GM and BRRR.

Shortly after we sent yesterday’s newsletter, news broke in the SEC’s case against Ripple Labs. The judge ruled in favor of Ripple - declaring that while Ripple Labs did break the law by initially selling XRP to institutional investors, XRP is not a security as defined by the Howey Test - and crypto markets rallied.

The nuance between the sale to institutional investors and the sale to traders on an exchange is simple: there was a formal investment contract between Ripple and the institutions, but there was no investment contract between Ripple and retail traders on any given exchange. 🔥

Regulatory risk has dragged crypto for years, so with one of the more egregious instances of token issuance deemed OK, we may see a cascade of other legal dismissals and a flood of institutional money piling back into the space. HODL.

The mood on Wall Street was already broadly bullish as the relentless melt-up in equities has persisted into the summer, with the Nasdaq soaring to prices not seen since January 2022.

The index sits within 5% of the all-time high set in 2021 after its 36% surge this year.

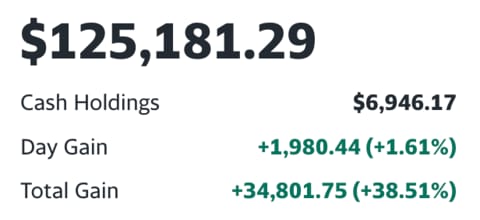

The BRRR’s portfolio is up 35% since the newsletter launched in March (Nasdaq up 22%), with Tesla, Nvidia, and shockingly Coinbase leading the way for us with the largest gains.

We remain bullish tech and crypto on a medium-long term timeframe, but believe we’re due for a short-term correction with possible bank and commercial real estate problems on the horizon.

We remain long tech, but have partially rebalanced from some of the high-flyers to stalwarts and less volatile stocks like Apple to reduce volatility.

Today’s news coverage goes deep into two stories:

1) Ripple Judgement

2) Twitter’s First Revenue-Share Distribution To Creators Was Sent

Today’s email is brought to you by the TLDR Newsletter. It’s an amazing free resource to help you stay on top of the tech world with the most impactful stories.

Please consider subscribing and opening their emails - it’ll support us at The BRRR. 👇

What Else I’m Reading

The TLDR Newsletter: Want to understand the most important trends and stories in tech in 5 minutes or less? TLDR has amassed over 1m subscribers because that’s exactly what they deliver. Here’s your link to subscribe for free.

Still reading: The AI Tool Report for specific ways to leverage AI for productivity.

Internet Income: Payouts and Pitfalls

Twitter's New Gold Rush: Monetize Your Haters!

Twitter has initiated a revenue sharing program where it pays creators for ads served in replies to their posts. Eligibility for the program extends to Twitter Blue subscribers who have garnered over 5 million tweet impressions each month for the last quarter. The first payout is said to total $5 million. The payments, determined by tweet impressions, are seen as substantial by several high-profile creators. However, the scheme doesn't permit monetization for certain types of content, including sexual content and get-rich-quick schemes.

Payouts Based on Impressions: Twitter determines its payouts to creators based on the number of tweet impressions. For instance, Ashley St. Clair, a writer for Babylon Bee, earned $7,153 with approximately 840 million impressions from February through July, translating to a rate of $8.52 per million impressions.

Response-Driven Monetization Strategy: Twitter's revenue sharing approach incentivizes creators to stimulate more user responses to their tweets, as the ads are served in the replies. This strategy can potentially spur meaningful conversations, but may also encourage extreme emotions for increased engagement. As pointed out by user Farzad Mesbahi, having more haters replying to a tweet could result in higher earnings, a sentiment echoed by Twitter's owner, Elon Musk, as "poetic justice."

Monetization Restrictions and Legal Woes: Twitter has outlined content limitations for its monetization program, with sexual content, pyramid schemes, violence, criminal behavior, and content related to gambling, drugs, and alcohol not eligible for monetization. This could impact certain sections of Twitter's community, including sex workers and crypto promoters.

Crypto World

Ripple Ruling Reshapes Crypto Landscape: XRP Not a Security

In a landmark ruling, U.S. District Judge Analisa Torres declared that Ripple Labs Inc did not violate federal securities law by selling its XRP token on public exchanges. This decision, the first of its kind in favor of a cryptocurrency company against the U.S. Securities and Exchange Commission (SEC), led to a significant surge in XRP's value. While the SEC did achieve a partial victory, the ruling is expected to influence other crypto firms' battles with the SEC over jurisdiction. The decision also prompted Coinbase, the largest U.S. crypto exchange, to resume XRP trading.

XRP Value Skyrockets: Following the ruling, XRP's value surged by 75% by late afternoon on Thursday, according to Refinitiv Eikon data. This significant increase reflects the market's positive response to the legal victory.

SEC's Partial Victory: While the ruling favored Ripple Labs, the SEC also achieved a partial victory. The judge held that Ripple violated federal securities law by selling XRP directly to sophisticated investors, amounting to unregistered sales of securities. This aspect of the ruling is currently under review by the SEC.

Impact on Coinbase: In response to the ruling, Coinbase, the largest U.S. crypto exchange, announced it would resume trading of XRP on its platform. The decision led to a 24% increase in Coinbase's stock, closing at $107 per share on Thursday. The ruling is also expected to aid Coinbase in its own ongoing case with the SEC.

Today’s Reader Poll

Vote and leave a comment - we’ll feature the top comment tomorrow!

Have you used Instagram Threads?

AI Art of The Day

The BRRR’s Portfolio Update

COIN taking the lead following Ripple news, looking like 2021 again for crypto. Amazon enjoyed Prime, and Tesla keeps charging.

On Watchlist:

$AMD: NVDA’s strongest competitor

$ASML: They make the machines that make AI machines

$ISRG: Robot Surgeons

$OPRA: Growing web-browsing solution

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Join our Facebook group to connect with the community.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.