*cue saxophone music

GM and BRRR.

In recent news from the Federal Reserve, St. Louis Fed President James Bullard has dismissed the notion of an impending recession or banking crisis, despite predictions from the Fed staff. In an exclusive interview with Reuters, Bullard noted the economy is strong, fueled by a strong labor market and consumption, and called for an increase in rates beyond currently anticipated levels, citing inflation. Bullard advised the Fed to be cautious in giving forward guidance on interest rates and instead to remain responsive to incoming data.

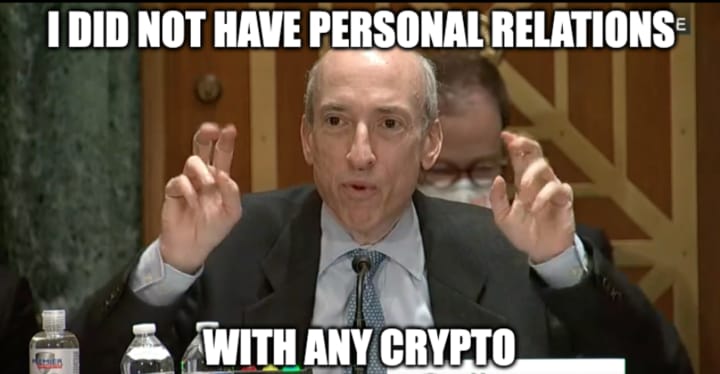

In other financial news, the Securities and Exchange Commission (SEC) reiterated its stance that crypto trading platforms and exchanges must abide by US securities laws, and that the SEC will continue to pursue them until they comply.

Despite arguments from Republicans that the rules are ill-suited to decentralized digital currency exchanges, SEC Chairman Gary Gensler maintained that these platforms must come into compliance if they are providing exchange, broker-dealer, or clearing services of crypto security tokens. Gensler, who previously taught a course on crypto and blockchain at MIT, revealed he has never owned or used cryptocurrency.

Finally, Fortune magazine discusses struggles faced by those earning a six-figure salary. Despite earning $100k, many still struggle to meet financial goals and maintain a comfortable lifestyle in big cities. The cost of housing, food, and transportation has significantly increased in the past twenty years, diminishing the purchasing power of $100k. Millennials face higher expenses than their parents, including pensions, retirement savings, housing, childcare, student loan debt, and healthcare, leading to sacrifices in saving and investing for other goals.

Here’s what we brrr’d today:

STL Fed. Pres assures there will be no recession…in 6 months

SEC Chair gets grilled on Capitol Hill over Crypto 🔥

$100k ain’t what it used to be

Prediction Contest Update

Tesla missed on Wednesday, with EPS landing a penny shy at $0.85. We’ll be back with another prediction contest question tomorrow.

STL Fed President: Recession “not coming in 6 months”

Bullard says it's not happening: In an exclusive with Reuters, Bullard dismissed the impending banking crisis or recession, despite fears from Wall Street. He sees no signs of a downturn and the economy is fueled by a strong labor market and consumption.

Fed staff predicted a mild recession in ‘23: Despite a low unemployment rate this year citing stress in the banking sector. However, Bullard believes this will not happen and dismissed the idea of a major financial crisis, noting that the financial stress index is currently at zero. Bullard wants to raise interest rates further, because why not?

Bullard believes Fed should raise rates: Beyond currently anticipated, stating that it won't require a large increase in the unemployment rate to control inflation.

Policymakers and Analysts worry: The final steps of the Fed's tightening cycle could push us into a recession, but Bullard doesn’t worry. Says tightening cycle may be close to the finish line, also believes that the policy rate will need to rise another half a percentage point. "The fewer promises made, the better"

Advises the Fed to be cautious: Giving forward guidance on interest rates, and instead remaining responsive to incoming data. Says inflation is coming down but not as fast as Wall Street expects, and it will take more time for pandemic-era savings to be spent, and price competition among firms to curb inflation.

Crypto Exchanges Beware: Gensler Says No More Crypto-ing Around

No more tip-toe: During a hearing before the House Financial Services Committee, SEC Chairman Gensler maintained his view that crypto trading platforms and exchanges should abide by strict U.S. securities laws and that the SEC will continue to pursue them until they comply.

Rules unclear: Republicans argued that the SEC's disclosure rules were ill-suited to decentralized digital currency exchanges and that without specific legislation from Congress, digital platforms would move overseas, endangering American competitiveness and weakening the country's status as a hub for cryptocurrency innovation.

Still…unclear: Gensler rejected the notion that crypto trading platforms don't know how to interpret U.S. securities laws, insisting that if they are providing exchange services, broker-dealer services, or clearing services of crypto security tokens, they should come into compliance.

SEC ramped up its enforcement: On the crypto industry, bearing down on companies and projects that it alleges are hawking unregistered securities.

Prospect of legislation: to regulate digital currencies has faded this year, and major crypto industry groups are planning to spend millions of dollars this year to lobby Congress and the Biden administration.

The Six-Figure Salary Struggle: Why $100k Is No Longer Enough for Financial Security

Modern Disillusionment: Despite earning $100k, discusses struggles to meet her financial goals and maintain a comfortable lifestyle in San Francisco.

Financial Well-Being Decline: A Morning Consult poll found that households earning over $100k experienced the biggest drop in financial well-being compared to a year ago.

The Cost of Living: The cost of housing, food, and transportation has significantly increased since 2000, diminishing the purchasing power of $100k.

Millennials' Expenses: Millennials face higher expenses than their parents did, including pensions, retirement savings, housing, childcare, student loan debt, and healthcare.

Talk about sacrifices: Young workers must save more but cannot afford to have fun or invest in their other goals due to high expenses and low wages.

AI ART OF THE DAY

We may win the inflation battle but at what cost, J-Pow?

The BRRR’s Portfolio

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Fed decisions can be a real pain in the assets. Join our Facebook group for industry insights and tricks to stay ahead of the curve. Memes for days, too.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.