TheBRRR’s Thoughts

BRRR.

CPI landed soft this morning and risk assets are moving higher.

Nasdaq up 1.4%.

Bitcoin up 3.6%.

Apple up 4.2%.

The Fed now has plausible cover to cut interest rates before the November election as the employment data has gotten worse while inflation has gotten better.

It also provides some level of cover to Congress/ The White House / Treasury to further inject money into the hands of consumers in an attempt to juice the economy headed into the election.

We can’t come up with a reasonable argument for bearishness headed into the second half of the year while we can point to a handful of positive catalysts for tech and crypto assets.

We’ll get some clarity from Jay Powell and the Fed later today when the FOMC inevitably announces no change to interest rates this month, but updated projections for interest rate cuts sooner than previously expected.

All eyes on JPow at 2pm for his statement and the Q&A.

We expect a continuation higher for risk assets to close the week.

Risk Assets Pump On Soft CPI Data

WHAT HAPPENED

• CPI Flat in May: The Consumer Price Index (CPI) remained unchanged in May and increased by 3.3% from a year ago, both figures coming in 0.1% below market expectations.

• Core CPI: Excluding food and energy, core CPI rose by 0.2% monthly and 3.4% annually, also below forecasts of 0.3% and 3.5%, respectively.

• Energy and Food Prices: Energy index fell by 2%, with gas prices down 3.6%, and food prices edged up by just 0.1%.

• Shelter Costs: Shelter inflation rose 0.4% for the month and 5.4% annually, remaining a significant inflation driver.

• Market Reaction: Stock futures increased, Treasury yields decreased following the report.

WHY IT MATTERS

• Fed’s Next Move: This data is crucial as the Federal Reserve deliberates on future monetary policy. The CPI figures, showing less aggressive inflation, might influence the Fed to maintain or even reduce rates sooner than previously expected.

• Shelter Inflation Buffer: Persistent shelter cost increases, represented by the lagged Owner’s Equivalent Rent metric, underscore ongoing inflationary pressures on the CPI. Real-time housing data indicates costs have stabilized over the last 12 months (see tweet below).

Apple Stock Surges on AI-Focused WWDC

WHAT HAPPENED

• Apple’s stock hit an all-time high, rising over 6% to $207.15 per share after announcing AI integration at the WWDC.

• The new features, branded as “Apple Intelligence,” aim to enhance Siri and streamline user tasks across iPhones, iPads, and Macs.

• A partnership with OpenAI will see ChatGPT integrated into Apple’s ecosystem.

• Despite the hype, questions remain about the monetization and potential privacy downfalls in these new AI features.

KEY REVELATIONS ABOUT APPLE INTELLIGENCE

• Enhanced Siri: Siri will be significantly upgraded, capable of handling more complex tasks by integrating data from multiple apps like Calendar, Maps, and Mail.

• Example: Users can ask, via text or voice, “Will I get to my daughter’s play performance on time?” Siri will gather data from Calendar for the event time, Maps for travel duration, and remind you when to leave.

• Email and Messaging Enhancements: AI will help summarize long emails, rewrite messages, and even create new emojis to express emotions better.

• Example: AI can summarize a lengthy work email into key points, saving time and increasing productivity.

• Privacy and Security: Apple Intelligence will process most data on-device to ensure user privacy, with complex queries routed to Apple’s secure servers.

• Private Cloud Compute: More intensive AI tasks are processed on Apple’s servers, ensuring high performance without compromising user data.

WHY IT MATTERS

• Market Reaction: The stock surge indicates strong investor confidence in Apple’s AI capabilities and potential future growth.

• AI Integration: Apple is finally stepping up in the AI race, focusing on user-friendly applications rather than broad, error-prone AI implementations.

• Privacy Focus: Apple’s approach emphasizes data privacy and on-device processing, differentiating it from competitors like Google and Microsoft.

• Skepticism on Execution: Concerns about the real-world performance of these features and their impact on Apple’s bottom line remain.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

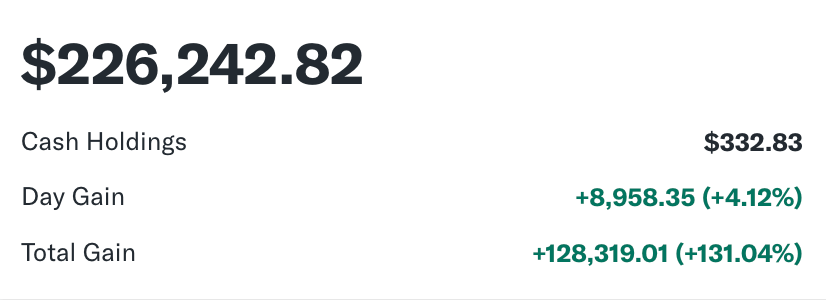

Trades, Watchlist & Live Portfolio

(paywall only)

Most Recently Revealed Trade:

Wednesday April 17 2024: We bought more Solana at $131 and added Solana’s top memecoin WIF at $2.36 on the heels of a leverage wipeout dip after the WW3 scare.

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio Notes

June 12: These assets all look great for continuation higher.

We are considering moving on from Tesla as it has lagged the rest of our portfolio badly and doesn’t have an obvious catalyst. We’ll monitor and let you know if we decide to move on.

Older Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll