TheBRRR’s Thoughts

GM,

Sad news in the investing world, as Charlie Munger passed away just shy of his 100th birthday. The legendary investor was a trove of knowledge and remained engaged with the financial world and the strategy at Berkshire Hathaway until the end.

Deutsche Bank sending out waves this week. New insights challenge the New York AG's lawsuit against Trump, exposing the bank's practice of approving loans despite asset value adjustments, while simultaneously, their economists' predictions of Federal Reserve rate cuts in 2024 signal potential inflation spikes, countering the prevailing belief of effective inflation control.

In quirky AI news, a report by Futurism tells how Sports Illustrated shot itself in the foot by posting AI-generated articles by AI-generated fake people as human-generated content. In an attempt at damage control, SI deleted the profile and headshot of the “authentic” author. (They could have just posted it as “AI-generated content” in the first place.)

In our deep-dive coverage today we highlight Amazon’s new genAI business-facing chatbot and upward revisions to the US GDP figures.

We also made a trade for the BRRR’s portfolio yesterday and the asset is up 7% since we published. Didn’t realize we had that kind of impact on markets already. 🫢

Editor’s Note: We’ve released V1 of our technical analysis chatbot. Premium subscribers can see the link in the premium section at the bottom of the email. I released a preview of what it can do in this post, where I ask it to analyze the daily and hourly bitcoin charts.

AI News

Amazon Q Launches as AI-Powered Assistant

WHAT HAPPENED:

Amazon's New Offering: Amazon recently unveiled "Amazon Q," a generative AI-powered assistant, designed specifically for professional work environments. This new tool aims to assist in a variety of business-related tasks.

Automation and Personalization: Amazon Q is engineered to automate a range of tasks, utilizing user-specific data. It promises personalized interactions, understanding company-specific information, code, and technology systems, and adjusting to user roles and permissions.

Capabilities of Amazon Q: The assistant is tailored to support developers and IT professionals. Key features include aiding in the development of applications on AWS, researching best practices, error resolution, and coding assistance. Notably, Amazon Q can perform tasks like Java application upgrades.

WHY IT MATTERS:

Technological Advancement: Amazon Q's introduction marks a significant advancement in the field of AI, particularly in its application to business and development environments.

Competitive Landscape: This launch positions Amazon as a significant player in the generative AI space, potentially altering the competitive dynamics with other tech giants.

Future Implications: The development and adoption of such AI assistants could have far-reaching implications on how businesses operate and innovate, especially in technology-driven sectors

Datanami, InvestorPlace, APNews

Macro News

Economy Races, Consumer Pace Braces

WHAT HAPPENED:

Revised GDP Growth Rate: The U.S. economy's growth rate for the third quarter has been revised upwards to 5.2% from the initial 4.9%, indicating a stronger economic performance than initially thought.

Changes in Consumer Spending: Despite overall growth, consumer spending's growth rate was revised down to 3.6%, suggesting a potential shift in consumer behavior and confidence.

Labor Market Shifts: Recent data shows a cooling labor market, with job growth slowing and the unemployment rate rising to 3.9%, hinting at possible changes in employment trends.

WHY IT MATTERS:

Economic Momentum and Challenges: The revised GDP growth highlights the U.S. economy's resilience but also underscores emerging challenges, such as reduced consumer spending and a cooling labor market.

Federal Reserve Policy Implications: These economic developments are crucial for the Federal Reserve's monetary policy, particularly regarding future interest rate decisions. Markets now anticipate a potential pause or reversal in rate hikes - there’s a 45.5% chance that rates will be lower after March 20th’s meeting and a 0.8% chance they’ll be higher.

Poll of the Day

Of the following assets, which is your favorite investment over the next 12 months?

AI Art of the Day

Premium Subscriber Section

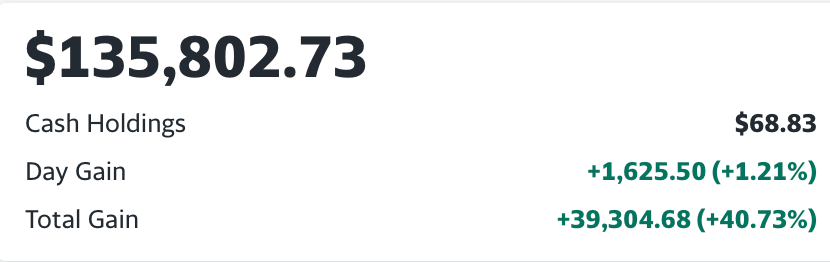

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $12.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio

Notes

Wednesday 11/29/23: We sent out the alert that we were buying Solana yesterday as we go full risk-on to close out the year.

Latest Trades

Tuesday 11/28/23 11:20 AM: BUY 183.85 SOL @$56.16

Tuesday 11/28/23 11:20 AM: SELL 101.62 XOM @$104.75

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.