To good earnings!

GM and BRRR.

On Monday, major US stock indexes saw modest gains, with financial and industrial shares leading the way, as investors awaited corporate earnings reports and comments from Federal Reserve officials on interest rates. The Dow Jones, S&P 500, and Nasdaq all recorded gains. Meanwhile, shares of Alphabet Inc. fell 2.7% due to reports that Samsung Electronics may replace Google with Microsoft-owned Bing as the default search engine on its devices.

In macro news, the New York Fed reported an increase in manufacturing activity in April, suggesting some strength and confidence in the economy. It’s only a small piece of the Fed’s interest rate calculus - but still an interesting data point.

The U.S. mortgage industry has faced significant losses, with companies experiencing the worst performance since 2008, according to the Mortgage Bankers Association's report. Declining production revenues and increased expenses, including production expenses per loan, led to a significant drop in profits. Combined with a decrease in refinancing share of total originations, trouble is on the horizon for companies who relied heavily on refinancing for profits. don’t let this happen to you…

Here’s what we brrr’d today:

Wall Street drifting higher, still guessing on the Fed’s next move

Mortgage Lenders went for broke - and got there

Prediction Contest Question #4

Tesla reports earnings on Wednesday, April 19. How will they do?

Wall Street Drifts Higher, Still Guessing Fed’s Moves

Wall St ends higher ahead of earnings and Fed cues: Major US stock indexes, including the Dow Jones, S&P 500, and Nasdaq, recorded modest gains on Monday, supported by financial and industrial shares, as investors brace for corporate results and comments from Federal Reserve officials that could give more insight into the path of interest rates.

Alphabet shares drop on Samsung's plan to dump Google search: Shares of Google parent Alphabet Inc fell 2.7% on Monday after reports that Samsung Electronics is considering replacing Google with Microsoft-owned Bing as the default search engine on its devices.

State Street slides on profit miss: State Street Corp's shares fell 9.2% after the financial services provider's quarterly profit missed analysts' estimates, impacted by a fall in fee income.

New York factory activity rebounds in April: The New York Fed said that its barometer of manufacturing activity in New York State increased for the first time in five months in April, suggesting a solid case for the US central bank to raise rates at its meeting next month.

Indexes up: Dow up 0.3%, S&P up 0.33%, Nasdaq up 0.28%: Financials rose by 1.1% and industrials gained 0.8%, while energy fell 1.3%. The S&P 500 recorded 15 new 52-week highs and one new low, while the Nasdaq Composite recorded 70 new highs and 158 new lows.

2022 Mortgage Report: Homeownership Possible, Not Probable

Mortgage industry in the red: Companies in the mortgage industry faced the worst performance in 2022 since the inception of the Mortgage Bankers Association's report in 2008. The report shows that the industry lost an average of $301 on each loan originated last year. This is a significant drop from an average profit of $2,339 per loan in 2021, leaving companies in the red.

Lenders fail to keep up with expenses: As production revenues declined in 2022, expenses continued to balloon, leading to significant losses. Companies struggled to adjust their capacity fast enough, resulting in productivity falling to a low of 1.5 closed loans a month per production employee. The average production expense per loan increased to $10,624 in 2022, up from $8,664 in 2021, which was too much for the companies to bear.

Refinancing becomes a thing of the past: Refinancing share of total originations plummeted to 20 percent in 2022 from 46 percent in 2021. For the entire mortgage industry, refinancing share last year decreased to 30 percent from 57 percent in 2021. This trend signifies a shift in the market, which may spell trouble for companies who relied heavily on refinancing for profits.

Servicing profits double, but not enough: While net financial income on the servicing side more than doubled in 2022, it was not enough to offset the significant production losses. Servicing expenses dropped as serious delinquencies fell, and valuation mark-ups on mortgage servicing rights contributed to servicing profitability. However, these gains were not enough to save many companies from suffering losses.

AI ART OF THE DAY

Tesla Earnings on tap for Wednesday - make sure to vote in the prediction contest above.

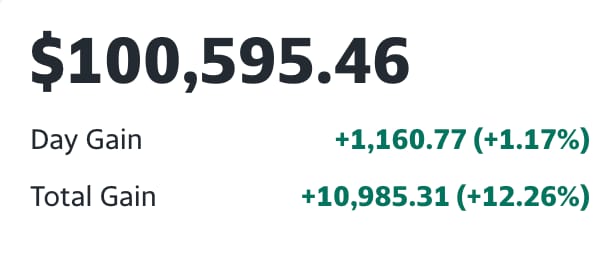

The BRRR’s Portfolio

Cruising along - nice jump across the crypto and NVDA to open up Tuesday.

Here’s your referral link to qualify for the Prediction Contest & $100 Prize 👇

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Fed decisions can be a real pain in the assets. Join our Facebook group for industry insights and tricks to stay ahead of the curve. Memes for days, too.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.