TheBRRR’s Thoughts

Waited until the afternoon to send today’s update because the FOMC’s minutes dropped at 2pm et, but the biggest story since our Monday update came from the crypto world.

The SEC had a change of heart at the last minute, and appears ready to approve ETFs tracking the crypto asset Ether.

Analysts had pegged the probability at 25% heading into tomorrow’s deadline but have since revised the estimate to 75%, and have speculated that there is political pressure from DC driving the pivot.

As we’ve written about over the last few weeks, Trump has loudly embraced crypto industry while on the campaign trail while democrats have continued to fight it.

Despite Biden threatening to veto, several democratic senators spoke up and voted with republicans on a key crypto + banking regulatory issue and the tides started to shift. The veto threat was retracted, Elizabeth Warren cried, and crypto assets rose.

Now with the Ether ETF on deck for approval, we could see a massive surge in the price of ETH in the coming weeks, as we saw after the bitcoin ETF started trading.

This approval, for a layer-1 smart contract gas token, would open the door to a flood of ETF applications for other crypto assets. We could see ETF applications for everything from Solana to Chainlink to Dogecoin in the coming weeks and months.

This is the part of the cycle you should avoid clicking too many buttons - allocate to the major assets with a bulk of your crypto portfolio and watch number go up.

Happy Nvidia earnings day to those that celebrate.

Biden’s Seismic Shift On Crypto: ETH ETF & Reasonable Regulation On The Way

WHAT HAPPENED

SEC Stance Reversal: A shift among Democrats reportedly led to the SEC reconsidering its rejection of spot Ethereum ETFs. This change was influenced by a call from the Biden administration, per insiders, suggesting the party's stance on crypto might be evolving.

Political Dynamics: The divide between Republicans and Democrats on crypto policy had intensified after Trump came out supportive of the industry, with Democrats now re-evaluating their position. This shift comes amid increasing bipartisan support in the house for crypto-friendly legislation.

Ethereum Price Surge: Ethereum's price surged by around 30% this week following reports of the SEC's leaning towards ETF approval.

WHY IT MATTERS

Market Impact: Approval of spot Ethereum ETFs could significantly boost market confidence, leading to higher prices for Ethereum, Bitcoin, and other cryptocurrencies.

Legislative Influence: The Financial Innovation and Technology for the 21st Century Act (Fit21), which aims to delineate regulatory responsibilities between the SEC and CFTC, is set for a crucial vote. This bill has garnered support from key Democrats and crypto industry players.

Future Regulations: A more crypto-friendly stance from the Biden administration could pave the way for further regulatory clarity and innovation in the US crypto market.

Fed Officials Posturing The Inflation Fight Isn’t Done

WHAT HAPPENED

Fed’s Inflation Worries: Federal Reserve officials expressed concerns over the lack of progress in reducing inflation during their April 30-May 1 policy meeting. The Fed’s target inflation rate of 2% remains elusive, with recent data showing price increases above this target.

Interest Rates Held Steady: The Federal Open Market Committee (FOMC) unanimously decided to keep the benchmark short-term borrowing rate in the range of 5.25%-5.5%, maintaining a 23-year high.

Economic Indicators: April’s Consumer Price Index (CPI) showed a slight decrease in inflation to a 3.4% annual rate, with core CPI (excluding food and energy) at 3.6%, the lowest since April 2021.

WHY IT MATTERS

Upside Risks to Inflation: Fed officials highlighted several risks that could push inflation higher, including geopolitical events and the financial pressure on low- and moderate-income households. Increased use of credit cards and buy-now-pay-later services were noted as indicators of financial strain.

Cautious Tone on Rate Cuts: Despite some positive signs, the Fed remains cautious about cutting interest rates. Officials, including Fed Governor Christopher Waller and Chair Jerome Powell, emphasized the need for “several months” of favorable data before considering rate cuts.

OUR TAKE

The tone from the Fed officials was a little more hawkish than expected, with several members postulating that they might not have done enough to fight inflation.

The caveat to the minutes here, is that the meeting took place before April’s CPI numbers were revealed - which painted the picture that inflation was falling a little faster than the Fed expected it to.

Risk assets fell on the news, but have since clawed back about half of the intraday loss.

The Nasdaq is still up 0.5% on the week with bitcoin up over 5%.

Learn how to make AI work for you.

AI breakthroughs happen every day. But where do you learn to actually apply the tech to your work? Join The Rundown — the world’s largest AI newsletter read by over 600,000 early adopters staying ahead of the curve.

The Rundown’s expert research team spends all day learning what’s new in AI

They send you daily emails on impactful AI tools and how to apply it

You learn how to become 2x more productive by leveraging AI

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Most Recently Revealed Trade:

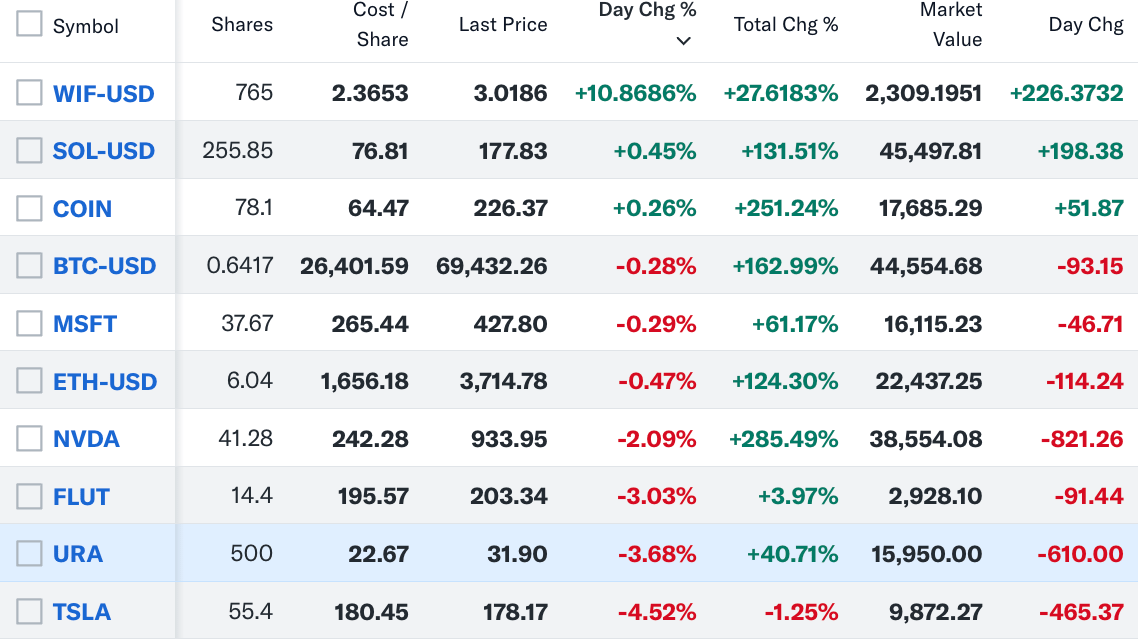

Wednesday April 17 2024: We bought more Solana at $131 and added Solana’s top memecoin WIF at $2.36 on the heels of a leverage wipeout dip after the WW3 scare.

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio

Older Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll