in a "permanent pause" in rate hikes for the rest of the year, according to Sal Guatieri, senior economist at BMO Capital Markets.

Inflation Trends: The June consumer inflation report showed a drop to a 3.1% annual rate from a high of 8.9% in the same month last year. This has led to a growing belief in the market that inflation is resolving itself. However, core consumer inflation remains at 4.8% annual rate, well above the Fed's 2% target, indicating that inflation concerns are not entirely off the table.

Tech Equities

Alphabet Spells Out Success with Q2 Earnings Beat

Alphabet Inc. has reported a robust Q2 performance, with a 7% YoY revenue growth and a surprising 7.5% beat on earnings per share estimates. The company's cost-cutting measures have started to yield results, improving operating margins by 100 basis points YoY. Google Cloud, a unit of Alphabet, has turned profitable, contributing $400 million to operating profit. The company also bought back $15 billion worth of shares during the quarter.

Earnings Beat Expectations: Alphabet's Q2 earnings surpassed estimates on both revenue and earnings per share. The revenue beat was around 2.5%, while earnings per share estimates were beaten by a significant 7.5%. This positive performance led to a 7% initial increase in Alphabet's share price.

Cost-Cutting Improves Margins: Alphabet's cost-cutting measures, including reducing employee count and rationalizing resources like unused office space, have started to pay off. The company's operating margin improved by 100 basis points YoY and 400 basis points sequentially, indicating a positive trend.

Cloud Unit Turns Profitable: Alphabet's Google Cloud unit, which previously reported a loss of $600 million in Q2 of the previous year, contributed $400 million of operating profit in the most recent quarter. As the unit continues to scale up, it is expected to contribute significantly to Alphabet's bottom-line growth in the future.

Share Buyback and Strong Balance Sheet: Alphabet bought back $15 billion worth of shares during Q2, indicating a strong cash flow and a robust balance sheet. The company's cash and equivalents rose by $4 billion YoY, while long-term debt declined by $1 billion, resulting in a $5 billion net cash improvement. This financial strength allows Alphabet to fund investments in areas like artificial intelligence technology.

Today’s Reader Poll

Vote and leave a comment - we’ll feature the top comment tomorrow!

The Nasdaq Composite is at $14,100. Where will it be at market close on August 2nd?

AI Art of The Day

Jerome Powell getting ready for a hike.

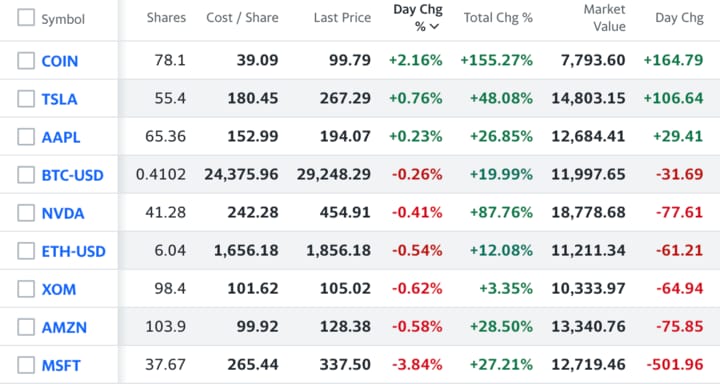

The BRRR’s Portfolio Update

Apple diverging to the upside today, as anticipation builds for its August 3rd earnings report.

On Watchlist:

$AMD: NVDA’s strongest competitor

$ASML: They make the machines that make AI machines

$ISRG: Robot Surgeons

$OPRA: Growing web-browsing solution

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Join our Facebook group to connect with the community.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.