TheBRRR’s Thoughts

Editor’s Note: We sold a stock for the newsletter’s portfolio yesterday afternoon. Premium subs can see the move and the reasoning at the bottom of the email.

GM.

Markets have been mixed this week. The big news event came on Tuesday morning in the form of the latest inflation report.

Headline CPI came in slightly higher than consensus predictions (3.7% y/y vs 3.6% expected), but equities and crypto took the news in-stride. The Nasdaq is slightly higher overall (+0.5%), while crypto has faired considerably better with BTC up 1.5% and SOL up over 20% amongst the majors.

Today we’re covering a story about declining demand for electric vehicles and the implications for top automakers and the continued rise of Solana.

The community behind the Solana memecoin dogwifhat has raised $650,000 to place the dog on the Las Vegas Sphere for a full week later this year.

EVs Aren’t Selling, Automakers Stuck With Inventory

WHAT HAPPENED:

The electric vehicle (EV) wave is experiencing a significant pullback. Key automakers including Ford Motor, General Motors, Mercedes-Benz, Volkswagen, Jaguar Land Rover, and Aston Martin are either scaling back or delaying their EV initiatives. Even Tesla, the U.S. EV market leader, anticipates a slowdown in growth.

Amidst expectations of a booming EV market, companies are witnessing a slower than anticipated consumer shift towards electric models. This has prompted a broader pivot to offering a mixed lineup of vehicles: gas-powered, hybrids, and EVs.

Despite the dampened enthusiasm, the projection for EV sales growth remains positive, albeit at a more moderated pace.

WHY IT MATTERS:

This recalibration underscores a reality check within the auto industry regarding the pace of transition to electric mobility. The initial EV adoption rush, spurred by low interest rates and Tesla's success, hit a roadblock as interest rates soared, and EV costs rose sharply.

Automakers are now advocating for a "freedom of choice" approach, increasing their production of hybrids as a bridge towards electrification. This strategy also aligns with meeting stricter emission regulations without fully depending on EV sales.

The shift signals a cautious but still forward-moving EV market, with sales figures expected to climb from 7.6% of the U.S. market in 2023 to between 30% and 39% by 2030. Yet, the journey towards an all-electric future appears more gradual and nuanced than previously envisioned.

Looking Ahead:

The auto industry's strategic pivot raises questions about the future trajectory of EV adoption and the broader implications for environmental goals. With regulatory pressures and consumer acceptance as critical factors, the evolution of the EV market remains a dynamic and closely watched space. Automakers' ability to balance innovation with practical market demands will be key in shaping the pace and success of the transition to electric mobility.

Solana’s Stellar Comeback Amidst Memecoin Frenzy

Solana's Stellar Comeback Amidst Memecoin Frenzy

WHAT HAPPENED:

Solana, a prominent layer-1 blockchain, has seen its token price soar to $160, the highest since January 2022, marking a dramatic recovery from a low of $8 in early 2023. This resurgence positions Solana as the fourth largest cryptocurrency by market cap, trailing only behind Bitcoin, Ether, and BNB.

The surge amounts to a 44.8% increase over the month and an astonishing 676% from the same time last year. Solana's ecosystem, known for its vibrant NFT marketplace and decentralized finance (DeFi) offerings, has also become a hotbed for rapidly produced memecoins.

WHY IT MATTERS:

Solana's rebound is emblematic of the broader crypto market's recovery from its "winter," with memecoins playing a significant role in driving interest and activity on the blockchain.

Memecoins like Bonk and dogwifhat on the Solana blockchain have recorded 150% and 600% monthly gains, respectively. These tokens, along with politically-inspired tokens with names playfully misspelling U.S. politicians, have captured significant market capitalizations.

The phenomenon underscores a wider trend of speculative investments in digital assets with little to no intrinsic utility, fueled by community engagement.

Despite the inherent volatility and risk of extreme fluctuations, the memecoin mania contributes to the growing interest in crypto wallets like Phantom, which reported a tripling in its active user base to 3.2 million monthly users.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

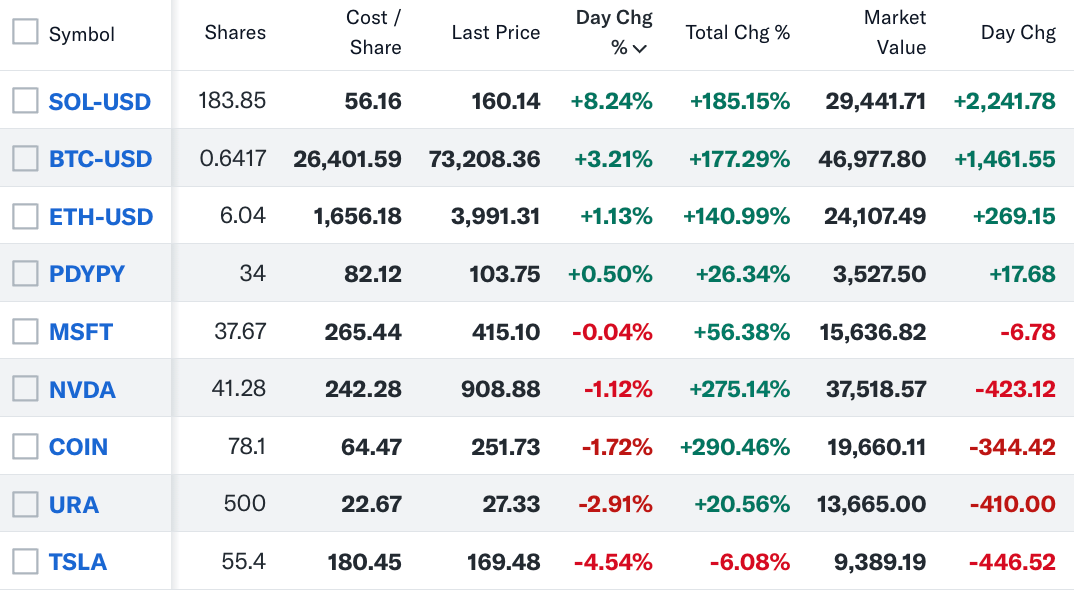

We bought Solana and announced it to premium subscribers on November 28th. It’s up 77% since.

Trades, Watchlist & Live Portfolio

(paywall only)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Solana’s up 106% since we bought and should continue to run. 🔥

Portfolio

Notes

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Latest Trades

Tuesday 11/28/23 11:20 AM: BUY 183.85 SOL @$56.16

Tuesday 11/28/23 11:20 AM: SELL 101.62 XOM @$104.75

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll