TheBRRR’s Thoughts

GM. Ready to build and share your own chatbot? That’s what AI-leader OpenAI has up its sleeve for next week. More on that below in today’s AI news.

Financial news this morning centers around new data that has reduced the probability of interest rate cuts in March.

The data is quite mixed with December’s strong data dampened by significant downward revisions to October and November’s. The correlation in play is as follows:

Strong job report = Strong economy = Less Need For Rate Cuts

The market suggests a 55% chance of rate cuts in March - we at the BRRR would assess the likelihood to be higher as the Fed attempts to juice the economy.

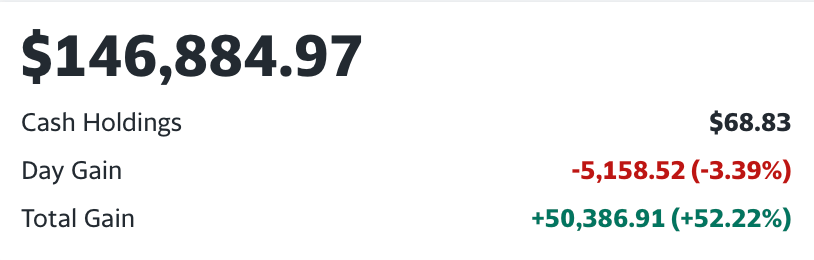

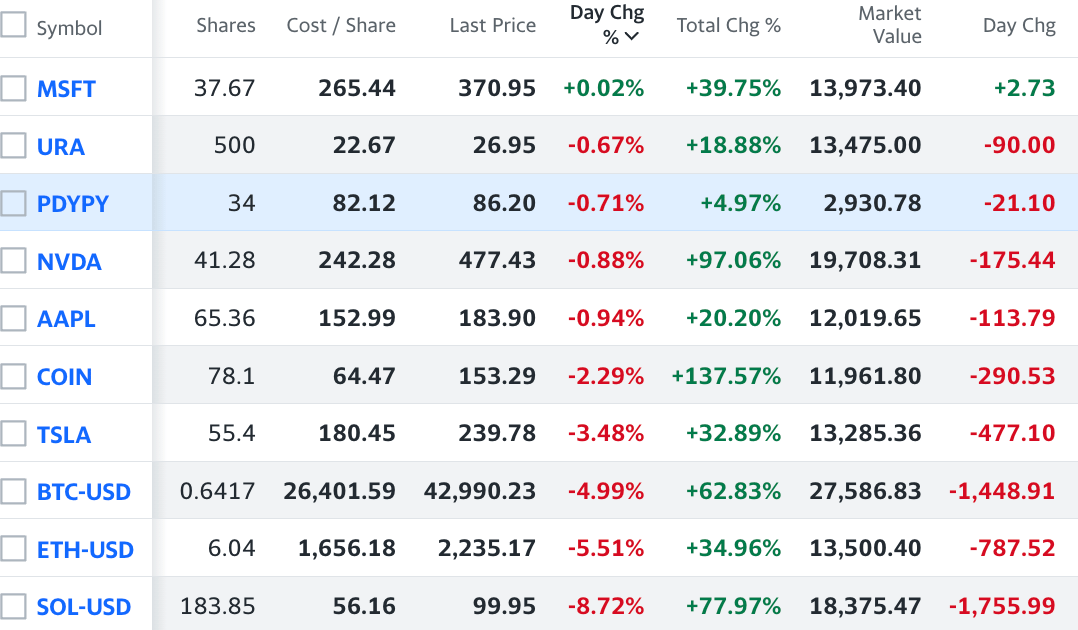

Our portfolio remains risk-on and overweight crypto (evident by our recent $SOL purchase) headed into the expected approval of the first spot bitcoin ETF.

We expect short-term volatility upon approval, but believe the ETF will structurally improve market dynamics for the asset class - allowing for more consistent and passive flows from the traditional finance world.

Macro News

Jobs Shocker: December Payrolls Surge, But November Revisions Paint Alternate View

WHAT HAPPENED:

Strong Headline Numbers: US added 216K jobs in December, surpassing most Wall Street estimates (average of 175k).

Revisions of Past Data: Notable revisions occurred in previous months' data:

October's numbers were revised down from 150K to 105K.

November's were also revised downwards, from 199K to 173K.

Part-Time vs. Full-Time Jobs: Dramatic shift with a plunge in full-time jobs by 1.5 million, the lowest since Feb 2023, and a record high in part-time jobs.

Multiple Jobholders Spike: The number of people holding multiple jobs spiked to a new all-time high (8.65M).

WHY IT MATTERS:

Impact On Interest Rate Projections: Odds of a March rate cut fell from ~75% to ~50% in reaction to the data.

Economic Indicators' Credibility: Revisions and discrepancies in surveys raise questions about the reliability of economic data.

Labor Market Dynamics: Shifts towards part-time employment and the rise in multiple jobholders reflect underlying volatility in the job market.

AI News

ChatGPT To Launch ChatBot Store Next Week

WHAT HAPPENED:

Launch Date Announced: OpenAI's GPT Store is scheduled to open between January 8-13, 2024.

Developer Engagement: OpenAI has reached out to creators who have already used the GPT Builder, outlining steps to share their GPTs in the store.

User-Friendly Development: The GPT Builder tool allows for easy creation of customized GPTs using plain language, making it accessible to a broader range of creators.

Anticipated Revenue Model: Details of OpenAI's revenue-sharing plan remain undisclosed, drawing parallels to Apple's App Store and its 30% sales cut.

WHY IT MATTERS:

AI Market Expansion: The GPT Store represents a significant step in commercializing AI, potentially transforming the landscape similar to how the App Store revolutionized mobile apps.

Revenue and Competition: How OpenAI structures its revenue cut will be crucial for attracting developers and could set a precedent in the burgeoning AI marketplace.

Simplicity and Accessibility: The ease of use of the GPT Builder could encourage a wave of innovation, as it lowers the barrier to entry for creating AI apps.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $12.99/year.

We bought Solana and announced it to premium subscribers on November 28th. It’s up 35% since.

Trades, Watchlist & Live Portfolio

(paywall only)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Solana’s up 30+% since we bought and should continue to run. 🔥

Portfolio

Notes

Wednesday 11/29/23: We sent out the alert that we were buying Solana yesterday as we go full risk-on to close out the year.

Latest Trades

Tuesday 11/28/23 11:20 AM: BUY 183.85 SOL @$56.16

Tuesday 11/28/23 11:20 AM: SELL 101.62 XOM @$104.75

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.