TheBRRR’s Thoughts

GM.

Markets have been mixed in the extended reaction to unchanged interest rates and Jay Powell’s FOMC press conference on Wednesday.

The dollar initially tanked but has since recaptured all of its losses.

By extension, crypto assets have given up about 2/3 of its gains from Wednesday’s pump with BTC sitting at $63,000 this morning.

The Nasdaq remains 3% higher than the Wednesday low after gaining by as much as 4%.

We don’t expect the dollar strength to persist - the Fed surprised markets with its plan to ease policy (at the expense of the dollar) well before inflation returns to their 2% target.

Markets are still showing great appetite for risk and we expect that to continue to be the case.

Illustrating this point was the reaction to Reddit’s IPO yesterday, with the stock surging by 50% upon listing.

Reddit leveraged an AI story as a key component of their story - selling the dream that they have unique/powerful data for AI models to learn from, and that they can license that data for a ton of money.

We’re covering that story in depth today, along with a story about how the SEC is making a last-ditch effort to damage/delay crypto adoption with a renewed effort to classify Ethereum as a security.

Have a great weekend!

Check out today’s sponsor to learn how to leverage AI for productivity:

AI won’t take your job, but a person using AI might. That’s why 500,000+ professionals read The Rundown – the free newsletter that keeps you updated on the latest AI news and teaches you how to apply it in just 5 minutes a day.

SEC Ramps Up Hostility Towards Ethereum Ahead Of ETF Deadline

WHAT HAPPENED

The SEC, under Chairman Gary Gensler, is intensifying its legal efforts to classify Ethereum as a security, sending subpoenas to U.S. companies about their interactions with the Ethereum Foundation.

The investigation targets the Ethereum Foundation's documents and financial records, particularly after Ethereum's shift to a "proof-of-stake" model in September 2022, which the SEC might use to argue Ethereum's status as a security.

Brian Quintenz, a former commissioner of the Commodity Futures Trading Commission (CFTC), has labeled the Securities and Exchange Commission (SEC)'s approach to Ethereum (ETH) as "illegal."

Quintenz refuted the SEC's claim over Ethereum, especially after the SEC approved Ethereum futures ETFs, which he argues implicitly recognized ETH as a non-security, thus outside the SEC's jurisdiction.

WHY IT MATTERS

Ethereum's Legal Status in Limbo: Ethereum's transition to proof-of-stake has reignited debates over whether it should be regulated as a security, complicating its legal standing and the broader regulatory framework for cryptocurrencies.

Impact on ETF Approvals: The SEC's actions signal a probable rejection of Ethereum ETF applications, affecting firms like BlackRock and Fidelity. This contrasts with the earlier approval of Bitcoin ETFs, showcasing a differentiated regulatory approach to different cryptocurrencies.

Broader Crypto Regulation: The SEC's scrutiny of Ethereum reflects a broader, aggressive campaign against the crypto industry, highlighting ongoing challenges in defining and regulating digital assets within existing legal frameworks.

Reddit’s IPO: A Windfall For The Company

WHAT HAPPENED:

Reddit's IPO caused a significant stir, raising $748 million and marking the fourth-largest US IPO of the year. Shares surged 48% in its debut, with the company valued at around $9.5 billion when fully diluted.

The IPO benefited a wide range of stakeholders, from Reddit's executives and employees, who sold $288 million in stock, to its users, who were given a unique opportunity to buy shares at the IPO price, reaping about $29 million in returns.

The Newhouse family's initial investment in Reddit, through Advance Magazine Publishers, ballooned to over $2.1 billion, showcasing a massive return on their 2006 investment.

WHY IT MATTERS:

Market Confidence: Reddit's successful IPO, alongside Astera Labs' strong debut, might reinvigorate the IPO market, signaling robust investor interest, especially in tech and AI-driven companies.

AI and Data Licensing: Reddit emphasized its AI potential and data licensing business as key growth drivers. With a $203 million contract value in data licensing agreements, Reddit is positioning itself as a critical player in the AI data sourcing arena.

Valuation Recovery: For investors who participated in the 2021 financing rounds, the IPO's success has nearly recuperated their investments, despite the company's valuation challenges in the preceding years.

Strategic Wins: The IPO underscores the strategic patience and positioning of Reddit, navigating market uncertainties to capitalize on the AI hype, improving its valuation, and strengthening its market proposition.

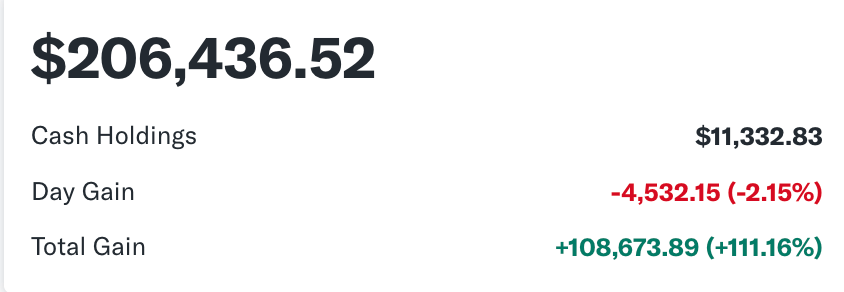

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

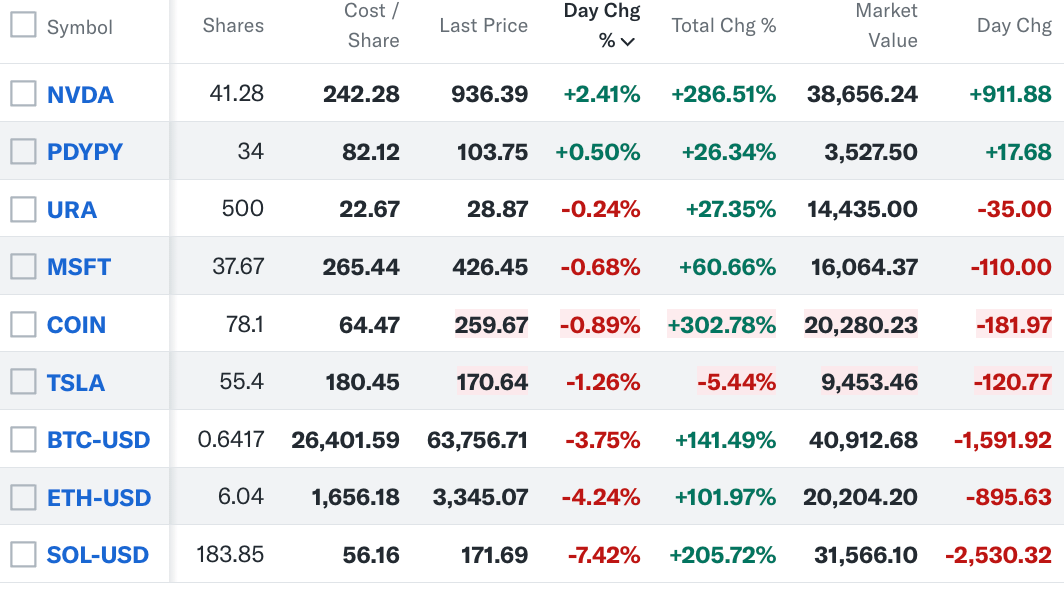

Solana’s now up 226% since we bought and should continue to run. 🔥

Portfolio

Notes

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Latest Trades

Tuesday 11/28/23 11:20 AM: BUY 183.85 SOL @$56.16

Tuesday 11/28/23 11:20 AM: SELL 101.62 XOM @$104.75

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll