TheBRRR’s Thoughts

GM, taking a break from the bitcoin coverage as it takes a breather at $44k to focus more on a bubbling macro situation and Google’s AI announcement.

First, here are my thoughts on the macro and the repo turmoil we alluded to in the subject line.

The Repo Market's Warning Signal

The repo market is sending a distress signal, reminiscent of the 2019 liquidity crisis. This time, however, the context is dramatically different with high rates and ongoing tightening, and it points towards a critical assessment of the Federal Reserve's current monetary policies.

A Flashback to 2019

In September 2019, the repo market, often unseen yet vital for the financial system's liquidity, spiraled into chaos. Overnight repo rates, usually a dull statistic hovering around 2%, rocketed to an alarming 10%. This unprecedented spike was primarily due to a cash crunch triggered by corporate tax payments and Treasury issuances, which drained over $100 billion from the system. The Federal Reserve, ever the arsonist masquerading as a firefighter, injected $75 billion to stabilize the rates.

Fast Forward to 2023

Today, we're witnessing a similar pattern, but under a different guise. The SOFR, a critical measure of repo market rates, has surged to 5.39%, signaling stress under the surface. Unlike 2019, this escalation unfolds amidst the Federal Reserve's quantitative tightening (QT) regime, an attempt to normalize the bloated balance sheet post-pandemic stimulus.

Data-Driven Insights

Comparing the two scenarios, there's a stark difference in the Federal Reserve's stance. In 2019, the total reserves in the banking system were at a low of $1.4 trillion. Today, we have over $700 billion lying in the Reverse Repo Program, yet face reserve scarcity concerns. This paradox suggests that the current liquidity issues are more systemic, intertwined with the broader impacts of QT.

The Fed's Tightrope Walk

This situation raises questions about the Federal Reserve's current trajectory. While the intention to curb inflation and normalize policy is valid, the repo market's stress signals could be early indicators that the Fed might have overstepped in tightening financial conditions. The fine balance between managing inflation and ensuring market liquidity is more nuanced than ever.

Looking Ahead

As these indicators continue to surface, they paint a picture of a financial ecosystem still grappling with post-pandemic adjustments and the Fed's aggressive policy shifts. There's a growing likelihood that the Fed might have to reverse course, easing off the QT pedal to prevent a liquidity squeeze akin to 2019.

In conclusion, the repo market, often a muted yet reliable barometer of financial health, is hinting at underlying strains. It serves as a reminder that the path to economic stability is fraught with complex trade-offs.

The Federal Reserve might soon find itself recalibrating its policy, prioritizing market stability at the risk of rising inflation.

The 2023 repo market dynamics could thus be a harbinger for a strategic pivot in monetary policy, a necessary response to ensure that the tightrope of economic management doesn't become a noose.

Editor’s Note: We’ve released V1 of our technical analysis chatbot. Premium subscribers can see the link in the premium section at the bottom of the email. I released a preview of what it can do in this post, where I ask it to analyze the daily and hourly bitcoin charts.

Macro News

Trouble At The Fed: Reverse Repo Tension

The Secured Overnight Financing Rate (SOFR) hit a record 5.39% amidst a drop in the Federal Reserve's Overnight Reverse Repo volume. This suggests emerging liquidity issues between banks, potentially leading the Fed to ease monetary policy to reduce systemic risk.

WHAT HAPPENED:

Record High in SOFR: The Secured Overnight Financing Rate (SOFR) surged to a record 5.39%, indicating a sudden tightening in the money market.

Decline in Overnight Reverse Repo (RRP) Volume: The Federal Reserve's RRP usage fell to a multi-year low of $765 billion, signaling a potential decrease in excess cash in the financial system.

Factors Behind the Shift:

SOFR's Role: As a critical financial benchmark, SOFR's increase reflects the rising cost of short-term borrowing.

RRP's Indicator: The drop in RRP volume is a vital gauge of liquidity in the financial system.

WHY IT MATTERS:

Indication of Liquidity Stress: Both the SOFR spike and RRP volume drop hint at emerging liquidity issues in the market.

Implications for Federal Reserve Policy:

Potential Policy Shift: Persisting liquidity challenges could lead to a rethink of the Fed's Quantitative Tightening (QT) and possibly a move back to Quantitative Easing (QE).

Monitoring for Systemic Risks: This situation is a crucial signal for the Federal Reserve and market participants to watch for broader systemic risks.

AI News

Google's AI Game Changer - Gemini

WHAT HAPPENED:

Google's AI Leap: Google unveiled a major upgrade to its AI chatbot Bard, now powered by Gemini, its newest and most advanced AI model.

Gemini Unpacked: Gemini, available in three sizes (Ultra, Pro, Nano), excels in multimodal understanding, combining text, code, audio, images, and video.

Benchmark Breakthroughs: Gemini outperformed GPT-4 in key benchmarks, including the MMLU (massive multitask language understanding) and various multimodal tests.

Bard's Boost: Bard, now integrated with Gemini Pro, offers enhanced capabilities in reasoning, writing, and content summarization, initially in English for 170 countries.

WHY IT MATTERS:

AI Arms Race: Google's move heats up the AI landscape, potentially reshaping the AI chatbot and generative AI market. A stronger play in AI could mean stiffer competition for players like OpenAI.

Tech Ecosystem Impact: Gemini's planned integration with Google Search, Chrome, and other services hints at AI becoming more embedded in daily tech interactions, enhancing user experience and possibly driving user retention and growth.

Market Reaction: Earlier this week Google sold off by 3% due to rumors of a Gemini delay. Despite the rumors proving false, Google hasn’t recovered and sits dead even with the Nasdaq YTD.

Poll of the Day

Friday we asked again about your preferred investment. A tad different results this time, with MSFT edging out for the lead.

Of the following assets, which is your favorite investment over the next 12 months?

AI Art of the Day

Premium Subscriber Section

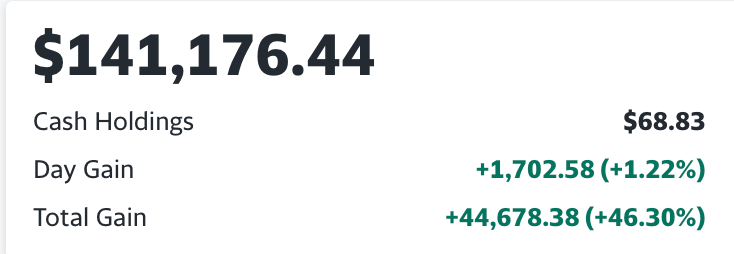

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $12.99/year.

We bought Solana and announced it to premium subscribers on November 28th. It’s up 13% since.

Trades, Watchlist & Live Portfolio

(paywall only)

(March 15, 2023 inception)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Solana’s up 8% since we bought and should continue to run. 🔥

Portfolio

Notes

Wednesday 11/29/23: We sent out the alert that we were buying Solana yesterday as we go full risk-on to close out the year.

Latest Trades

Tuesday 11/28/23 11:20 AM: BUY 183.85 SOL @$56.16

Tuesday 11/28/23 11:20 AM: SELL 101.62 XOM @$104.75

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.