GM and BRRR.

We had a surprisingly quiet weekend and Monday NY market open, as no new landmines in the financial sector have been uncovered while peace has broken out in the middle east, with Syria getting reinstated into the Arab league.

The weekend did see The Ethereum Foundation send 15,000 ETH to an exchange, spooking traders into a broad crypto sell off. The Foundation has famously sold the top a few times over the last few years, but it remains to be seen if they were again prescient.

Elsewhere in crypto, memecoin trading continues to clog the Ethereum blockchain as the top new meme coins PEPE and TURBO have cooled off.

In bitcoin land, NFTs (called Ordinals in bitcoin) have caused massive network congestion and expensive transaction fees. To get included in the next block, you’ll need to bribe miners with at least $30, up from under $2 just a week ago.

Here’s what we brrr’d today:

Regional Banks Rally: Is the Banking Crisis Over or Are We Just Seasonally Adjusted?

Binance Stuffs Bitcoin in Digital Traffic Jam: Fees Go Up, Tempers Flare

Will the NASDAQ end the year higher than today's price of $12,200?

Bank Run? Let’s Seasonally Adjust That

Regional banks see relief rally: PacWest Bancorp led a relief rally on Monday, following its dividend cut to 1 cent per share from 25 cents. Other regional banks also rebounded, with Western Alliance and Zions Bancorp gaining 3.7% and 3.4%, respectively. PacWest reassured investors that the bank’s businesses remain “fundamentally sound”.

Worries about regional banks linger: The third failure of an American bank since March has kept worries about regional banks lingering. The rapid increase in interest rates has weighed on banks with long-term bond assets, causing a deposit flight. Institutions with a high proportion of uninsured deposits found themselves particularly vulnerable because customers feared losing savings in a bank run.

Outflows continue for small banks: Fed data on Friday showed that deposit outflows continue for small banks. However, small bank lending has soared, especially in CRE loans. This theoretically pushed implied US commercial bank residual "equity" to record highs, which may help explain the squeeze higher in some regional bank names.

Seasonal adjustments raise questions: The Fed’s seasonal adjustments for bank deposits have raised questions about the accuracy of reported data. In the case of regional banks, the gap between seasonally adjusted and actual data was significant, leading some to question the end of the banking crisis.

Binance Stuffs Bitcoin in Digital Traffic Jam: Fees Go Up, Tempers Flare

Binance resumes Bitcoin withdrawals after congestion: Binance, the largest digital-asset exchange, restarted withdrawals of Bitcoin after halting them twice within 12 hours due to congestion on the network.

Higher fees to incentivize miners: Binance applied higher fees to pending transactions to ensure they are picked up by Bitcoin miners and prevent similar disruptions in the future.

Bitcoin drops amid halts: The repeated suspension of Bitcoin withdrawals weighed on cryptocurrency markets, causing the price of Bitcoin to fall by as much as 3.7%.

Emergence of NFTs on Bitcoin network: The release of a protocol called Ordinals by Bitcoin developer Casey Rodarmor helped to boost transactions on the Bitcoin blockchain by enabling the minting of nonfungible tokens (NFTs) for the first time.

Binance dominates market: Binance, with a trading volume of over $7 billion in the past 24 hours, is by far the largest exchange in the digital-asset sector, following the collapse of rival FTX last year.

AI ART OF THE DAY

Bitcoin network is congested

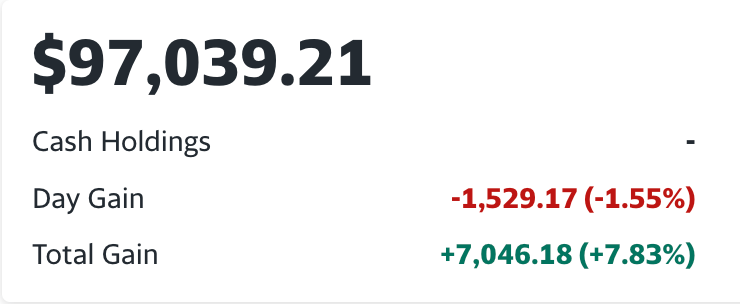

The BRRR’s Portfolio

Keeping our eyes on crypto

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Fed decisions can be a real pain in the assets. Join our Facebook group for industry insights and tricks to stay ahead of the curve. Memes for days, too.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.