TheBRRR’s Thoughts

Dollar strength continues to tame risk assets, as the surprising results in the French election have caused a bit of chaos and a selloff in the Euro, compounding recent dollar relative strength.

These moves are minor gyrations in the larger scope of the macro environment, as Wednesday’s CPI report and Thursday’s FOMC interest rate guidance will be far more instructive for market direction.

We continue to believe inflation and interest rates have topped for this cycle, and liquidity conditions will continue to support risk assets in the coming months.

In today’s top story, w cover the tail risk still present in the US banking sector, as unrealized losses on bank books continue to mount higher in this high interest rate environment. It’s our belief that the Fed needs to cut rates sooner rather than later in order to reduce pressure in the system.

Later today Apple is set to reveal an upgraded Siri, courtesy of its long-rumored partnership with OpenAI. It’s about time - Siri has been a disaster for years.

Our next email will be Wednesday after the CPI data hits the tape.

Is There A Banking Crisis Bubbling Under The Surface?

As the Federal Reserve's interest rate hikes continue to impact the financial landscape, the U.S. banking system is grappling with significant unrealized losses and rising pressures in the commercial real estate market.

With $517 billion in unrealized losses and a recent increase in problem banks, the financial sector's stability is in question.

WHAT HAPPENED

Unrealized Losses: U.S. banking system sits on $517 billion in unrealized losses due to deteriorating bond portfolios.

Increase in Losses: Unrealized losses increased by $39 billion (8.1%) in Q1 2024.

Historical Context: Ninth consecutive quarter of high unrealized losses since Fed's 2022 monetary tightening.

Bank Failures: Collapse of SVB, Signature Bank, and First Republic Bank in 2023 due to similar issues.

WHY IT MATTERS

Bond Portfolio Impact: Rising interest rates decrease bond and MBS prices, hitting bank balance sheets hard.

Potential Bank Failures: Number of “problem banks” rose from 52 to 63 in Q1. Recent closure of Republic First Bank.

BTFP Program: Fed’s bailout program still has $148 billion outstanding, hinting at unresolved issues.

Commercial Real Estate (CRE) Stress: CRE loan delinquency rates highest since Q4 2013, with a $1.2 trillion maturity wall over the next two years.

DATA POINTS

Unrealized Losses: $517 billion (9.4% of $5.47 trillion in securities).

Bank “Problem” Count: Increased from 52 to 63.

BTFP Outstanding Balance: $148 billion as of April 30.

CRE Loan Exposure: Regional/local banks hold 70% of CRE loans; banks with <$250 billion in assets hold >80% of CRE loans.

ANALYSIS

Interest Rates: Fed's long period of low rates led banks to load up on long-term securities. Rates hikes exposed this risk.

CRE Market: Weak office space demand and high rates are increasing CRE loan defaults, affecting bank stability.

Economic Risks: Small economic disruptions could trigger widespread bank issues due to high unrealized losses and CRE stress.

France’s Macron Loses Bigly, Calls For “Snap Elections”

In a bold political maneuver, French President Macron has called snap parliamentary elections following a poor performance in the European elections. This move, set for June 30 and July 7, aims to challenge Le Pen’s Rassemblement National and reshape the political landscape ahead of the 2027 presidential election.

The European Parliament, now the most right-wing ever, signals a shift towards conservative policies, impacting future EU strategies.

WHAT HAPPENED

European Elections Recap: The European People’s Party (EPP) leads with 184 seats, Socialists with 139, and centrists with 80, totaling 403 seats for the grand coalition. Hard-right ECR alliance and far-right Identity & Democracy group gain traction, while Greens and the Left see losses.

French Political Shift: Following a poor performance in European elections, French President Macron calls for snap parliamentary elections on June 30 and July 7.

Macron's Strategy: Aims to challenge Le Pen’s Rassemblement National (RN), which secured 31.5% of votes, and weaken their position for the 2027 presidential election.

WHY IT MATTERS

Right-Wing Surge: Most right-wing European Parliament ever elected, signaling a shift towards conservative and radical-right policies, impacting future EU policies.

Macron's Gamble: Snap elections could either check RN's momentum or backfire, complicating the political landscape further ahead of the Olympics and the 2027 presidential election.

Economic Impact: Euro under pressure, CAC 40 down 1.5%, Euro Stoxx 50 down 1.2%, French 10-year note yield up 8 basis points to 3.17%.

DATA POINTS

European Parliament Seats: EPP 184, Socialists 139, Centrists 80, ECR 73, Identity & Democracy 58, Greens 52, Left 36, Non-Attached 45, New Members 53.

French Election Dates: June 30 and July 7.

Euro Performance: Trading at 1.075.

Market Reaction: CAC 40 down 1.5%, Euro Stoxx 50 down 1.2%, French 10-year yield up to 3.17%.

ANALYSIS

Macron's Tactical Move: By calling snap elections, Macron forces opposition parties into a high-stakes gamble that could reshape the French political landscape. His move aims to exploit the two-round system to prevent an outright RN majority.

These stories are presented thanks to beehiiv, an all-in-one newsletter suite built by the early Morning Brew team.

Fully equipped with built-in growth and monetization tools, no code website and newsletter builder, and best-in-class analytics that actually move the needle.

The top newsletters in the world are built on beehiiv, and yours can be too. It's the most affordable option in the market, and you can try it for free — no credit card required.

Premium Subscriber Section

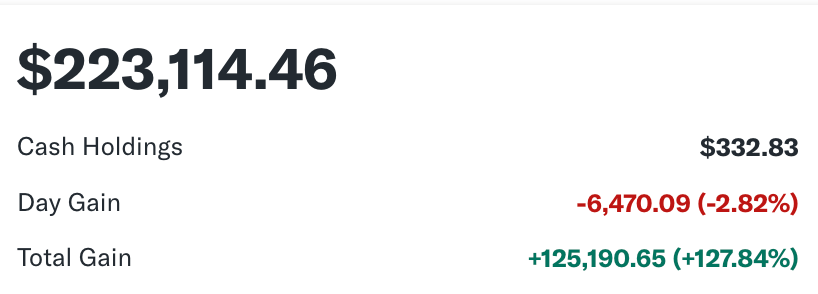

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Most Recently Revealed Trade:

Wednesday April 17 2024: We bought more Solana at $131 and added Solana’s top memecoin WIF at $2.36 on the heels of a leverage wipeout dip after the WW3 scare.

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio

Editor’s note: Our portfolio tracker broke this morning as it deals with the 10-1 NVDA stock split. We’ll provide an updated snapshot on Wednesday. Rest assured, no changes to holdings have been made.

Older Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll